|

She's a saver. He's a spender It's a classic marital clash of styles. 5 lessons for easing the tension.

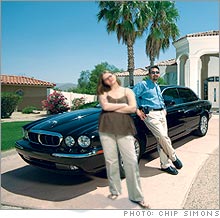

NEW YORK (Money Magazine) -- No doubt haggling over a car is stressful. But for Michael and Brittany Abbate, the most heated negotiations over their new wheels last year weren't with the dealer - they were with each other. Freelance television producer Brittany, 31, was content to stick with their four-year-old Saturn. Michael, 32, a representative for a financial-services firm, craved an upgrade.

"I want to drive something more in line with how much money I'm making," argued Michael, who'd recently hit six figures. "I want more curb sizzle." His wife's standard retort: "A car is not a status symbol; it's a way to get us from point A to point B. I don't want to spend money unnecessarily." It took six months of similarly exasperated exchanges before the couple arrived at a compromise: leasing a low-end Saab. That settled the car issue - for a while anyway. In a spender-saver relationship, the debate is never really over. Take Christmas, for instance. Last year Michael dropped a cool $2,500 on presents for Brittany, including a Lladro figurine and a diamond necklace; Brittany bought him a $300 iPod. Then there are the everyday squabbles: Michael shells out $2.50 a day to indulge his iced-coffee habit; she argues that she could brew it at home for him for a lot less. On a weekly basis, if each spouse takes $20 from the ATM on Monday, he might need another $20 on Tuesday, whereas she'll still have a few bucks left on Sunday. "I am a miser," Brittany freely admits. "I'd rather have money in the bank than almost anything else." Not Michael. "I think that's stupid," he responds with a laugh. "Take the hair shirt off and live your life a little." A series of recent events have exacerbated the differences in their financial styles. In January, Michael was offered a job in Phoenix, prompting the couple to move there from Chicago with their daughter Ava, 19 months. But Michael's new position pays mostly on a commission basis, and Brittany's hunt for part-time work has been stymied by the news that she's expecting their second child in January. Although Michael expects to be earning six figures again in a few years, at the moment their once comfortable $135,000-a-year dual income has dropped by more than half. To make ends meet, they've burned through $11,000 of their $15,000 emergency savings and tapped $15,000 of a home-equity line of credit on their soon-to-be-sold Chicago condo. And Brittany is increasingly nervous about managing their spender-saver tendencies on an unpredictable income. "I'm constantly stressed out about it," she says. Welcome to the club. Some 84 percent of husbands and wives say money is a source of tension in their relationship, according to a recent Money Magazine survey, and the most common reasons stem from clashes over spending and saving. Contrary to stereotype, it's not just women doing the buying. In about a third of couples, the husband admits he's more likely to whip out the wallet. And when men are the spenders, they typically shell out more than wives do - about 40 percent more, according to a new ICR survey. If you and your spouse, like the Abbates, are among the many couples fighting over differing spending and saving styles, these tips should help you find a middle ground. Talk Back Blog: Is your spouse a spender or a saver? Tip 1: Think big picture Rather than harp on your financial differences, redirect your attention and energy to your common financial goals. Try this exercise, suggests Mary Claire Allvine, author of "The Family CFO:" Break out some index cards and separately write down your short- and long-term goals, one per card. Then put them in order from most important to least. Get back together, compare goals, and choose the top three that you're going to aim for as a couple. Each month the first money you shell out should be toward those three goals. The no-fights way to accomplish this is to automate the process, setting up regular withdrawals from your paychecks or bank accounts. The typical result of this exercise: The spender, with concrete, mutually agreed upon goals as his motivation, automatically fritters away fewer dollars. The saver, her mind more at ease with the knowledge that a few hundred bucks or so a month are actually going toward their goals, lets up on nagging her partner to mend his spendthrift ways. Brittany and Michael give it a try and easily agree on the following priorities: selling their Chicago condo, saving enough to buy a place in Phoenix and re-establishing a financial cushion. Tip 2: Give each other financial space When partners have opposing financial habits, each can feel as if the other is always looking over his or her shoulder and judging, which can breed resentment. Avoid this problem by designating an amount each month that is entirely nag-free - you can do whatever you want with the money and your partner isn't allowed to hassle you about it, and vice versa. You might, for example, put the majority of your take-home pay into a joint account so that you can cover combined expenses, and then deposit a small, predetermined percentage into separate his-and-hers accounts. Or you could simply agree on a dollar amount that each of you is allowed to spend without consulting the other. (Money's survey found that a third of husbands and wives talk to their spouse even before spending as little as $100.) This gives the spender liberty within prescribed boundaries and lets the saver have a say in purchases that will ding the bank account. "It's important that you don't have to ask permission for every little thing," says Connie Brezik, a financial planner in Scottsdale, Ariz. "That keeps stresses down between a couple." Tip 3: Swap roles If the spender has never balanced the checkbook, have her sit down and try to make ends meet. If the saver has never bought groceries for your family of four, give him the list and point him toward the supermarket. Sometimes quarrels occur because of lack of understanding. If you've never shopped for the household basics, you probably don't have a realistic handle on how much things cost - it all seems ridiculously expensive. By the same token, if you don't pay the bills, check savings and investment account balances and participate in long-term planning, you probably don't have a good grip on how close - or far - the family is from being able to afford important goals. "If you were to ask Michael at any given time how much money we have, he probably wouldn't be able to tell you," Brittany says. Michael's response: "She's the details person. I'm happy with the 20,000-foot view of things." Handing over their respective controls for a month could help each gain a little perspective. Tip 4: Schedule money dates Talking about cash is important when you and your other half disagree, but avoid bringing it up at bedtime or when one of you is halfway out the door. Agree to rendezvous at a regular time - say, every other Wednesday, from 7 p.m. to 7:15 p.m. Having a recurring appointment will keep you from springing money worries on your partner at inopportune moments; putting a limit on it will help you stay focused. Use this meeting to review progress toward your goals and to bring up any grievances. The discussions will probably be tense at first, but they'll become more comfortable as they become a habit. And by addressing problems early on, you have a better chance of heading off more serious money arguments down the road. Tip 5: Get help if you need it Sometimes the issues underlying spender-saver clashes are too serious to be resolved with weekly meetings and a little role reversal. If the spender is hiding the bills and racking up big credit-card balances or if out-of-control purchases are preventing your family from reaching key goals like buying a house or saving for retirement, consider bringing in a third party - a financial planner, a marriage counselor or both - to help you work through your problems. The same goes if the saver in the family seems out of control, vetoing dinners out, vacations and all other nonessential purchases, for example, or enforcing a draconian $10-a-week budget. Money is a charged topic, and for many people it is inextricably linked to issues of love, power and security. "If you spend $5,000 a month and you're arguing over $5, maybe the fight is about control, not money," says Tucson financial planner Mike Burdick. (Check aamft.org for family-therapist listings, and napfa.org for referrals to fee-only financial planners.) Whether you choose to work it out yourselves or seek the help of a professional, be patient about your progress. Money habits can be deeply ingrained, and it takes time to learn new ones. Meanwhile, bear in mind that there can be real benefits to having a spouse who's your opposite. "Would there be less stress in our marriage if Michael saw things the way that I did?" Brittany asks. "Sure. But life would be a lot less interesting. And I wouldn't be getting diamonds for Christmas." _______________________________ Kim and Gil Kerkbashian are scared of an uncertain economy, but their conservative portfolio raises the risk that they won't meet their goals. Here's what they should do. What it takes to be rich...lessons from America's richest zip codes Are you a Millionaire in the Making? To be considered for feature on CNNMoney.com, tell us your story at millionaire@money.com. |

|