TARP profit claim bugs skeptics

The Treasury Department's bank investments are paying dividends. But saying they have earned $6 billion for taxpayers, as Tim Geithner did, is a stretch.

|

| Tim Geithner may have jumped the gun by saying taxpayers have earned money on TARP. |

|

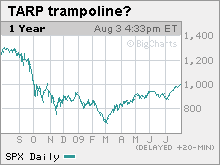

| The S&P 500 has jumped 50% in five months. |

NEW YORK (Fortune) -- The markets are on a roll, but it's still a tad early for Treasury Secretary Tim Geithner to be counting his bailout winnings.

Geithner said this past weekend that taxpayers have made a small profit on their investments in banks via the Troubled Asset Relief Program. "We've already earned about $6 billion for the taxpayer on those investments," Geithner said Sunday on ABC's "This Week."

The claim seems to reflect regular payments banks have made since Treasury rolled out the TARP last fall.

Treasury didn't return a request for comment, but the agency had received $6.85 billion in bank dividend and interest payments through June, according to data published last month by Neil Barofsky, the special inspector general for TARP.

But as welcome as the dividend payments are at a time of surging federal spending, it would be premature to conclude they represent profits for taxpayers.

"Dividends are definitely income, but they're not necessarily profit," said Alex Pollock, a resident fellow at the American Enterprise Institute in Washington.

Pollock said it's impossible to assess the profitability of TARP without a robust and systematic accounting of the program's costs, including interest expense and overhead.

Others have reached similar conclusions. Gary Engel, director of financial management and assurance at the Government Accountability Office, was asked at a hearing last month whether he views the stream of dividends into Treasury as a profit for taxpayers. "Not at this point," he said.

Pollock said the answer is for Treasury to administer the program as if it were an independent company, with its own independently audited financial statements and balance sheet.

Doing so would make clear exactly how much it costs Treasury to borrow the money it uses for TARP. The shortage of data on that question came to light at a congressional hearing last month.

Rep. Randy Neugebauer, R-Texas, speculated at a July 9 House Financial Services hearing that the Treasury could end up spending $28 billion annually to finance TARP.

The committee's chairman, Rep. Barney Frank, D-Mass., said he thought the costs are "far less" and said he'd ask GAO to provide an estimate. Frank's office said Monday it would check on the answer.

Congress initially empowered Treasury to make $700 billion in TARP investments. The government has some $371 billion in TARP investments outstanding, according to Barofsky's report last month.

There's also the question of subsidies -- the amount by which Treasury overpaid for the preferred stock it received from banks that got TARP funds, as measured by market values. The Congressional Budget Office estimated in June that institutions received $159 billion more in aid than Treasury received in securities.

None of this is to say the program has been an unmitigated disaster. Officials proposed TARP not to make money but to cushion the collapse of economic activity last fall following the collapse of giant finance firms such as Lehman Brothers and Washington Mutual.

"This program is delivering very important improvements in availability of credit, which is the ultimate test," Geithner said Sunday.

And the bet taxpayers made on the financial sector is looking a lot better now than it was when Geithner took office: on Monday, the S&P 500 closed above 1,000 for the first time since President Obama's election last November.

But Marcus Peacock, project director at Subsidyscope, a Web site run by the Pew Charitable Trusts that tracks federal spending, said the government isn't doing enough to document what's happening with the money. He said government data collection projects are often "pockmarked" with omissions and outright errors, a pattern that hasn't been broken with the financial bailouts.

Despite the administration's public embrace of transparency, it has failed to provide full and understandable disclosure of its actions in TARP, Peacock said.

Pollock, likening taxpayers to the ant who saved all winter and the TARP-taking banks to the profligate grasshopper, said only a full airing of TARP accounts can satisfy responsible Americans.

"I'd like to do something for the ant," he said. ![]()

-

The retail giant tops the Fortune 500 for the second year in a row. Who else made the list? More

The retail giant tops the Fortune 500 for the second year in a row. Who else made the list? More -

This group of companies is all about social networking to connect with their customers. More

This group of companies is all about social networking to connect with their customers. More -

The fight over the cholesterol medication is keeping a generic version from hitting the market. More

The fight over the cholesterol medication is keeping a generic version from hitting the market. More -

Bin Laden may be dead, but the terrorist group he led doesn't need his money. More

Bin Laden may be dead, but the terrorist group he led doesn't need his money. More -

U.S. real estate might be a mess, but in other parts of the world, home prices are jumping. More

U.S. real estate might be a mess, but in other parts of the world, home prices are jumping. More -

Libya's output is a fraction of global production, but it's crucial to the nation's economy. More

Libya's output is a fraction of global production, but it's crucial to the nation's economy. More -

Once rates start to rise, things could get ugly fast for our neighbors to the north. More

Once rates start to rise, things could get ugly fast for our neighbors to the north. More