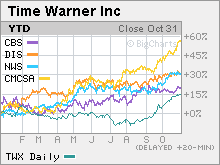

Time Warner: Good but not greatNo. 1 media company's sales and earnings miss forecasts, but shows signs of improvement at AOL; stock off.NEW YORK (CNNMoney.com) -- Time Warner posted solid gains in third-quarter earnings and revenues thanks to strong sales growth from cable and an improving profit picture at the company's AOL unit. But the world's largest media company, which owns the CNN and HBO networks as well as the Warner Bros. movie studio, reported sales and earnings that were slightly below Wall Street's expectations. Shares of Time Warner (down $0.16 to $19.85, Charts) fell about 1 percent in morning New York Stock Exchange trading after the report. New York-based Time Warner reported revenue of $10.9 billion, up 7 percent from a year ago. Analysts were expecting sales of $11.1 billion. The company, which is the parent of CNNMoney.com, reported a profit, excluding one-time items, of 19 cents a share, up 12 percent from the same period last year. Wall Street had projected that Time Warner would earn 20 cents on this basis. But Time Warner beat consensus estimates on another measure of profitability. The company reported adjusted operating income before depreciation and amortization (OIBDA) of $2.85 billion, up 16 percent from a year ago and ahead of Wall Street's forecast of $2.8 billion. Time Warner also reaffirmed its profit growth forecast for the year. Time Warner's stock has rallied in recent weeks on hopes that the company's AOL division is finally turning around. The stock's now up 16 percent year-to-date and earlier this month closed above $20 for the first time in more than 4-1/2 years. But the stock still lags behind some of its other media rivals, such as Walt Disney (Charts), News Corp (Charts), as well as cable competitor Comcast (Charts). One analyst noted that in light of the stock's recent move up, some investors were probably selling Wednesday to lock in gains, and not because of any concerns about the company's outlook. "This is probably a sell-on-the-news reaction. There was nothing stunningly bad or stunningly great in the report," said Joe Bonner, an analyst with Argus Research. Time Warner announced in August that AOL was getting rid of fees for AOL broadband users, a move that analysts think could position AOL to get a bigger cut of the online advertising market currently dominated by the likes of Google (Charts) and Yahoo! (Charts) So far, the plan appears to be working. Although AOL's revenues fell 3 percent from a year ago, due mainly to a 4.9 million decline in subscribers from the same period last year, advertising revenue at AOL increased 46 percent from last year. And that helped to lift AOL's OIBDA by 21 percent. "We're particularly encouraged by AOL's early progress in making the transition to an advertising-supported business," Time Warner CEO Dick Parsons said in a statement. And during a conference call with analysts, Parsons dismissed recent speculation that AOL could be for sale. "AOL is a core asset. We are pleased with the new strategy," Parsons said. "We have it on the right track." Parsons added that he expected AOL's online ad growth to be robust in 2007, noting that ad revenue should rise in line with industry estimates of about "mid-teens" to 30 percent growth next year. There is also optimism about Time Warner's plans to sell a stake in its thriving cable business to the public. Time Warner filed for an IPO of its cable division earlier this month. Sales at Time Warner Cable surged 44 percent from last year, largely due to new subscribers Time Warner gained once it completed its acquisition of a portion of bankrupt cable provider Adelphia during the quarter. OIBDA at the cable business jumped 28 percent from a year ago. But Thomas Eagan, an analyst with Oppenheimer & Co., noted that subscriber growth at Time Warner Cable was not as strong as the results that Comcast reported last week. He noted that Time Warner added fewer digital phone customers than he and other analysts were expecting. During the conference call, Time Warner president and COO Jeffrey Bewkes said Time Warner was happy with the subscriber gains it has seen in the digital phone business so far but conceded that Time Warner Cable is seeing increased competition from telecom firms. He added, though, that the growth in the digital phone business is just beginning. "Have we hit a ceiling? No. It's clear to us that we haven't," he said. Mixed bag at other divisions The financial performance of the company's other businesses were uneven, however. "The results were mixed but mostly positive. It does appear that the focus on making AOL an advertising vehicle seems to be working and the cable numbers were mostly better than expected," Oppenheimer's Eagan said. Time Warner's filmed entertainment division reported a drop in sales and operating profits due to tough comparisons to a year ago and disappointing results from this year's slate of summer movies. Last year, Time Warner had several big box office blockbusters, including "The Wedding Crashers" and "Charlie and the Chocolate Factory." But this year, the heavily hyped "Poseidon" and New Line Cinema's "Snakes on a Plane" both bombed. Time Warner's networks business, which includes CNN, TBS and HBO, reported sluggish growth, with sales rising 4 percent and OIBDA increasing by 9 percent. And the company's magazine division posted even slower growth. Sales rose just 1 percent while OIBDA increased by 3 percent from the same period last year. Time Warner is in the process of trying to sell 18 of its magazines, including Popular Science and Field & Stream. During the conference call, Parsons said that there was a large amount of interest in the magazines that are for sale and that Time Warner is currently looking at bids from about eight to ten different potential acquirers. Barry Diller's Net bet: Nice "Ask" Oppenheimer's Eagan owns shares of Time Warner but his firm has no banking ties to the company. Argus' Bonner does not own the stock and his firm has no banking relationship with Time Warner. The reporter of this story owns shares of Time Warner through his company's 401(k) plan. |

|