Click chart for more bonds and rates.

Click chart for more bonds and rates.

NEW YORK (CNNMoney) -- Savers and investors relying on fixed incomes have been punished for several years.

Many healthy companies sat on their growing piles of cash instead of boosting dividends. Some struggling firms were forced to cut or even suspend quarterly payouts during the financial crisis. And the Federal Reserve's easy money policies (rates near 0% plus QE and QE2) have kept long-term bond yields at relatively low levels.

But this is all slowly starting to change, giving conservative investors some reason to celebrate.

Companies are, for the most part, continuing to report improving profits. That's led firms ranging from insurers Hartford Financial Services (HIG, Fortune 500) and Aetna (AET, Fortune 500) to shipping giant UPS (UPS, Fortune 500) and CNNMoney parent company Time Warner (TWX, Fortune 500) to all announce dividend increases this week.

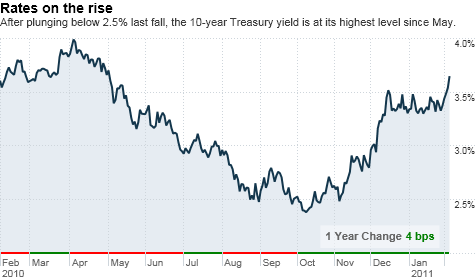

In addition, Treasury yields are creeping up as economic data point to a gradual rebound. Typically, fixed-income investors sell bonds in times when the economy is showing signs of recovery. That pushes their rates, which move in the opposite direction of prices, higher.

The yield on the benchmark 10-year Treasury hit 3.64% Friday morning, its highest level since last May, despite a mixed jobs report for January. (Job growth stalled but the unemployment rate dropped.)

Experts said this trend toward higher yields -- i.e. companies lifting dividend payments and bond rates edging north -- should continue as long as the economy doesn't suffer a pullback.

"There are many opportunities in bonds broadly for solid investment returns," said Christopher Molumphy, chief investment officer of fixed income at Franklin Templeton in San Mateo, Calif. "With a return to a healthy, growing economy in 2011, that should bode well for several parts of the bond market."

Interestingly though, Molumphy doesn't think Treasuries are the best bet for investors looking to benefit from yield returns. He notes that government bond rates have already shot up pretty significantly since the Fed first announced QE2 in November.

Molumphy said many of the same trends that have helped boost stocks in recent months may also benefit corporate bonds.

With that in mind, other money managers said stocks that pay steady dividends are better investments than bonds. That's because you get the reliability of a quarterly payment with a (hopefully) added kick of growth that comes from a rising stock price.

Tom Cameron, chairman at Dividend Growth Advisors, an investment firm in Ridgeland, S.C., said the trick is not to get tempted by companies that have abnormally high dividend yields.

The average yield for companies in the S&P 500 is 1.7%. Some companies with yields substantially above that may only have a high yield because their shares have plunged. After all, the yield is the dividend itself divided by the stock price.

And as we know from recent history with bank stocks, companies that are getting pummeled by Wall Street often are forced to cut their dividends to preserve cash.

BP (BP), which reinstated its dividend this week after suspending it last year following the Gulf oil spill, is another example of how dividends are not guaranteed.

"I look for companies that have increased their dividend every single year for the past 10 years and has low debt. That way, they have room to keep increasing the dividend," Cameron said.

Cameron, who manages the The Rising Dividend Growth Fund for his firm, said IBM (IBM, Fortune 500), corn processor Archer-Daniels-Midland (ADM, Fortune 500) and McDonald's (MCD, Fortune 500) are all stocks he owns that fit his criteria.

Andrew Corn, chief investment officer at E5A Funds, an asset manager in New York, added that dividends can help make a difference when trying to pick one stock over a competitor.

For example, he said oil giants Exxon Mobil (XOM, Fortune 500) and Chevron (CVX, Fortune 500) have fairly similar growth potential. But he said that Chevron's 3% dividend yield compared to Exxon's 2.1% yield is one key reason he owns Chevron instead of Exxon.

Still, Corn said a dividend could also be a red flag that a company's best days are behind it.

Sure, there's nothing wrong with a company giving back cash to shareholders. But some tech firms with a lot of cash, most notably Apple (AAPL, Fortune 500) and Google (GOOG, Fortune 500), have hinted that no dividend is in their future. It's better to invest cash on acquisitions and research and development.

"For many large companies in mature industries, it's nice to see a dividend," Corn said. "But for other companies, another perspective is 'Gee, these guys are so lame they can't find anything else to do with the money?'"

It's a great point. And investors should certainly not make a dividend the only reason to buy a stock.

But in a market and economic environment that still seems highly uncertain at best, it would be foolish to ignore bonds and dividend-paying stocks. A little yield could go a long way.

Reader comment of the week. Tupperware (TUP) didn't raise its dividend this week. But it already pays one that yields a solid 2.3%. I tweeted on Tuesday about how the plastic container maker famous for those goofy parties of yesteryear reported superb earnings. The stock surged 15% on the news.

Alex Baillargeon, aka @apbONapb on Twitter, had a good theory to explain why Tupperware is doing so well. "Recession = less eating out = more home-cooked meals = more Tupperware needs & purchases for leftovers?"

-- The opinions expressed in this commentary are solely those of Paul R. La Monica. Other than Time Warner, the parent of CNNMoney, and Abbott Laboratories, La Monica does not own positions in any individual stocks. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |