Why Kozlowski should get clemency

The notorious former CEO of Tyco is serving up to 25 years for his sins. But in the age of Wall Street chicanery, it may be time to rethink who's really a criminal. A contrarian's take.

|

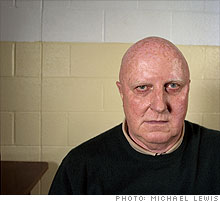

| Dennis Kozlowski, former CEO of Tyco, was convicted of a range of felonies. |

(Fortune Magazine) -- For inmate No. 05A4820, the days are pretty much the same. At the Mid-State Correctional Facility in upstate New York, Dennis Kozlowski, 63, sorts prison laundry, awaits mail call, enjoys his private supply of fresh fruit, watches Yankees games (he's a minority owner), and tries to sleep in a cell where the bright light never goes out.

Eight years and a lifetime ago, "Deal-a-Day" Dennis was among America's most celebrated, highest-paid CEOs, transforming a company named Tyco (TYC) from a backwater manufacturer with a market cap of $1.5 billion into an industrial conglomerate worth more than $100 billion.

BusinessWeek had lauded him as one of the Top 25 Managers of the Year. (Fortune got into the act in 1986, including young Kozlowski on a list of People to Watch because he had turned around Tyco's sprinkler-system division.) Along the way he amassed nearly a half-billion dollars and reveled in the toys that came with it: a $31 million Fifth Avenue apartment, a vintage yacht, a Renoir, and a Monet.

Then came the fall. In 2002 the Manhattan district attorney accused him of cheating on $1 million in sales tax on his art purchases, which in turn led to a wider investigation of Kozlowski by the Tyco board and the DA.

The following year Kozlowski was indicted for systematically looting his company of hundreds of millions of dollars, including unauthorized bonuses. After one mistrial he was convicted of a range of felonies and sentenced to prison for the remarkably indeterminate period of eight to 25 years, as well as tens of millions in fines and restitution.

The evidence against him included a corporate-funded $6,000 gilded shower curtain for his apartment and a notorious video of a Roman-orgy birthday party in Sardinia for his wife. Costing $2 million, with Tyco funds paying half, the extravaganza featured an ice sculpture of David peeing Stolichnaya.

"OINK, OINK," sniggered the front page of the New York Post. "I was piggy," Kozlowski tells Fortune, with some insight, in the visiting area of his prison. "I had bad judgment. But I don't deserve to be here."

He has a point. If avarice alone were grounds for incarceration, much of Wall Street would be doing time. Those who destroyed AIG (AIG, Fortune 500) or Lehman or Bear Stearns would now be sharing cellblock apples and pears with Kozlowski, a point not lost on the most infamous miscreant in the New York state pokey. "It's galling," he says.

He is the embodiment of an earlier epoch of corporate greed and personal profligacy, circa a decade ago. Yet along with WorldCom's Bernie Ebbers and Jeffrey Skilling -- serving their own long sentences -- Kozlowski now looks like small fry in the sea of financial shenanigans. The question is whether that makes him a template for prosecutors today or a scapegoat deserving retrospective leniency. I would suggest the latter.

Kozlowski has a new appeal pending, this time before a federal judge in Manhattan; the government's papers are due Nov. 30. State courts have thrown out his claims. The technical constitutional issue is whether he was denied a fair trial because he didn't have access to prosecutorial evidence that might have helped his defense.

While that's not a bad argument, federal courts usually defer to state criminal rulings. Instead of judges, politicians ought to be reassessing the fairness of Kozlowski's sentence.

Given that Tyco remains a strong company -- unlike Enron and WorldCom, whose demises were caused by their leaders' criminality -- wasn't Kozlowski unfairly demonized? And isn't the inequity of his punishment underscored by what has not yet befallen the corporate leaders who nearly took down the international economy last year?

As monumentally excessive as his conduct was and as damning as the evidence seemed to be that he got some of his compensation by playing fast and loose with his board of directors, the putative crime simply doesn't seem to warrant a punishment longer than many killers get.

The tax charge, a convincing one, is not why he's doing time. At its essence the case against Kozlowski -- some of whose compensation was indisputably legitimate based on a soaring company stock price that benefited all shareholders -- amounts to a glorified dispute over ridiculously fabulous bonuses. "Everything I got was on the company books," Kozlowski says. "None of it was hidden."

Keep him from teaching ethics classes at Harvard Business School. Don't let him back on the Nantucket yachting circuit. In hindsight, though, eight to 25 comes off as gratuitous -- personal payback for a white-collar crime wave that really wasn't about him.

Remember Michael Milken and his hundreds of millions in ill-gotten gains? He served less than two years. Mollycoddling sentences aren't good. Vindictive sentences are a lot worse.

The New York governor has the power of clemency, and state parole officials, in an indeterminate sentence, have vast discretion: Based on good behavior, Kozlowski could be out on work release in a couple of years. (Imagine his job potential in interior design -- John Thain, have we got a consultant for you!)

As a matter of PR, no public official wants to be the one who lets out the reprobate bald guy who gave gluttony a bad name. But in the tough economic times in which we live, when populist scorn cries out for Robespierrean blood, the quality of mercy should retain its noble place.

David A. Kaplan, a Fortune contributing editor, once practiced law on Wall Street and wrote "The Accidental President," an account of Bush v. Gore that was the basis for the Emmy-winning "Recount" on HBO last year. He is working on a new book, "The Age of Avarice." ![]()

-

The retail giant tops the Fortune 500 for the second year in a row. Who else made the list? More

The retail giant tops the Fortune 500 for the second year in a row. Who else made the list? More -

This group of companies is all about social networking to connect with their customers. More

This group of companies is all about social networking to connect with their customers. More -

The fight over the cholesterol medication is keeping a generic version from hitting the market. More

The fight over the cholesterol medication is keeping a generic version from hitting the market. More -

Bin Laden may be dead, but the terrorist group he led doesn't need his money. More

Bin Laden may be dead, but the terrorist group he led doesn't need his money. More -

U.S. real estate might be a mess, but in other parts of the world, home prices are jumping. More

U.S. real estate might be a mess, but in other parts of the world, home prices are jumping. More -

Libya's output is a fraction of global production, but it's crucial to the nation's economy. More

Libya's output is a fraction of global production, but it's crucial to the nation's economy. More -

Once rates start to rise, things could get ugly fast for our neighbors to the north. More

Once rates start to rise, things could get ugly fast for our neighbors to the north. More