Odds on Steve Wynn beating Vegas

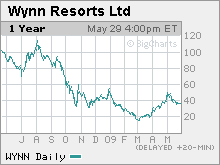

Shares of Wynn Resorts have bounced back from their 52-week lows, but are they a good bet?

NEW YORK (Fortune) -- Wynn Resorts is suffering as fewer gamblers visit its hotel casinos, and those who do visit bet less.

In the first quarter Wynn (WYNN) lost $34 million, while the Las Vegas Strip recorded its 15th straight month of revenue declines, the worst on record.

But the stock has more than doubled from its 52-week low as the Macau market improves and the company reduces debt. Will the shares continue to rise?

We upgraded Wynn to a buy in April for two reasons: an improving balance sheet and gains in the Macau market. Wynn has no debt due in 2009 and relatively little due in 2010. When you can buy a strong operator like Wynn without balance sheet issues -- that's a good entry point.

In Macau, March gaming figures showed improvement, and several other casino projects under construction have been halted. So Wynn's Encore Macau, set to open in May 2010, is now one of only two new projects opening in the next two years. And it is a fully funded project, so it is not incurring delays.

At one point, Macau's gaming capacity was on track to increase 42% a year in 2009 and 2010. Now there will be only single-digit growth. Wynn is well positioned to capture any market growth that results from those next projects.

Wynn has already done well in a competitive Macau market. That includes growing their market share over the last 12 months when more capacity was coming online.

Right now you're getting a good operator in Wynn at a time when the balance sheet is in good shape; its projects are fully funded; and it's well positioned in Macau.

Our upgrade was not based on assumptions that Vegas was improving. We believe Las Vegas will be down significantly, and we have those declines factored that in.

But Wynn is well positioned for when that market starts to turn. We have a $50 price target for the stock.

To bet on this stock, you need to believe that visitation will be up significantly next year. That's the primary headwind Wynn faces in Las Vegas and Macau, its only markets. Visitation is down in 2009, and there's nothing to suggest that it will increase in 2010.

In Las Vegas, along with the slump in demand, Wynn has to contend with the CityCenter project, which will increase the supply of high-end hotel rooms by 28% when it opens later this year.

There's a difference of opinion on Wall Street about whether or not Wynn is going to be able to hang on to their high-end business in the face of additional supply entering the Vegas market. The answer probably lies somewhere between a categorical `yes' and a categorical `no'. But given that limited visibility, Wynn's valuation --17- or 18-times EBITDA, by our estimates -- is too much of a premium to pay.

In Macau, where Wynn earns the majority of its profits, 2008 was a fabulous year. But it's gone. And Macau's table volumes were driven higher last year by one junket consolidator that provided tremendous credit for VIP players. That consolidator is pulling back this year.

Certainly Wynn has executed extremely well since 2002. Its developments have opened and performed well, and it has proven itself to be among the best operators in the industry.

But Wynn's markets are under pressure, and we don't think things will improve next year.

And while it may do incrementally better than some other gaming stocks, the markets are what they are.

A game-changer for Wynn would be if business conventions to Las Vegas are back up sharply next year. But I don't know that anybody has that thesis or that notion at this point.

We think the stock can fall to $27. ![]()

-

The retail giant tops the Fortune 500 for the second year in a row. Who else made the list? More

The retail giant tops the Fortune 500 for the second year in a row. Who else made the list? More -

This group of companies is all about social networking to connect with their customers. More

This group of companies is all about social networking to connect with their customers. More -

The fight over the cholesterol medication is keeping a generic version from hitting the market. More

The fight over the cholesterol medication is keeping a generic version from hitting the market. More -

Bin Laden may be dead, but the terrorist group he led doesn't need his money. More

Bin Laden may be dead, but the terrorist group he led doesn't need his money. More -

U.S. real estate might be a mess, but in other parts of the world, home prices are jumping. More

U.S. real estate might be a mess, but in other parts of the world, home prices are jumping. More -

Libya's output is a fraction of global production, but it's crucial to the nation's economy. More

Libya's output is a fraction of global production, but it's crucial to the nation's economy. More -

Once rates start to rise, things could get ugly fast for our neighbors to the north. More

Once rates start to rise, things could get ugly fast for our neighbors to the north. More