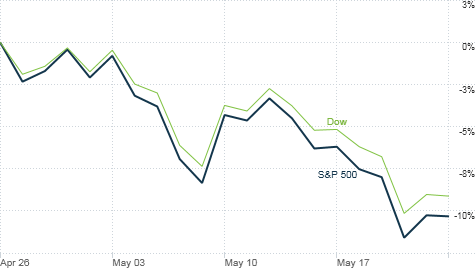

The market's plunge in May has rattled investor confidence. But few experts think that this is the beginning of another major downturn.

The market's plunge in May has rattled investor confidence. But few experts think that this is the beginning of another major downturn.

NEW YORK (CNNMoney.com) -- Sell in May and go away may seem like a silly Wall Street saying. But if you actually followed those words of wisdom, you'd be breathing a lot easier right now.

Stocks fell Monday as a better-than-expected jump in existing home sales in April was not enough to outweigh fears about the debt crisis in Europe. Tthe S&P 500 is now down about 9.5% in May.

So what now? Is the May malaise merely a long-awaited correction or the start of a new bear market that could last months or years? Is it time to buy in June and sing a happy tune?

Several market experts are guardedly optimistic that things won't get significantly worse. That's the good news.

"The most immediate concerns are transitory. They are important but they will get resolved soon," said David Joy, chief market strategist with Columbia Management in Boston. "It's important to have a well diversified portfolio and be prudent. But there's no need to exit the stock market."

Bruce McCain, chief investment strategist with Key Private Bank in Cleveland, added that he thinks there is little room left for stocks to fall from here. In fact, he said it's possible the market may have already hit bottom.

"This could be a surprisingly short correction," he said.

The bad news though is that the market may remain choppy for the foreseeable future.

"Volatility is a given. As far as Europe is concerned, there is a lot going on and many questions that are unanswered," said Matt O'Reilly, chief investment strategist with People's United Wealth Management in Bridgeport, Conn.

O'Reilly is confident that stocks will eventually bounce back, but he said it's no surprise that many individual investors are still sitting on the sidelines. The memory of 2008's meltdown is still fresh and events like the May 6 flash crash do little to help restore faith in the markets.

"Investors have still yet to recognize what their tolerance for risk is. Every time there is a rapid response in the markets to news, it undermines their confidence and makes them more wary," he said.

The biggest problem is that Europe is a big massive unknown. Are the issues facing the PIIGS nations a mere hiccup on the road to economic rebound or a precursor to another worldwide downturn?

"The one thing we don't know is what impact the decline in Europe will have on the global recovery. I don't think we are going to have a double-dip recession. But the pace of growth may slow," said Phil Dow, director of equity strategy RBC Capital Markets in Minneapolis.

But overall, Dow said he thinks some of the broader fears are overblown. He thinks that energy, tech and health care stocks could be due for a comeback once investors realize that Europe 2010 may not be a sequel to Lehman Brothers 2008.

McCain agreed. He said that some hard hit stocks have been oversold as investors got too gloomy and added that the rush into U.S. Treasurys this month is a crystal clear sign that investors may be overreacting to Europe's problems. People are flocking too much into so-called safe havens, he said.

"Bonds may be a successor bubble to real estate. Everybody is putting money into them and historically when people all rush into one asset, that doesn't come to a good end," he said.

Still, the Europe crisis has proven to be a reality check for investors. Jeff Applegate, chief investment officer with Morgan Stanley Smith Barney in New York, said that this month's market decline was necessary.

"We were a little concerned about stocks having such an enormous run. This sell-off, given the big move up since the March 2009 lows is a healthy development," he said. "I don't think it's anything more than that. It's not the start of a new bear market."

So when push comes to shove, investors probably should just simply expect more of the same for the coming months. It appears unlikely that Europe is going to create another extended global economic meltdown.

But that doesn't mean the U.S. economy or stock market is likely to come roaring back anytime soon either.

"The crisis in Europe got the sleep out of investors' eyes. It gave people a reason to sell," said John Norris, managing director of wealth management with Oakworth Capital Bank in Birmingham, Ala. "This isn't a precursor to a financial panic but it's a realization that the economic recovery will be tepid."

- The opinions expressed in this commentary are solely those of Paul R. La Monica. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |