Search News

(Money Magazine) -- You knew it couldn't go on forever. And deep down, the spectacular run-up in stocks that began when the bear market bottomed in March 2009 was actually making you a little nervous. An 80% surge in just 13 months was starting to feel a lot like bubble territory. So yes, a breather was probably in order.

But another full-blown financial crisis? One that would hammer stock markets around the globe? You were hardly expecting that; few people were. Spiraling debt troubles in Greece, Portugal, Italy, Ireland, and Spain kicked off the chaos. Worries about a sharp economic slowdown in China and anemic job growth at home only made things worse.

In just over two months from late April to the end of June, the Standard & Poor's 500 index cratered by 15% -- the market's first official correction (defined as a drop in stock prices greater than 10% but less than 20%) since the bull run took off last year.

That rapid descent, coupled with the still-fresh memories of the market's painful 50% collapse in 2008 and early 2009, probably has you wondering if another brutal bear market is just around the corner. You're hardly alone.

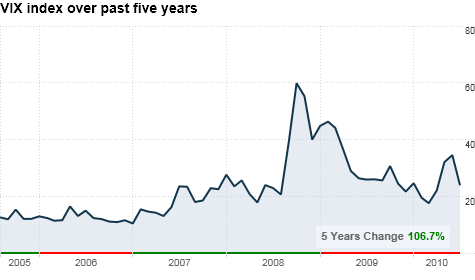

The most common measure of investor fear is the Chicago Board Options Exchange Market Volatility Index (known as the VIX), which uses options contracts to decipher the degree to which traders think the S&P 500 will bounce up or down over the next 30 days. For the first time in more than a year, the VIX rose above 40 in May -- double the index's long-term average.

More important, investors are beginning to act on that fear. From 1960 through 1999, the S&P 500 fell by 2% or more in a single day an average of five times a year. But in the wake of the mess in Europe, it took little more than a month for the market to deliver the same number of 2%-plus daily blows.

Shareholders yanked a net $21 billion out of stock mutual funds in May, the largest monthly outflow since March 2009, the nadir of the bear market. Says Sam Stovall, chief investment strategist at Standard & Poor's Equity Research: "Investors have adopted a 'sell first, ask later' trading approach."

In this environment, where it feels like danger lurks around every corner and steady growth is an elusive goal, you need a way to manage risk so you can still make money in stocks over the long run without needing a ready supply of Xanax. These five strategies should help.

1. Use fear to your advantage

Stocks have always been subject to sometimes dramatic price swings in the short run. And coming out of the worst economic meltdown since the Great Depression, it's not exactly surprising that the ups and downs have gotten even more explosive, as investors veer between optimism that the worst of the crisis is over and fear that more nastiness lies ahead.

Get used to it, experts say -- greater volatility is here to stay in the stock market. But understand this too: Bigger price swings over the course of a day, a month, or even a year don't translate to a greater chance of losing money in stocks over the long run. In fact, if you have a time horizon of at least 10 years, those interim price drops can be a real opportunity, allowing you to buy promising stocks at more reasonable values.

Still, big price swings are nerve-racking, so it's important to know what's within the realm of normal. The most common measure of volatility is standard deviation, which tells you how much an investment's short-term returns bounce around its long-term average.

Since 1926, stocks have averaged gains of 9.7% a year, with a standard deviation of 21.4 percentage points, according to Ibbotson Associates. That means that about two-thirds of the time, the annual return on stocks landed 21.4 percentage points below or above the average -- so your results would range from a 12% loss to a 31% gain. A third of the time, your gains or losses would be more extreme.

A balanced mix of government and high-quality corporate bonds, on the other hand, typically has fluctuated less than eight percentage points off its long-term average annual gain of about 6%, Ibbotson found. But while you'd avoid a wild ride with an all-bond portfolio, those lower returns mean you'd run the very real risk of not having enough money to reach your goals in the long run.

YOUR BEST STRATEGY:

Focus on proven growth. Within the equity universe, some stocks are far more volatile than others, and often an ability to stomach big short-term price moves pays off with loftier gains long term. But not always, so it's crucial to tilt the odds more in your favor.

For instance, stocks that trade more on hope than fundamentals (like many fledgling biotech companies working on yet-to-be-approved drugs, with no revenue or profits) can have especially wild price swings. But putting money into unproven entities can be a crapshoot.

A better bet: large-cap companies with established earnings that are growing at above-average rates. These stocks also deliver a bumpier ride than the overall market, but not nearly as rocky as companies that have yet to turn a profit. And while investors usually pay a premium for growth, the market's recent dive means these stocks aren't nearly as expensive anymore, with the average price/earnings ratio for large-cap growth stocks down to 18, from a historic level of 24.

Prices for big technology stocks, in particular, have been unfairly beaten down lately over fears that a strengthening U.S. dollar will crimp the value of profits earned overseas, says David Bianco, chief U.S. equity strategist at Merrill Lynch. The safest way to invest is through a diversified mutual fund with a mix of established tech firms, such as American Funds AMCAP (AMCPX). The fund, which counts Google, Microsoft, and Yahoo among its top holdings, is on the Money 70 list of recommended funds.

If you prefer individual stocks, Microsoft (MSFT, Fortune 500) is now on many analysts' buy lists. The stock fell 25% from April to July, yet its earnings prospects remain strong, notes Goldman Sachs analyst Sarah Friar. Also garnering recommendations is Cisco Systems (CSCO, Fortune 500), down 22% over the same period. But Deutsche Bank analyst Brian Modoff expects strong revenue growth of at least 16% next year, as the equipment maker benefits from strong tech spending from companies abroad.

Set a target price. If you have a long time horizon, use market downswings to buy the stocks and funds you want at better prices. But be systematic. You might, for instance, set up a limit order that directs your broker to buy a certain number of shares when the stock drops to a specified price. So if you think XYZ stock, now trading at $100 a share, would be a good deal if the price were 10% lower, set a buy order for $90; if the stock falls to that level, your trade will automatically be executed.

Want to be able to reconsider before the order is actually placed? Instead, set up an alert through your brokerage or a portfolio-monitoring site like our website, cnnmoney.com, and you'll be notified by e-mail or text message when the investment in question drops to the preset price or by a certain percentage. At that point you can decide whether you want to go through with the transaction.

2. Reset your expectations

Coming out of deep slumps, stocks historically have been strong for the next decade. That's been especially true following those rare long stretches when bond returns have bested those of equities, as has been the case for the past 10-plus years.

If you bought stocks in the early '70s, for instance, you would have enjoyed gains of about 12.6% annually over the next 25 years, according to Ibbotson.

Don't count on a replay. Many of the conditions that propelled stocks into long-term bull markets in the past no longer exist. The great bulls of the 1980s and 1990s were fueled by a potent combination of falling interest rates, dwindling inflation, and low unemployment. Today all three of those indicators instead look like they'll be a potentially powerful drag on future gains.

Against that backdrop, it makes sense to assume conservative future stock returns when plotting your investing strategy. Jason Hsu, CIO of Research Affiliates, says you can come up with a reasonable estimate by adding the current dividend yield on stocks (that's the amount of income a company pays out per share each year divided by its stock price, now about 1.8%) to the long-run growth in earnings per share (1.5%) and the long-term inflation rate (2.5%).

Result: a projected gain of nearly 6%, a view shared by many experts.That's well below the historical norm for stocks, but far better than the past decade.

YOUR BEST STRATEGY:

Create an income cushion. While you can't expect stocks to be lifted by the same economic tail winds that drove them in the past, you can boost your chances of earning solid total returns by adding some high-dividend payers to your mix. Those regular payments can also help steady your portfolio when the market gets volatile, especially if you focus on companies with a history of consistently increasing payouts.

During the 10 years ended 2009 -- which included two brutal market collapses -- shares of companies within the S&P 500 that consistently increased dividends returned 6.5% a year, according to T. Rowe Price, while the overall index lost just over 1% a year.

A low-cost way to get yield is with the SPDR S&P Dividend ETF (SDY), which tracks the highest-yielding stocks in the S&P 500 High-Yield Dividend Aristocrats index. The fund has beaten the overall market by more than three percentage points a year over the past three years. Another solid choice on the Money 70 list: iShares Dow Jones Select Dividend Index ETF (DVY), which has returned 25% over the past year.

Pump up your savings. If you can't create a big enough nest egg earning a mere 6%, you'll need to sock more money away. Remember, investing $7,200 a year at 6% will get you to $100,000 just as fast -- a bit over 10 years -- as investing $5,000 at 12%. And the amount you save is something you can control, whereas earning a double-digit return is not.

Not maxing out your 401(k)? Direct your plan provider to ratchet up your contributions by one percentage point every six months until you hit your limit, and earmark half of every raise to your other investment accounts.

3. Look beyond the next move

Depending on whom you ask, stocks right now are either dangerously overpriced or a real bargain, with respected experts on both sides of the debate.

For instance, Yale professor Robert Shiller, who famously predicted the bursting of the tech bubble in the late 1990s, believes stocks are expensive: Investors are paying about 20 times earnings for stocks in the S&P 500, well above the historical average of about 16. To arrive at that price/earnings ratio, Shiller uses 10 years of historical, inflation-adjusted earnings.

But Wharton's Jeremy Siegel, author of "Stocks for the Long Run," says that when the economy is shifting from slowdown to growth mode, it's more appropriate to focus on projected earnings, rather than a P/E ratio that incorporates beaten-down results from the recession years.

Under this forward-looking approach, stocks look like a good deal right now. The consensus estimate among analysts is that 2010 operating earnings for S&P 500 companies will reach $82 a share. That puts the market P/E at 13 times projected 2010 earnings, or about 20% below the historical norm.

Who's more likely to be right? Trick question. There's no way of knowing with any certainty. Instead of trying to pick a side and plan your next move accordingly, the better idea is to take yourself out of that game altogether and position your portfolio for steady gains if Siegel is right and cushion your losses if Shiller is closer to the mark.

YOUR BEST STRATEGY:

Add asset categories. A classic mix of stocks and bonds runs less risk of tanking in any given year than an all-stock portfolio, without necessarily sacrificing much, if anything, in long-term gains. But it's not foolproof. For diversification to work, you've got to own investments that don't move in lockstep with your core holdings, which means adding small allocations to real estate and, possibly, commodities.

From 1972 through 2009, a portfolio of U.S. and foreign stocks, REITs, commodities, and bonds produced an annualized return of 9.9%, vs. a 9.6% return for an all-U.S.-stock portfolio. What's more, the diversified portfolio had half the level of risk. That makes it far less likely you'll do something dumb when the market goes into one of its periodic fits.

Although investing in commodities through futures contracts has become popular lately, these complex instruments may not continue to perform as well as they have in the recent past, and Wall Street tends to find ways of charging you more for selling you complexity.

A sound, inexpensive way to invest is through a diversified fund that puts its money into the actual commodity producers, such as T. Rowe Price New Era (PRNEX), a Money 70 fund with two-thirds of its assets in oil and natural-resources companies such as Exxon Mobil and Schlumberger. Over the past 10 years, the fund has returned 9.6% a year, vs. a loss of 1.1% for the S&P. Be forewarned: No matter what commodities vehicle you choose, think really long term since these assets can go through long ups and downs, sometimes lasting decades.

Diversify within asset categories too. Small- and large-cap stocks, growth and income-producing companies, corporate bonds and Treasuries. Given the still-shaky economy and the risk that today's historically low rates could rise, keep your bond holdings short and focused on quality. A smart choice: Vanguard Short-Term Bond Index Fund (VBISX), a Money 70 fund that invests mostly in the highest-rated government and corporate bonds.

Mix your bets globally. With a good swath of Europe apparently falling apart at the seams and even economic powerhouses like China slowing down, you can't be blamed for feeling skittish about investing internationally. Yet foreign markets generally still provide much-needed diversification benefits.

For starters, you're hedging your exposure to the U.S. dollar; if the greenback drops, the return on your foreign holdings gets a boost. While the dollar's strength against a plummeting euro is instead working against you right now, currencies can change in a hurry.

Emerging markets, meanwhile, offer opportunities you can't get at home; China's economy, despite the slowdown, is still expected to expand 10% this year. "Emerging-market countries have entirely different demographics and economies than developed markets, and that means you can expect stock returns to be different as well," says Nariman Behravesh, chief economist at IHS Global Insight.

That difference has already been playing out: Since hitting a low in 2009, the MSCI Emerging Markets index has rocketed by more than 75%, compared with a 57% gain in the S&P 500. A smart way to go abroad: T. Rowe Price International Discovery Fund (PRIDX), a Money 70 fund that emphasizes small and medium companies within developed and emerging countries. The fund has consistently outperformed both the S&P 500 and its international peers, gaining an annualized 7.1% over the past five years.

4. Forget portfolio protection (mostly)

The market's rocky ride of late has given new life to a variety of complex investments that pledge to protect you from big losses. There are "long-short" or "market neutral" funds that use hedge-fund-like strategies to try to produce positive returns, regardless of how the stock market performs. There are heavily peddled equity-indexed variable annuities, which guarantee that you'll earn a minimum return based on underlying investments that you select. There are exchange-traded notes that allow you to place direct bets on the market's volatility as well as complicated options strategies that promise you ways to profit even if stock prices tumble. And there's gold, which is marketed as a refuge from falling stock prices and possible economic Armageddon and recently hit a record $1,265 an ounce.

But for the most part, these investments rarely deliver on their promises of safety in the long run. Gold, for instance, has only recently emerged from a 20-year period of negative returns.

As for long-short funds and equity-indexed annuities, the only real guarantee is that you'll pay hefty fees to invest in them -- often topping 2% for the funds and averaging 2.5% for the annuities, vs. 1.4% for a typical stock fund and 0.8% for index funds.

YOUR BEST STRATEGY:

Use options judiciously only on stocks you own. Options contracts are a bet on the direction of share prices, giving an investor the right to buy or sell a stock at a future date and specific price. If you trade options on a stock you don't own and the shares never hit the preset price, your option can expire worthless and you'll lose all the money you put in.

But there is a more conservative approach involving options on stocks you already own. You can sell a "covered call," granting another investor the right to buy the stock from you at a higher price in the future. You pocket money from the option sale, which cushions your losses if the stock falls. But if the stock takes off, you'll lose gains above the preset sale price, known as the strike price.

Financial advisers recommend limiting the use of covered calls to about 10% of your stock holdings -- preferably shares you don't think are likely to take off anytime soon but don't want to unload, maybe because they pay stable dividends. For example, if you owned 100 shares of Johnson & Johnson, which pays a 3.6% dividend, you might make about 1% a month selling calls at recent option prices.

Trade (a tiny bit) on fear itself. A more aggressive strategy: Buy an exchange-traded note -- a debt security that trades like an ETF -- that tracks the Volatility Index, such as the iPath S&P 500 VIX Short-Term Futures (VXX). This ETN can provide some insurance against market meltdowns because the VIX usually rises when stocks fall. In May, as the market cratered, this ETN soared 35%.

Let's be clear about this: You're speculating here, not investing. And you can get crushed if the market has another hot streak. For instance, during the 13-month bull run that ended in April, the VIX ETN lost a stunning 83%. If you're so compelled, put no more than 2% of your portfolio toward playing risky short-term hunches like the VIX. If it pays off, great. If it doesn't, well, you won't have lost very much money and you'll have a good story to tell.

5. Protect yourself from yourself

In the end, your worst enemy isn't the volatility of the market -- it's your own reaction to it. Example: Research by behavioral economist Richard Thaler of the University of Chicago shows the more often people check stock prices, the greater they perceive their risk to be. That in turn can prompt you to make rash moves, like bailing out of stocks just as prices hit bottom or jumping in and out every time the market jolts.

Indeed, numerous studies over a variety of time periods have shown that the typical investor earns just a fraction of the average returns on stocks due to ill-fated attempts at market timing.

YOUR BEST STRATEGY:

Rethink your commitment to stocks. As a rough rule of thumb, advisers recommend this formula for determining the portion of your portfolio you should keep in stocks: Subtract your age from 120 or 110. But if you're prone to the jitters when the market hiccups -- and are apt to tinker with your portfolio when that happens -- you're better off substituting "100" in this equation or, as Vanguard founder John Bogle puts it, invest your age in bonds.

Yes, dialing back your allocation to stocks by 10 or more percentage points will theoretically ding your returns in the long run. But it will also substantially cut your potential losses in any given year. If that enables you to actually stick with the program, you may end up making more money after all.

Rebalance periodically. A buy-and-hold approach generally serves you better over time than darting in and out of the market. But changes in stock and bond prices will eventually throw your mix out of whack if you don't make occasional adjustments (say, once a year) to get back to your targets.

While that may not dent your returns too much in the very long run, you'll have a far rockier ride getting there than if you rebalance once a year. And a rockier ride increases the likelihood that you'll bail out of stocks at the worst possible moment.

One thing's for sure: "Volatility isn't about to subside anytime soon," says Harold Evensky, a Coral Gables, Fla., financial planner. But if you tread carefully, you can brace yourself against the worst a turbulent market can throw at you and stay steady on a path to solid gains. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |