The credit card company everybody hates

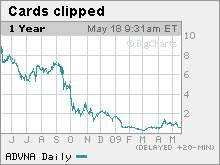

Facing soaring losses, small business credit card lender Advanta is shutting down accounts and tells investors it will try to wait out the downturn.

|

| Delinquencies soared over the past year as the economy slowed and the company raised rates. |

|

| Advanta shares recently fetched less than a dollar each in Nasdaq trading. |

|

| Rep. Carolyn Maloney is among the legislators proposing credit card reform. |

NEW YORK (Fortune) -- The credit card business has grown so wretched that one major issuer is clipping its customers' cards and giving its investors a haircut.

Advanta (ADVNA), the nation's No. 14 card issuer and a top lender to small businesses, said last week it will shut down its card business to stem losses. The move is a momentous one, because credit cards bring in nearly all Advanta's revenue.

The company will close customer accounts next month, leaving a million borrowers looking for credit at a time when lenders are pulling back. And Advanta's small-business customers aren't the only ones in limbo: So are the investors whose bond purchases financed Advanta's expansion over the past decade.

The firm says notes due to mature next month won't be repaid in full on schedule. Advanta is offering to buy some bondholders out at a roughly 30% discount.

The news comes as Advanta, which last month reported a $76 million first-quarter loss, struggles to stanch the bleeding as more customers fall behind on payments.

"The stress rises as you get more delinquencies," said Steven Mann, a professor at the University of South Carolina's Moore School of Business. "Then you see these companies start to break the glass in case of fire."

Delinquencies, measuring accounts a month or more past due, hit 11.5% in April, Advanta said -- down slightly from its March level, but more than double the year-ago tally.

Advanta isn't the only bank struggling to deal with late payments. Delinquencies have risen sharply at bigger issuers as well, ranging from Bank of America (BAC, Fortune 500), JPMorgan Chase (JPM, Fortune 500) and Citigroup (C, Fortune 500) to Capital One and American Express.

But those companies are much bigger and have deeper pockets, after years of consolidation at the top of the U.S. banking industry.

BofA, JPMorgan and Citi -- the three big diversified issuers - together accounted for more than half of 2008 U.S. credit card lending. Advanta sold most of its consumer credit card portfolio to Fleet Financial in 1997. Fleet was later acquired by BofA.

What's more, none of the bigger issuers has posted numbers as dire as Advanta's. Capital One (COF, Fortune 500) and American Express (AXP, Fortune 500) both passed the government's stress tests without having to raise new capital.

Advanta may have made its problems worse by jacking up some customers' interest rates, prompting them to cancel.

John Dykstra, a computer consultant in Kenmore, Wash., was spending between $2,000 and $3,000 a month on an Advanta rewards card before the company gave notice in August of a plan to boost his rate to 26% from 8%.

"It just ticked me off that they would triple my rate," he said. "It seems like they made some bad business choices."

The latest steps Advanta has proposed aren't ones credit card issuers take lightly. Closing accounts makes outstanding balances harder to collect and eliminates income from the fees issuers charge merchants.

"Advanta's stated intention to terminate cardholders' charging privileges is likely to cause an acceleration of losses measured as a percentage of the pool, as the trust portfolio reduces in size due to charge-offs and payments," analysts at Moody's wrote Friday in downgrading 23 classes of Advanta credit card-backed securities.

The Moody analysts added they expect charge-offs to increase to a range of between 40% and 50%, from 17.3% in March.

In turn, investors in the securities issued by the credit card trust can expect smaller payouts, as the trust unwinds in a process known as early amortization. Advanta plans to offer to buy back $1.4 billion in outstanding bonds issued by the credit card trust, at between 65 and 75 cents on the dollar.

Advanta says that rate is in line with the recent trading in the Advanta Business Card Master Trust Class A senior notes, but investors aren't likely to look fondly on the decision.

Indeed, Advanta spent months claiming it wouldn't come to this. The company said in January that "early amortization for our business credit card master trust is avoidable and the company does not expect it to occur."

But credit card defaults continued to surge, prompting Advanta to shift its focus to cutting its losses. Under the new approach, the company said last week, Advanta "will be free to do new business in the future to the extent it chooses, but it does not expect to do so in a significant way until implementation of the plan is well under way."

Though all the credit card-issuing banks are dealing with rising delinquencies, Advanta is the first in recent years to allow outside investors to take losses on its credit card-backed securities.

This spring, both Bank of America and Citigroup bought bonds from their credit card securitization trusts to make sure bondholders wouldn't suffer losses even if the downturn steepens. In those moves, BofA contributed $6 billion and Citi $3 billion to cushion against future losses that could threaten the trusts' income streams.

The bigger problem for major issuers stems from their own poor behavior during the boom, said Myron Glucksman, a structured finance consultant.

He said the public has grown exasperated with huge rate increases, excessive fees and unclear disclosure.

That's why the Federal Reserve last year proposed new limits on fees and other restrictions, in a move that is to take effect next year. And that's why Congress is currently considering a credit card bill that would further restrict the banks' leeway to change pricing -- not to mention where you can carry a gun.

"There has to be some understanding that the industry has made a mistake," said Glucksman, who was a managing director in Citi's corporate and investment bank and owns Citi shares. "They're facing a situation where not only are delinquencies rising, but everybody hates them." ![]()

-

The retail giant tops the Fortune 500 for the second year in a row. Who else made the list? More

The retail giant tops the Fortune 500 for the second year in a row. Who else made the list? More -

This group of companies is all about social networking to connect with their customers. More

This group of companies is all about social networking to connect with their customers. More -

The fight over the cholesterol medication is keeping a generic version from hitting the market. More

The fight over the cholesterol medication is keeping a generic version from hitting the market. More -

Bin Laden may be dead, but the terrorist group he led doesn't need his money. More

Bin Laden may be dead, but the terrorist group he led doesn't need his money. More -

U.S. real estate might be a mess, but in other parts of the world, home prices are jumping. More

U.S. real estate might be a mess, but in other parts of the world, home prices are jumping. More -

Libya's output is a fraction of global production, but it's crucial to the nation's economy. More

Libya's output is a fraction of global production, but it's crucial to the nation's economy. More -

Once rates start to rise, things could get ugly fast for our neighbors to the north. More

Once rates start to rise, things could get ugly fast for our neighbors to the north. More