Search News

Click chart for more commodity prices.

Click chart for more commodity prices.

NEW YORK (CNNMoney.com) -- A weaker dollar has been propelling commodity prices higher over the past couple of months. But the rally has cooled its heels.

Commodities got a nice boost earlier this week after President Obama announced a compromise with Republicans to extend the Bush-era tax cuts for two years. But that momentum also fizzled.

"Tax cuts initially gave confidence into economic recovery.... It was like another shot of stimulus initially," PFG Best senior market analyst Phil Flynn said. "Whether you're pro tax cuts or against it -- the good thing that the tax cut deal does is give certainty."

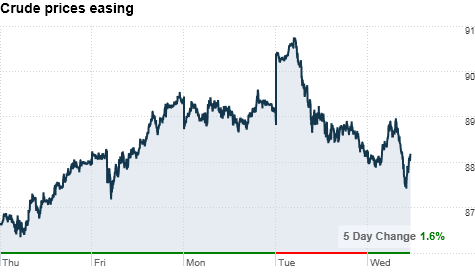

Oil prices slipped 41cents to settle at $88.28 a barrel Wednesday. Prices have eased from the previous session, when oil topped the $90 per barrel mark for the first time since October 2008. Crude has been on a steady rise since Nov. 23, gaining more than 10% during the two-week period.

But analysts say the run-up over the last couple months could be coming to an end as investors take a step back. Concerns about the possibility of China raising interest rates is keeping investors a little at bay when it comes to commodities.

"Too many positive things are happening right now -- economic growth appears to be picking up here and abroad [and] it looks to be quite bullish," said Brian Hicks, co-manager of the U.S. Global Investors Global Resources Fund.

But as investors continue to worry about the price of inflation, the price should go higher. Hicks also noted that concerns over monetary instability with the euro supports a push toward buying gold.

Because commodities are priced in dollars, any signs of weakness in the U.S. currency, whether against the euro or other currencies, also helps prop up prices of oil, gold, silver and other commodities.

After surging to record levels above $1,432 an ounce in Tuesday's session, the price for the gold slipped $25.90 ending at $1,385 an ounce, down 1.8%.

The upward trend certainly seems to be taking a break. "Commodities were absolutely on fire and we kind of hit a brick wall yesterday," said Flynn.

Meanwhile, it's not all about gold. Silver closed off the session at $28.25 an ounce, down 5.1% from Tuesday's session when it surged to 30-year highs of $30.75 per ounce during trading hours.

"Everyone was focused on gold, silver then became very cheap in comparison . if you want to buy quantity instead of quality you're going to look to silver right now," Flynn said. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |