|

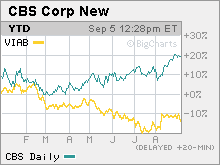

CBS hopes for big ratings from Katie Couric The former 'Today' show host is finally set to debut as CBS' evening news anchor. Can she help lift ratings and ad dollars for the Eye Network? NEW YORK (CNNMoney.com) -- Katie Couric is finally making her long-awaited debut as the anchor of the CBS Evening News on Tuesday. But while that may be big news on Main Street, analysts say it doesn't mean much for Wall Street. Couric signed a deal with CBS in April to become the first solo female anchor of a weekly news telecast. At the time, this was seen as a big coup for CBS (Charts) and a major blow to NBC, where Couric was the co-anchor of the network's "Today," the ratings leader for morning news shows. CBS has seen an increase in viewers for its nightly newscast during the past year. But the network still trails NBC and ABC by a fairly wide margin. So the hope is that Couric's star power can help bridge this gap. Still, some wonder if Couric really can have that big of an impact on the news ratings at CBS. And even if Couric's presence helps the Eye Network overtake NBC, which is owned by General Electric (Charts), or Walt Disney's (Charts) ABC in the nightly news race, it may not matter all that much in terms of increased ad revenue. "CBS's news division is a very small part of a large corporation," said Joe Bonner, an analyst at Argus Research. "Sure, it would be nice if they broke even as opposed to losing money. But if they captured the number one spot in news it would be good more for bragging rights than anything financial." But others think Couric can only help CBS. The addition of Couric comes at a time when the overall network is doing well. CBS finished in first place in the 2005-2006 primetime ratings race -- although it came in third with the advertiser friendly 18-49 demographic -- thanks to hits such as "CSI," "Survivor" and "Without a Trace." According to media buyers, CBS sold about $2.3 billion in ad sales during this spring's upfront buying period, the time when marketers and networks negotiate ad rates for the upcoming fall TV season. That level is about flat with last year's upfront ad sales. Ratings risk or reward? So if news, the one major weakness at CBS, does get a boost from Katie Couric, then that could be a boon to CBS's overall ad sales. "As long as CBS can continue with its hit programs and complement that with good ratings from of its news division then its financial success will continue. If the network can accelerate its revenue growth, that will only be warmly received by Wall Street," said Frederick Moran, an analyst with Stanford Group. In fact, CBS has been rewarded by investors this year. Shares are up nearly 15 percent since the company was spun-off from its former parent Viacom in January. Viacom's stock, meanwhile has slumped more than 10 percent since the break-up and on Tuesday, Viacom (Charts) announced that its CEO Tom Freston was stepping down. CBS has also won raves from analysts for new digital initiatives, such as running advertiser-supported online streams of the popular NCAA men's basketball tournament and launching an Internet broadband TV network called Innertube. To that end, CBS has already said that it will air live simulcasts of the "Evening News with Katie Couric" on CBSNews.com as well as on demand versions after the show airs on TV. But what about the financial ramifications for CBS if Couric doesn't pan out in the anchor chair? The network and Couric did not disclose the terms of her contract when she joined CBS but according to rumors, Couric is said to have signed a three year deal worth $39 million. Even though $13 million a year sounds like a big gamble, analysts said that for a company like CBS, which is expected to generate $14.5 billion in sales this year, it really isn't a huge risk. "CBS is a big company. It's hard to pay one person so much money that it can hurt the company," said Laura Martin, an analyst with Soleil/Media Metrics. "She's not expensive enough to affect the bottom line of CBS. If it doesn't work out, it costs them little." -------------------------------------------------------------------------------- Analysts quoted in this story do not own shares of CBS and their firms have no investment banking ties with the company. |

|