Search News

NEW YORK (CNNMoney.com) -- The Federal Reserve has been in the hot seat since its last meeting. But don't expect its embattled policymakers to signal any significant change of heart when they meet Tuesday.

Economists and other Fed watchers expect the central bank's statement to be somewhat more upbeat than a month ago, acknowledging some signs of improvement in the economy.

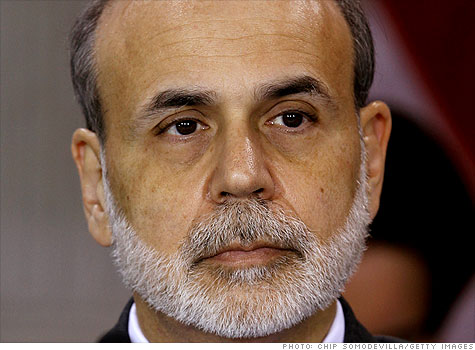

That might seem like a change from the tone that Fed Chairman Ben Bernanke took in his recent interview on "60 Minutes" when he warned about the U.S. economy was still at risk of another recession, and that unemployment would likely not return to desired levels for another four to five years.

But stronger than expected consumer spending, highlighted by a good start to the holiday shopping season, coupled with falling levels of workers filing for initial jobless claims has helped to lift expectations that the economy might finally take a pronounced turn up soon.

Still, economists say the central bank is likely to stress that the improvement is not enough to make it change its controversial efforts to try to jumpstart the economy -- at least not yet.

"They have to acknowledge that the data has turned better, but they're going to want to see a much higher rate of growth, an escape velocity, before they'll start to signal any kind of change of policy," said Michael Gapen, senior U.S. economist at Barclays Capital.

The Fed announced plans at its Nov. 3 meeting to pump $600 billion into the sputtering U.S. economy. That sparked attacks from overseas finance officials as well as economists, politicians and even some Fed members. The policy is known as quantitative easing, or QE2 in popular short-hand because it is the second round of such purchases.

Many have argued QE2 risks driving down the value of the dollar and sparking a return of inflation. Some critics think the Fed should cut short its plans to buy the full $600 billion of Treasuries.

But Gapen said the Fed is unlikely to do so -- even if the central bank gives a more positive economic outlook.

"We don't see anything in recent months altering our view they will complete their intended purchases of the full $600 billion," he said.

Bernard Baumohl of the Economic Outlook Group said the Fed's statement may include assurances to the market that it is ready to change policy as conditions warrant. But that's different from signaling and end to QE2.

"They still need to be convinced that QE2 is no longer necessary," he said. "They'll say there's been recent signs of improvement, but not enough to justify a change in policy."

Still, the Fed faces a more delicate task Tuesday, given the attacks since the last meeting. That's why Baumohl is looking for hints that the Fed is actually willing to stop short of completing QE2.

"The Fed is under much greater scrutiny these days," he said. "Somehow it has to send a signal it is not fully committed to the $600 billion in purchases, and that it plans to monitor economic conditions on a monthly basis." ![]()

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |