Search News

NEW YORK (CNNMoney.com) -- The American dream of home ownership has turned out to be the American nightmare for those who could never really afford a home in the first place.

Many borrowers are now in deep trouble as home prices have plummeted and the payments on bubble-era adjustable rate mortgages have shot up. Foreclosures are still continuing at an alarming pace.

If the so-called Great Recession has taught us anything, it's that buying a house is not a divine right. It's a privilege to be earned only after you've saved up a nice chunk of cash for a down payment and are in a healthy enough financial position to keep making those monthly mortgage payments .

So for many consumers, renting is not necessarily the worst thing in the world. That's worth keeping in mind now that some experts think home prices are close to bottoming and fixed mortgage rates are still fairly low.

Sure, we've all been taught that buying real estate is the smartest thing you can do in order to build wealth. That's probably still true for the long haul.

But like with any investment, you should only make a purchase if you can afford the near-term hit that comes from doling out all that money now. Plus, you have to be able to stomach the possibility that the value of the house may actually fall over a short period.

And guess what? It seems many people are in fact coming to the realization that, for now at least, it makes more sense to rent instead of buy.

Jerry Davis, senior vice president of property operations for UDR (UDR), a Denver-based real estate investment trust (REIT) that owns and manages apartments, said that before the housing market collapsed, about 25% of the company's renters that moved out of apartments did so because they were buying a home.

Now, only about 12% are moving out to purchase a home, and in some of the harder hit real estate markets, such as California, Davis said that fewer than 10% of movers are buying a house of their own.

"Even though prices have come down, you're not seeing a big exodus of renters to buy homes," Davis said. "Buying a house used to be the way to get rich, but people are afraid to jump back in."

In addition, banks also appear to have learned lessons from the housing crash. Many remain reluctant to give mortgages to even the most credit-worthy consumers.

"It was Shakespeare who wrote that when home prices are declining, neither a borrower nor a lender be," joked Edward Leamer, chief economist for the Ceridian-UCLA Pulse of Commerce Index and professor at UCLA's Anderson School of Management.

Simply put, many consumers just aren't buying the notion that the economy is getting better. For many, the stock market rally does not make their daily lives any easier. Consumers are more interested in the job market improving than the Dow or S&P 500 hitting highs.

"This is a frugal recovery. People are more reluctant to buy homes as they would in a normal recovery," Leamer said. "If you don't have a job or are worrying about your job, you're not going to buy a home. That's the ultimate statement of optimism about the future."

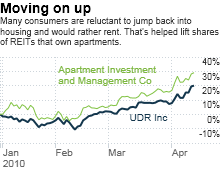

Add that up and it's reasonable to expect a rental boom that could last for some time. That's not lost on Wall Street. Shares of UDR, for example, are up 20% this year.

Other apartment REITs have also surged this year and an analyst at RBC Capital Markets upgraded UDR, BRE Properties (BRE), Camden Properties Trust (CPT) and Apartment Investment and Management (AIV) last week, citing their growth potential.

Thomas Toomey, CEO of UDR, said that favorable demographics will also probably drive more people to rent than buy. He pointed to the increasing number of retiring Baby Boomers who may look to downgrade from bigger houses to apartments.

He also said that record-high college enrollment levels are a boon for UDR and other apartment owners. Most recent college graduates, particularly those finding work in cities, are not in a position to buy a home.

Toomey added that cities are also interested in building more apartments closer to where people work for environmental reasons.

"So if you look toward the future, it's not just demographics and people making a conscious decision of whether they can afford a home that will lead to more renters. Cities want more apartments for younger and older generations," he said.

Of course, that's exactly what you'd expect the head of a company that owns apartments to say. But I also agree with him. And I'm curious to hear what you think.

Are any of you long-term renters finally looking to buy? Homeowners that want to sell and not deal with a mortgage anymore? E-mail me and if I get enough feedback, I may do a follow-up column about renting versus buying.

- The opinions expressed in this commentary are solely those of Paul R. La Monica. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |