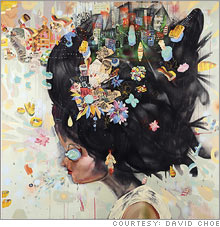

Collecting profitsBuying the works of today's unknown artists can pay off famously tomorrow.(Business 2.0 Magazine) -- A few years ago, the artist known as Banksy was just another anonymous graffiti punk plastering his work on London city streets. Today, Sotheby's auctions off his art for six figures, and early collectors are taking their Banksys to the bank. Thanks in part to the Internet, which has globalized the market, artists are rocketing from unknown to renown in record time. That makes putting your money in "art futures" - buying the work of obscure artists before they board the fame train - a potentially lucrative short-term investment. Take, for example, Claire Sherman, a 2005 art school graduate who sold out her recent Chicago show via an e-mail gallery before it even opened. Or David Choe. Barely three years ago, you could have bought the San Jose street artist's paintings for a few hundred bucks apiece. Now a Choe portrait will set you back as much as $50,000.

"There is an entire base of urban/street artists that are now coming into their own," says Marc Schiller, the co-founder of urban art blog Wooster Collective, "and there is this incredible opportunity to buy them while they're still within reach." How to spot the next Keith Haring: Picking artists who are poised to make it big is an art in itself. The best way to get a clue is to keep close tabs on art scene connoisseurs. That can mean a regular scouring of sites like Wooster Collective, Are You Generic, Stencil Revolution, and Newartdealers.org, the website of the New Art Dealers Alliance. CerealArt, which produces limited editions of works by lesser-known artists, is another place to spot affordable up-and-comers. There are also brick-and-mortar galleries with track records for finding and exhibiting new artists who go on to fame and fortune. You might keep an eye on Canada, Deitch Projects, and Gavin Brown's Enterprise, all in New York City. Others to watch include London-based Elms Lesters Painting Rooms, Jack Hanley in Los Angeles, and the Luggage Store in San Francisco. Once you zero in on a piece of art, examine the artist's resume. What museums have bought pieces, what group shows has the artist been in, what school did he or she go to? Yale and Columbia are in fashion these days. What to avoid: Nothing destroys value more than an artist who floods the market. Another killer is a radical shift in style. Early Andy Warhol still lifes aren't nearly as valuable as the Marilyn and Mao silk screens that came later. How to invest: John Doffing, an art dealer and startup entrepreneur in San Francisco, recommends not paying too much attention to a piece's price or whether it will appreciate in value. "It's fun, it's important, and maybe someday the pieces you buy will be worth more," he says. CerealArt founder Larry Mangel sees collector-investors taking a shotgun approach, buying a smattering of works from several artists simultaneously. "If you spend $1 million on a bunch of artists, and just a couple of them make it, you'll do well," Mangel says. Sure, putting money on unsung artists is risky - but so is investing in tech startups. And let's face it, even if an artist like Banksy loses his cachet, one of his prints of senior citizens lawn-bowling with bombs is going to look a heck of a lot nicer over your fireplace than a stock certificate from Pets.com. |

Sponsors

|