|

Bitter partisan politics: Good for TV?

Political ad spending should lift sales for local TV companies during the next few months...but will that help broadcasters' stocks?

NEW YORK (CNNMoney.com) - This year's midterm Congressional elections stand to be even more contentious than the usual political fights. Democrats are hoping to take advantage of dissatisfaction about how the war in Iraq is going. Hot button issues such as gay marriage and illegal immigration have moved to the forefront of the political debate.

And all this bipartisan rancor is music to the ears of television executives. It means that politicians are likely to spend heavily on mudslinging ads between now and November. According to research from BIA Financial Network, a strategic consulting firm for the media and communications industries, local TV station revenue should increase by more than 7 percent this year, thanks largely to political advertising. "We love the bad feeling between the two parties," joked Leslie Moonves, the chief executive officer of CBS (Charts) during a presentation at the Deutsche Bank Media and Telecommunications Conference last week. Companies like CBS, News Corp., Walt Disney and GE (the latter three own Fox, ABC and NBC) all should benefit. But some smaller public companies that own local television stations affiliated with the major broadcast networks are also hoping to see a boost. "Local TV is still able to deliver mass audiences, especially from the news. So many news viewers are likely voters, so that's always an attractive program for political advertisers," said Mark Fratrik, a vice president with BIA Financial Network. Station owners' stocks eyed

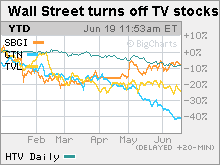

That could be good news for companies such as Hearst-Argyle Television (Charts), Lin TV (Charts), Sinclair Broadcasting Group (Charts), Gray Television (Charts), and Nexstar Broadcasting (Charts), which have all seen their stocks take a hit this year. Victor Miller, an analyst with Bear Stearns, wrote in a recent report that he thinks political ad spending on local TV will hit $1.25 billion this year. While that would be down from the $1.4 billion spent during the 2004 presidential election, it's up a healthy 13.6 percent from the $1.1 billion spent during midterm elections in 2002 and more than double what was spent in 2000. "This has truly been local TV's only consistent growth category in the last decade. Political advertising is now local TV's second-largest national ad category in even numbered years," Miller wrote. But it's uncertain whether or not Wall Street will reward local TV companies for the increase in ad spending. Fratrik said one problem with political advertising is that the rates for political spots don't tend to cost as much as commercials for other businesses, such as auto companies and retailers. So TV station owners may lose out on more profitable business from other local customers. "Some stations lament political because it crowds out some local advertisers. When campaigns are in full swing, it's always prime time for retailers to start advertising for Christmas," he said. Too much?

Miller also points out that investors are worried about local stations relying too much on political advertising. It's easy to point to strong ad growth in even-numbered years. But excluding political ads, Miller estimates that most local TV stations will post little growth in revenue this year. "While the political advertising is 'nothing to shake a stick at', investors have shown concern that, industry 'core' (auto, retail, fast food, telecom, movies) ad growth, setting aside political advertising, is anemic," Miller wrote. Auto industry ad spending in particular has slumped due to the high-profile financial problems plaguing General Motors and Ford. So that will make it even more important than usual for broadcasters to seek business from the Republicans and Democrats. "Political advertising generally provides some tailwinds, but it's going up against a significant headwind with the auto industry," said David Bank, an analyst with RBC Capital Markets. "Local TV stations need every penny of political advertising that they can get." Still, any near-term lift to ad spending this year could be short-lived. In odd-numbered years - when there aren't as many elections - ad revenue for local TV owners tend to tail off. "Psychologically, even if political ad spending gives a lift, does it really change the business? Political ads are not going to be there next year, so they are a bit of a double-edged sword since there will be tougher comparisons," Bank said. _____________________ Related: Ad rates: TV's hot summer drama Related: Big media: Adapt or die

Analysts quoted in this story do not own shares of the companies mentioned and their firms have no investment banking relationships with the companies. |

|