NEW YORK (CNN/Money) -

Stocks started the fourth-quarter with a bang Friday, with investors scooping up beaten-down tech shares in a show of optimism about the remainder of the year.

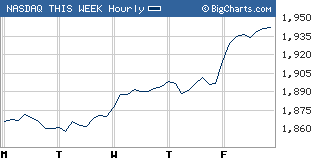

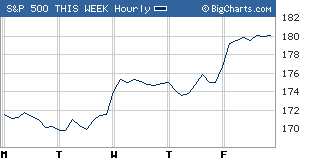

The Nasdaq composite (up 45.36 to 1,942.20, Charts) rallied 2.4 percent, closing at its highest level since July 9. The Standard & Poor's 500 (up 16.92 to 1,131.50, Charts) index added 1.5 percent, closing at its highest level since June 30.

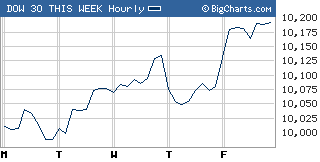

The Dow Jones industrial average (up 112.38 to 10,192.65, Charts) jumped 1.1 percent.

All three major indexes closed higher for the week. The Dow gained 1.4 percent, the S&P 500 gained 1.9 percent and the Nasdaq gained 3.3 percent.

The rally started with the opening bell as investors cheered a breakthrough in the Oracle-PeopleSoft impasse and some upgrades in the chip sector. But the buying soon rippled out across the broader market.

Investors were undeterred by an afternoon reversal in the price of oil, which pushed the commodity to a new record high close.

The day marked a welcome start to the fourth quarter. The third quarter was tough, with all three major indexes falling, as rising oil prices and a slowdown in the economy spooked most investors.

"It's a good start to the quarter," said Joseph Battipaglia, chief stock strategist at Ryan, Beck & Co. "We're at the lower end of the recent trading range, so there's probably more room to gain."

Next week brings the start of the third-quarter earnings reporting period. The pre-announcement period has been more negative than in recent quarters, creating concerns about the third-quarter earnings.

Alcoa (AA: Research, Estimates), General Electric (GE: Research, Estimates) and Genentech (DNA: Research, Estimates) are set to release results next week, with the reporting period heating up the following week.

The week ahead is light on economic news until Friday, when the September jobs report is released. The influential report is also the last jobs report before the presidential election, making it even more relevant to market participants.

PeopleSoft zooms

PeopleSoft (PSFT: up $2.98 to $22.83, Research, Estimates) soared about 15 percent on investor optimism that Oracle's proposed hostile takeover bid could turn friendlier. Two key events led to the speculation.

Late Thursday, PeopleSoft canned its CEO, amid growing concern about his leadership, replacing him with the company's founder and chairman. Additionally, Friday afternoon the Justice Department said it won't continue trying to block the proposed takeover.

Oracle (ORCL: up $0.62 to $11.90, Research, Estimates) shares also gained on the news, as did the broader software sector.

Chip gear makers bounced, in part on a bullish analyst note. J.P. Morgan upgraded Applied Materials (AMAT: up $0.81 to $17.30, Research, Estimates) and Novellus Systems (NVLS: up $1.36 to $28.00, Research, Estimates) to "overweight" from "neutral." Teradyne (TER: up $0.96 to $14.36, Research, Estimates) was upgraded to "neutral" from "underweight."

That gave a boost to a number of chip stocks. The broader tech sector gained, too, on some relief buying.

"The PeopleSoft news could make it more likely that the Oracle deal will go through," Battipaglia added. "And after all the recent downgrades, people are probably relieved to see a brokerage lifting its view on the chip sector."

A trio of economic reports were released shortly after the open. Results were mixed and stocks showed little reaction.

Street reacts to debate?

Partly, the advance came as investors looked to get back into the market at the start of the fourth quarter, with many mutual funds starting their fiscal year on Oct. 1, analysts said.

But Thursday night's presidential debate may also have been a factor," said Donald Selkin, director of research at Joseph Stevens.

"I think it's interesting that on a day when crude oil closes over $50 a barrel for the first time, the market is flying," Selkin said.

He said that the morning tech news and the first day of the quarter factors were certainly in play, but in addition, the gains might be something of a 'Kerry victory rally,' although that would seem to counteract the belief that Wall Street would prefer Bush's re-election.

Early polls gave Sen. John Kerry the edge in Thursday night's debate with President Bush about Iraq and foreign policy, creating more uncertainty about the outcome of the election. Prior to the debate, polls had indicated President Bush had a small lead.

"I hate to say it, but maybe there's a bet that if Kerry wins, (former Secretary of the Treasury) Robert Rubin will take over as Fed chairman, and the market would like that," Selkin said.

Alternately, investors may be reacting in a renewed bet for Bush's victory. Despite polling suggesting Kerry won the debate, trading in political futures continue to give Bush the edge in the election, according to a pair of electronic markets.

(For a look at how markets fare under Republicans vs. Democrats, click here. For a look at how individual stocks fare, click here.)

On the move

Gains were broad-based, with 28 out of 30 Dow components advancing.

Chips were strong across the board, with the Philadelphia Semiconductor (up 17.71 to 401.91, Charts) index, or the SOX, gaining 4.6 percent.

Chip leader Intel (INTC: up $0.79 to $20.85, Research, Estimates) rose nearly 4 percent and was the Dow's biggest gainer.

Among other active issues, Hewlett-Packard (HPQ: up $0.37 to $19.12, Research, Estimates) gained 2 percent and Microsoft (MSFT: up $0.60 to $28.25, Research, Estimates) gained more than 2 percent.

Merck (MRK: up $0.31 to $33.31, Research, Estimates) bounced 1 percent. The stock had tumbled 27 percent Thursday after Merck recalled its blockbuster arthritis treatment, Vioxx, on safety concerns.

All was not rosy, however. Alliance Gaming (AGI: down $2.96 to $12.10, Research, Estimates), a casino owner and slot machine operator, fell 20 percent after warning that first-quarter results will not meet expectations.

Telecom gear maker Redback Networks (RBAK: down $1.78 to $3.44, Research, Estimates) plunged 34 percent after warning that third-quarter revenue will miss expectations, due to customer order delays.

Automakers were releasing September sales figures throughout the session.

Ford Motor (F: up $0.14 to $14.19, Research, Estimates) said September sales fell 7 percent, despite aggressive end-of-month incentives. DaimlerChrysler (DCX: up $1.11 to $42.53, Research, Estimates) said sales rose 13 percent in September and General Motors (GM: up $0.66 to $43.14, Research, Estimates) said its sales rose 20 percent.

Market breadth was positive. On the New York Stock Exchange, advancers beat decliners by close to three to one on volume of 1.58 billion shares. On the Nasdaq, winners topped losers by seven to three on volume of 1.83 billion shares.

Sentiment, manufacturing indexes slip

In the first of the morning's economic reports, the University of Michigan's final reading on consumer sentiment in September was revised down to 94.2 from a previous read of 95.8. Economists surveyed by Briefing.com thought it would be revised up to 96.

The Institute for Supply Management's manufacturing index fell to 58.5 in September from 59 in August. That was roughly in line with the expectations of economists, who thought it would fall to 58.3, on average. Any reading above 50 points to expansion in the manufacturing economy.

Construction spending in August rose 0.8 percent after rising a revised 0.4 percent in July. Economists expected it to rise 0.4 percent.

U.S. light crude futures for November delivery rose 48 cents to settle at $50.12 a barrel on the New York Mercantile Exchange, a record close and the first above $50.

Treasury prices fell on the morning’s economic news. The 10-year note lost 1/2 of a point in price, pushing its yield up to 4.18 percent from 4.12 percent late Thursday. Treasury prices and yields move in opposite directions.

In currency trading, the dollar gained against the yen and euro.

COMEX gold added 80 cents to settle at $421.20 an ounce.

In global markets, Asian stocks gained, with the Japanese Nikkei up 1.5 percent following the release of the closely-watched tankan quarterly business survey. European markets closed higher.

|