Click the chart to view other bonds and rates.

Click the chart to view other bonds and rates.

NEW YORK (CNNMoney) -- Like a dripping faucet filling up a sink, yields on U.S. Treasuries have been slowly rising for several months now -- raising concerns that inflation may be on the horizon.

Higher Treasury yields are a direct result of the Federal Reserve's near-0%interest rates and its massive quantitative easing strategy, combined with a slowly improving but sluggish economy.

On many fronts, inflation is already here. Oil prices are up 17% from a year ago, and wheat, cattle and coffee prices have all posted doubled-digit increases, deepening worries about skyrocketing food prices.

As fuel prices and food prices keep rising, no one is using the "s" word yet, but there are some whispers of the dreaded stagflation - a condition of low economic growth in an inflationary environment.

We're not necessarily bracing for a return to the 1970s era of Jimmy Carter sweaters and long gas lines. But with the an unemployment rate of 9.4% and oil at $87 a barrel - it's not the prettiest picture. On top of that, the first look at fourth-quarter GDP showed growth but fell short of forecasts.

"Frankly we need a little inflation right now, it would show the economy is expanding," said Josh Feinman, chief global economist with DB Advisors, a division of Deutsche Bank.

Still, fears about inflation and stagflation shouldn't be overblown. Consumers are starting to spend again. Holiday sales were strong and consumer spending in the fourth quarter expanded at its fastest rate in five years, according to the Commerce Department.

So that brings us back to bond prices.

The U.S. Treasury yield curve -- a graph of the interest rates on government bonds with different maturities -- has steepened noticeably, which typically signals economic expansion and the possibility of inflation.

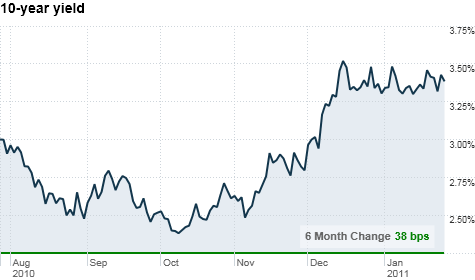

Just six months ago, the curve was much flatter, with investors still talking about the possibly of deflation or even a double-dip recession. The yield on the benchmark 10-year note is currently hovering around 3.4%, compared with the 2.6% level it was at back in September.

"On balance, the general economic picture has been better and the growth prospects have been getting better," Feinman said. "Bond yields are rising because we are no longer concerned at all about deflation or even a double-dip."

But for bond investors who buy investments to hold for months or even years, it's not what inflation is now that matters, it's what it it's going to be down the road.

"The bond market is pricing things in that may happen six months, 12 months, two years down the road, long before this will happen" said Ken Naehu, portfolio manager with Bel-Air Investment Advisors, who manages about $6 billion in assets for mostly high net-worth clients.

If the recovery gains momentum and the threat of inflation becomes a reality, some experts are concerned the Fed may be caught with its pants down, figuratively speaking.

Most economists expect the central bank will keep a 0% interest rate policy at least until the second half of this year or maybe into 2012 by some estimates.

"The longer they keep rates where they are, the faster they are going to have to raise them," said Adolfo Laurenti, an economist with Mesirow Financial in Chicago. "That makes the market a bit concerned." ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |