Search News

FORTUNE -- Athletes have trophies, gunslingers have notches, and David Boies has his wine cellars. The corridors en route are lined with framed headlines of his courtroom conquests. "The man who ate Microsoft!" proclaimed Vanity Fair; "Westy raised the white flag!" announced the New York Post, after Gen. William Westmoreland withdrew his libel suit against 60 Minutes. The climate-controlled cellars themselves, beneath his Georgian mansion in the northern suburbs of New York City, are stocked with 10,000 bottles of Bordeaux and California reds -- the evident spoils of success. But, as he tells you in a favorite tale, his beloved wine also becomes a reminder of what's made him the nonpareil lawyer of his time.

Back when the cellars were completed, he had his then-modest collection shipped from storage in a Manhattan warehouse. He went to find a '59 Margaux. "I knew exactly what I was looking for," Boies told me, "because it was a case I had earlier opened up and taken out six bottles and put in six different bottles of '66 Lafite Rothschild." It was his best case, and it wasn't there. Compulsive and methodical, he did an inventory and found nine other cases missing. The warehouse admitted it had shorted him, yet offered a paltry $150. The cases were worth $5,000, so he sued -- the only time he's been a plaintiff. He was then a partner at the venerable Cravath Swaine & Moore, which had platoons of associates who could have handled the matter. Boies insisted he'd do it himself.

The turning point in the case came when Boies spotted something another lawyer might have missed. At a deposition, the warehouse manager kept leafing through a folder. Boies asked, "Have you produced all those documents to us?" Boies was told yes, but he asked to see the documents just to be sure. What he found was an incriminating accounting of what had gone missing -- assembled by the warehouse long before Boies discovered his losses. Boies now raised the ante by charging fraud and demanding punitive damages. "It was great!" he recalls. "They calculated nobody would spend $25,000 of lawyer time on a claim for $5,000." They calculated wrong -- that Boies would not be Boies. The warehouse capitulated, and Boies got a settlement of $78,000 -- which he promptly spent on wine.

Through that trifling dispute -- long before he maneuvered a record $4 billion antitrust settlement for American Express (AXP, Fortune 500), vivisected Bill Gates in cross-examination, or argued Bush v. Gore for the loser -- you can learn a lot about David Boies, how he's so good and why he's still doing it. He has a formidable memory, he knows when to strike, and he thrives on litigation as sport. Sure, he likes the multimillion-dollar wine collection, but even more how he started it. "I love to litigate," he says.

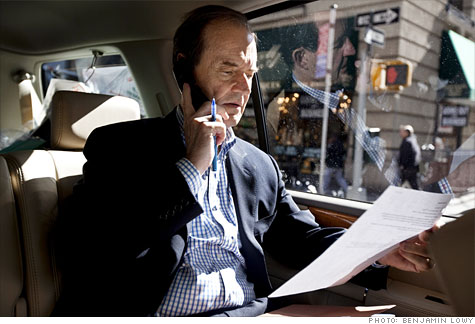

He still does. As he nears 70 -- with an annual haul of more than $10 million -- Boies has never been in higher demand. Plaintiffs in the gargantuan BP (BP) oil-spill litigation want him to be their champion; a judge will decide who gets the plum job as lead counsel. He recently sued Google (GOOG, Fortune 500) on Oracle's (ORCL, Fortune 500) behalf in an important test case about copyrights and patents in Silicon Valley. Between now and Christmas, Boies has three more trials lined up: He'll be representing Guy Hands and the British private equity firm Terra Firma against Citigroup (C, Fortune 500) over the billion-dollar auction of the music company EMI; Merck (MRK, Fortune 500) and Schering-Plough in a billion-dollar breach-of-contract arbitration; and Oracle against SAP in another billion-dollar intellectual-property quarrel. Then there's the same-sex marriage case in California that's on a possible fast track to the U.S. Supreme Court, and a divorce spectacle involving control of the Los Angeles Dodgers. It's no wonder Charlie Rose once asked Boies, "Are you involved in every important case in America?"

His close friend and a current law partner, James Fox Miller, compares Boies to a peerless brain surgeon. "There are many patients with complicated brain tumors, and there's one doctor in the world who knows how to remove them," he says. "David's like that -- with the most difficult legal cases. He moves from one to the next to the next." There's not much handholding -- sometimes Boies swoops in just before a court date, and you'll be disappointed if you want your calls returned immediately.

Even so, for 44 years, clients have sought his counsel because of the results he gets. Understanding his colorful history and record explains why it's been said that each generation discovers Boies anew. Clients come to appreciate that he ignores orthodoxy. Unlike many trial lawyers, he wanders in and out of specialties. He's happy to represent either side in a dispute -- saving a company from financial ruin or suing one into it. And he'll work on a contingency basis if a case looks sweet enough. In fact, his 240-lawyer firm -- Boies Schiller & Flexner -- has revolutionized the economics of corporate law practice by pulling away from a billable-hour model. Boies Schiller builds incentives into billing, so value is based on results rather than merely time put in. According to The American Lawyer magazine, among large firms Boies Schiller has the nation's third-highest profits per equity partner -- $2.9 million, even better than those of Cravath.

Boies excels in the courtroom by going against convention. He's hypercompetitive, yet many foes adore him. He's Manhattan urbane, yet Midwestern soft-spoken -- juries think of him as an Everyman who resembles Bill Murray. Boies works hard, yet once got ready for a trial by reading documents for two straight weeks while sitting in a box at the U.S. Open. He is obsessively prepared, yet instinctive on his feet -- when making an argument in court, he doesn't use notes, which makes him seem like the consummate listener. "David doesn't shout or try to win by overwhelming the opposition by noise," says Maurice "Hank" Greenberg, the former CEO of AIG (AIG, Fortune 500), whom Boies successfully defended against AIG's claims of financial irregularities.

Above all, Boies is a storyteller. "Nobody is better able to describe the gist of a case," says Ted Olson, a friend and his opponent in Bush v. Gore a decade ago. "He has a sixth sense of how to be persuasive. People instantly like David -- he's not a bore at the dinner table."

Read the full version of: David Boies: Corporate America's No. 1 hired gun ![]()

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |