Search News

NEW YORK (CNNMoney.com) -- It's the last trading day of May. Thank goodness.

It's been a brutal month for stocks. Heading into Friday, the S&P 500 was down more than 7% this month (and that's after factoring in Thursday's big rally).

|

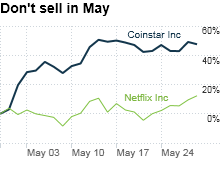

| Shares of the two DVD rental leaders had momentum coming into May and continued to do well in spite of the big market sell-off. |

The market carnage has been fairly widespread too. According to figures from Thomson Baseline, less than 15% of the companies that make up the S&P 1500 (a combination of its benchmark S&P 500 as well as the companies in its Mid-Cap 400 and SmallCap 600 indexes) were in positive territory in May.

But let's end the month on a happy note by taking a look at some of May's market winners. If the market volatility continues into June and the rest of the summer, will the stocks that bucked the May bear continue to do well?

Some might. It's worth pointing out though that several of the big winners in May were up only because of takeovers -- which means that if you missed the move in May, it's too late to invest in them now.

Software company Sybase (SY), for example, is the top S&P 1500 performer in May, up nearly 50% this month thanks to SAP's (SAP) purchase of the company. The second biggest winner this month, Odyssey Healthcare (ODSY), soared 27% because it too was taken over. Rival Gentiva (GTIV) agreed to buy it.

Still, some companies that didn't succumb to the May mayhem might be worth a look because they are solid performers in hot sectors.

Coinstar (CSTR), which owns the popular $1 DVD rental kiosk company Redbox, was up nearly 25% in May thanks to healthy profit and sales growth. DVD rental rival Netflix (NFLX) is also doing extremely well and its stock is up 10%.

Several other consumer companies also escaped the May sell-off thanks to strong results and solid guidance for the rest of the year.

Weight loss company NutriSystem (NTRI), auto parts retailer Advance Auto Parts (AAP, Fortune 500), soft drink maker Dr Pepper Snapple (DPS, Fortune 500) and Sam Adams brewer Boston Beer (SAM) all were up at least 10% in May. All four companies reported quarterly earnings this month that were significantly ahead of analysts' estimates.

But investors need to be wary of some of May's winners.

Money managers said that there's no problem sticking with companies that have momentum as long as they still appear reasonably priced. But given how dismal a month May was, it's probably also a good idea to go bargain hunting for companies that were unfairly punished along with the rest of the market.

"Anything that did well last month we're grateful for, but we would look more at valuation than recent performance. There are a lot of stocks that are more attractive now," said Maris Ogg, president of Tower Bridge Advisors, a money manager in Conshohocken, Pa.

In particular, Ogg said that some of the blue chip multinationals that were dumped on fears about Europe's woes are looking like good buys now. She said medical equipment company Becton Dickinson (BDX, Fortune 500), tech giants Cisco Systems (CSCO, Fortune 500) and Google (GOOG, Fortune 500) and alcoholic beverage producer Diageo (DEO) look good.

Adrian Cronje, chief investment officer of Balentine, an investment firm based in Atlanta, added that stable companies that pay healthy dividends will probably outperform the market over the next few months. That's because he expects that the volatility that has become a hallmark of trading as of late will continue for some time.

"In the first quarter, there was little volatility. It was buy now and ask questions later. People thought all the problems facing the global economy would somehow miraculously go away and we'd have this mythical V-shaped recovery," he said. "May has brought a healthy dose of realism."

With that in mind, several of May's winning stocks, including NutriSystem and Dr Pepper Snapple, pay healthy dividends that are above the S&P 500's average yield of 2%. Hasbro (HAS) and check-printing company Deluxe (DLX) also offer above-average dividends and were up in May.

Some companies even have dividends that are higher than the yield on the U.S. 10-year Treasury, which is now hovering around 3.3%. That could make them particularly safe places to ride out any more market tumult.

"Quality stocks are now trading at a discount," Cronje said. "With the yield on fixed-income so low, in some respects bonds look riskier than dividend-paying stocks."

Reader comment of the week: I wrote about the struggles that Yahoo (YHOO, Fortune 500) continues to face in Tuesday's column. One reader summed up his problem with the company pretty humorously, albeit with an annoying Owen Meany-esque ALL-CAPS style that's unfortunately too prevalent on the Web. (You can make a point without resorting to cyber-shouting. But I digress.)

"yahoo is great IF YOU WANT SPAM,VIRUSES,ROBOT PORN AND SCAMS FROM AFRICA," wrote Ray Miller.

I share his frustration. I've stubbornly stuck with Yahoo Mail even though I get more spam than my wife reports getting on her Gmail account. Oh well. Have a great Memorial Day weekend, everyone.

- The opinions expressed in this commentary are solely those of Paul R. La Monica. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |