Search News

Click chart for prices and yields.

Click chart for prices and yields.

NEW YORK (CNNMoney) -- Treasuries ended higher Monday, as Japan's devastating earthquake, tsunami and nuclear threat rattled global markets -- sending traders flocking to the safety of the bond market.

The earthquake in Japan on Friday was the most powerful earthquake to hit the country in more than 100 years, triggering massive tsunamis that have taken thousands of lives. The damage done to several nuclear reactors over the weekend also sparked fears of a nuclear meltdown.

With traders already worried about geopolitical turmoil in the Middle East region, the chaos in Japan has only added to the uncertainty in the market.

U.S. stocks slumped on Monday, following world markets lower. Japan's benchmark Nikkei plummeted more than 6%.

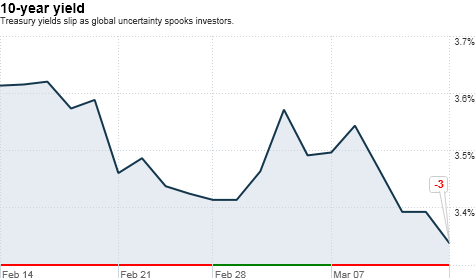

World tensions have turned many investors to the perceived safety of government-backed Treasuries, sending the yield on the benchmark 10-year note down to 3.37% on Monday, from 3.39% Friday. Bond prices and yields move in opposite directions.

The 10-year yield has hovered in the mid-3% range since December, but has headed to the lower end in recent sessions as international worries remain in the spotlight.

The yield on the 30-year bond ticked down to 4.54%, the 5-year yield slipped to 1.99%, and the yield on the 2-year note edged down to 0.61%.

Economic Factors: The slide in yields may continue, even as investors eventually turn their focus away from other countries and back to the issues facing the U.S. economy -- like surging oil prices, the threat of inflation and the effectiveness of the Fed's efforts to boost the economy.

"Will the price of oil derail the economic growth? Can the U.S. economy continue to grow at this pace? Will the Fed 'hang around' too long, and will the price of that produce a spike in the inflation rate somewhere down the road?" wrote Kevin Giddis, president of Fixed Income Capital Markets at Morgan Keegan, in a research note. "These are the current questions facing the market these days, and the answers will also take time to be known."

A packed week of economic data will help begin to answer some of these questions, with reports on manufacturing, housing and inflation all on deck. The Fed will also announce its latest rate decision, and traders will be eyeing the statement for any changes in its quantitative easing policy.

"The Fed is expected to keep the Fed Funds rate at its current 0% to 0.25%, and they are likely to stay diligent as it pertains to QE2, but there could be more than one dissenter," Giddis said. "The [Federal Open Market Committee] appears to be 'not in full agreement,' as to how long the Fed needs to hang around with cash falling out of its pockets." ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |