Search News

NEW YORK (CNNMoney.com) -- Bank of America chief executive officer Brian Moynihan seems as if he can do no wrong these days -- a pleasant surprise given how little excitement his hiring generated in the first place.

Many industry experts thought Bank of America should have hired an outsider to take over for CEO Ken Lewis instead of promoting from within. Moynihan had previously been the president of the company's retail banking operations.

|

| In one of his first public appearances as Bank of America CEO, Moynihan testified before the Financial Crisis Inquiries Commission in January. |

|

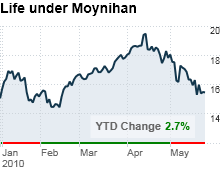

| Bank of America shares have remained resilient so far this year, despite the recent pressure markets have come under recently. |

But nearly everything Moynihan has touched has turned into proverbial gold in the five months he has been at the helm of the nation's largest bank.

Last quarter, the first with Moynihan in control, the Charlotte, N.C.-based lender enjoyed a sharp rebound in profits, earning approximately $3.2 billion.

More importantly, he has made a lot of progress mending ties with the bank's customers as well as the government.

In March, Bank of America (BAC, Fortune 500) became the first to stop charging overdraft fees for debit card transactions, a practice that the entire industry will be required to adhere to starting in July.

"We are moving ahead and making changes we believe are responsive to our customers' and clients' needs," Moynihan wrote in a letter to company shareholders earlier this year.

Moynihan also seems to have usurped JPMorgan Chase's (JPM, Fortune 500) Jamie Dimon as President Obama's favorite banker. Moynihan threw his support behind the administration's proposal to create a consumer financial protection agency earlier this year and has pledged to do more regarding foreclosures and providing loans to small businesses.

In one telling sign, Moynihan was among a select group of bankers invited to attend last week's state dinner at the White House.

"Bank of America is no longer the four-letter word it was," said Ken Thomas, a Miami-based independent bank consultant and economist. "[Moynihan] changed the perception."

As recently as last fall, Bank of America could seem to do nothing right.

It was embroiled in an ugly legal fight with the Securities and Exchange Commission, for example, over its decision to pay bonuses to former Merrill Lynch employees.

Much of that blame was laid upon Lewis, who almost single-handedly pushed through the Merrill purchase. Faced with an overwhelming amount of criticism from shareholders and lawmakers over the deal, he stepped down as CEO at the end of last year.

In his short time leading the firm, Moynihan appears to be going out of his way to make amends.

Since securing the top spot, the Ohio native has reportedly spent a lot of time talking with company employees, scheduling town halls and even making unannounced visits of the company's retail locations.

"It's one of the things that you need to do," he said in a recent interview with the Charlotte Observer.

A Bank of America spokesman acknowledged that employee optimism has been an integral part of putting everything else on the right track.

Even shareholders seem more encouraged about Moynihan's abilities, given how well the stock has held up despite a steep sell-off in the broader market recently. Bank of America shares are up nearly 3% so far this year.

"Even though we opposed his appointment, we are very much behind him and hope he succeeds," said Jonathan Finger, a partner at the Houston-based investment management firm Finger Interests, who led a successful shareholder campaign aimed at stripping Lewis of his chairman title last spring.

But it would be wrong to attribute the firm's recent victories to Moynihan alone. Without Lewis' purchase of Merrill, it is unlikely the company would have delivered record trading revenue of more than $7 billion in the first quarter.

The bank has also enjoyed a tailwind from the broader economic environment, as a decline in the unemployment rate has led to improvement in various lending businesses.

The company's massive credit card division, for example, swung to a profit last quarter after losing money throughout all of 2009. April figures published by the company also revealed that both losses and the number of customers behind on their payments declined during the month.

"He obviously took over when the economy was improving," said Shannon Stemm, financial services analyst at Edward Jones. "From that standpoint, we've seen improvement, and some of that is directly attributable to timing."

Where Moynihan goes from here however remains a bit cloudy. Experts agree that the company has no appetite to take on any more large acquisitions after its purchase of Merrill and mortgage giant Countrywide in 2008. The bank's deposit base also is bumping up against the 10% federal limit.

Some speculate that Moynihan, a former FleetBoston Financial executive who joined BofA when the two merged in 2004, may be setting his sights overseas, perhaps in growing regions like China. Recent reports have suggested otherwise however, as the Wall Street Journal recently reported that the company was looking to sell its ownership stake in Brazil's largest private bank - Bank Itau Unibanco.

Perhaps what is most likely for Moynihan, experts said, is making Bank of America as efficient an organization as possible, including getting its mortgage business in order and adapting to Washington's new rules of the road for the banking industry.

"We must continue to be flexible and build on our strong tradition, and change to meet our customers' needs," Moynihan said, following the announcement of his promotion to the CEO post in December. "We think of this not as changing the business model, but changing the way we do business." ![]()

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |