Don't believe the MySpace hype

Yes, the social networking site is cool and rapidly growing...but it's not going to turn News Corp. into the next Google or Yahoo.

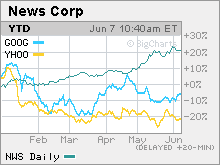

NEW YORK (CNNMoney.com) - Shares of online media firms Google and Yahoo! have taken a hit this year. But traditional media outlets that are just starting to dip their ink-stained toes in cyberspace are benefiting from the latest round of Internet hype. Look at News Corp., which last year bought Intermix Media, the parent company behind the rapidly growing social networking site MySpace. Shares of News Corp (Research). are up more than 20 percent in 2006 and at about $20 a share, the stock is trading near its 52-week high. Much of the enthusiasm is about MySpace, which is a big hit with teens and young adults. One zealous poster on the Yahoo! Finance message board for News Corp. wrote the following message in mid-May: "MySpace will take NWS to 35-40..... MySpace is the biggest thing around these days! Easy money.. Get in and join the ride!" To be sure, investors do have other reasons to be excited about News Corp. The Fox broadcast TV network finished in first place with 18-49 year-olds for the second consecutive season. The company's movie studio has also churned out the two biggest box office hits so far this year: "Ice Age: The Meltdown" and "X-Men: The Last Stand." But it's premature to think that MySpace will turn News Corp. into the next Google or Yahoo. Still a tiny part of the News Corp. empire

MySpace is part of Fox Interactive Media (FIM), which includes other web properties such as IGN, a gaming site, and the sports-news site Scout.com. FIM is still so small that it is merely lumped into the "Other" category of News Corp business units. Revenues from "other" divisions accounted for only about 5 percent of News Corp.'s total sales through the first nine months of fiscal 2006. In addition, the "other" segment is losing money, primarily due to operating losses at FIM. During News Corp.'s fiscal third-quarter earnings conference call last month, president and chief operating officer Peter Chernin said FIM should generate about $350 million in total revenue this calendar year. By way of comparison, analysts are projecting sales of $4.8 billion for Yahoo this year and $6.9 billion for Google. So while MySpace is immensely popular -- the site attracted a whopping 38.4 million unique visitors in April according to Nielsen//NetRatings, up from 8.2 million a year ago -- it's far from being the money-maker that Google and Yahoo are just yet. "The key with MySpace is they only have the eyeballs. The question is how successful will they be in monetizing the number of users," said Alan Gould, a media analyst with Natexis Bleichroeder. News Corp. management is hopeful that MySpace will eventually bring in big bucks for the company. During the earnings call, Chernin listed some of MySpace's "great roster of blue-chip advertisers" including Verizon, Coke, Procter & Gamble and Target. "I think we're at a point right now where for almost anybody who wants to reach young demos in this country, this is about the broadest young demo reach vehicle, and we continue to see growth of branded advertisers coming on the site to reach them," he said. But for now, the big money in online advertising is with search, selling ads tied to specific keywords. So far, MySpace is a miniscule player there. According to data from comScore Networks, MySpace has a 0.6 percent share in search. Industry leader Google (Research) commands 43 percent of the search market while Yahoo is a strong number two with 28 percent. Yahoo (Research) currently powers MySpace's search results. There have been rumblings that News Corp. is looking to forge a deal with Google or Microsoft's (Research) MSN which would allow those companies to post their search results on MySpace and split the ad revenues. There has also been some speculation that News Corp. could just build or buy its own search engine. Social networking is hypercompetitive business

However, MySpace runs the risk of alienating users if advertising becomes prevalent. MySpace is a vastly different animal than Google or Yahoo. Most people go to those sites to find information. So advertising is not necessarily as obtrusive. In fact, a sponsored link could even be helpful. That may not be the case for teens that are primarily using MySpace for socializing and entertainment. "MySpace is in a little bit of a difficult situation. If they aggressively sell ads on the site and change the character of it you run the risk of losing your users," said Greg Sterling, principal of Sterling Market Intelligence, an independent Internet research firm. "The dilemma is how to broaden it out but not kill it." MySpace is also in a far more fragmented market than Google and Yahoo. Other social networking sites such as Facebook and Bebo have cropped up, and there's also competition from video-sharing sites like YouTube and Grouper. So it may be tough to stay on top. "This is an environment of hypercompetition so there is potential for innovators to come in and leapfrog everybody else," said Bill Tancer, general manager of research for Hitwise, an online research firm. Another risk with targeting the teen and young adult demographic is that what's in fashion today could easily be forgotten tomorrow. "For some number of users, MySpace is already passé. There is a fickle dimension to these audiences," said Sterling. Still, Tancer thinks that MySpace, even if it never becomes a big revenue source for News Corp., can help the media company by getting MySpace users to go to other News Corp. sites such as FoxNews.com. "A secondary benefit to News Corp. is that MySpace is an amazing distribution channel. It can get people to visit other sites and from there they can make money," he said. And Gould said investors should not underestimate News Corp. chairman and CEO Rupert Murdoch's desire to transform News Corp. into a leading online player. "News Corp. has gone from being just an Australian newspaper company and evolved into a U.S. media and global satellite company. If anyone has the DNA to adapt and change, it's Murdoch," he said. That may be true. But until News Corp. can prove to Wall Street that it can really cash in with MySpace, instead of just generating clicks from it, investors shouldn't be rushing to compare News Corp. to Google just yet. _____________________ For a look at why Internet stocks may rally this summer, click here. For more about why "American Idol" has been a huge boon for Fox, click here. Big media companies are hoping to make money from video games. Click here.

Natexis' Gould owns shares of News Corp. but his firm has not done investment banking for the company. |

| |||||||