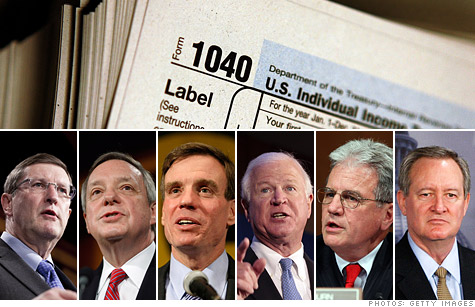

The Senate's Gang of Six (left to right): Democrats Kent Conrad, Dick Durbin and Mark Warner; and Republicans Saxby Chambliss, Tom Coburn and Mike Crapo.

NEW YORK (CNNMoney) -- The Gang of Six wants to reform the tax code, something fiscal experts have been recommending for years. A better tax code is good for the economy and can help rein in debt.

But taxes are a lightening rod.

Many Republicans run screaming at the thought of any tax increase whatsoever. And many Democrats will fight to their last breath to make sure the rich pay more.

So how would the Gang of Six proposals affect taxes? It's impossible to say with certainty because the group only put out an outline.

But based on that framework, here's what the plan may do.

Total revenue: So would the proposal raise revenue or reduce it? It depends on what you compare it with.

There's the status-quo scenario, in which all the Bush tax cuts stay in place and the middle class is protected from the Alternative Minimum Tax. Compared with that, the Gang of Six plan would raise about $2 trillion more over the next 10 years, former Congressional Budget Office acting director Donald Marron estimates.

Then there's the Obama-preferred scenario, which is similar except some of the Bush tax cuts expire for the highest-income households Compared with that, the framework would only raise an additional $1 trillion or so, according to the outline.

But were the Bush tax cuts to expire for everyone after 2012, and the AMT was left to run roughshod over the middle class, the Gang of Six's proposal would actually reduce revenue by $1.5 trillion, the group estimates.

Tax breaks: A key way the plan would raise additional revenue is by eliminating some tax breaks altogether and reducing the value of others.

The outline indicates that some of the most popular and expensive tax breaks, such as deductions for mortgage interest and retirement savings, would be retained but reformed. No details were given as to how.

It also said some tax breaks -- such as the earned income tax credit for low-income families -- would be preserved or replaced with something equivalent.

Tax rates: Part of the additional revenue raised -- there's no indication how much but presumably a large amount -- would be used to pay for lower income tax rates.

The Gang's outline indicates that the number of tax brackets would be cut in half to three from six, although it's not clear what income levels would apply to each bracket.

It also didn't specify the exact rate for each of the new brackets, but rather offered a range: between 8% and 12% for the lowest bracket; 14% and 22% for the middle bracket; and 23% and 29% for the top bracket.

That means income tax rates would certainly be lower for those in the top two brackets. Currently their rates are 33% and 35% versus somewhere between 23% and 29% in the Gang's plan.

But for some tax filers rates could be a little higher ... or not. For instance, with a proposed range of 8% to 12% for those in the lowest bracket, it's not clear whether the final rate chosen would be above or below the 10% rate in effect today.

Kill the AMT: Part of the additional revenue raised would also presumably be used to pay for the Gang of Six's proposal to repeal the byzantine Alternative Minimum Tax.

While the AMT was intended to be a tax on the wealthy who don't pay very much income tax, it now threatens to hit the middle class in increasing numbers every year because of how it was originally set up.

To date, lawmakers have been spending tens of billions every year to protect the middle class from having to pay the AMT.

Eliminating the AMT would cost more than $1 trillion.

Will my tax bill go up or down? Good question. There's no way to know yet.

Just because the Gang of Six's proposal would raise more overall revenue compared with today's policies, that doesn't mean everyone's federal tax bills would go up.

As with any tax reform plan, some people's taxes will go up, others' will go down and still others' will remain roughly the same, said Roberton Williams, senior fellow at the Tax Policy Center.

Just who would pay more (or less) -- and by how much -- is hard to say.

Consider the high-income tax filer in the top tax bracket, Williams said.

He would enjoy a lower income tax rate under the Gang of Six plan. But his net tax liability may still go up because some of his most valuable deductions and credits may be eliminated or reduced in value.

Conversely, a low or middle-income tax filer may be taxed at the same or a slightly higher rate, but may qualify for more tax breaks, depending on how they are reformed, resulting in a tax liability that is the same or less than it is today.

A clearer picture might emerge if lawmakers choose to adopt some or all of the Gang of Six's framework. But right now, Williams said, "It's all words, not numbers." ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Latest Report | Next Update |

|---|---|

| Home prices | Aug 28 |

| Consumer confidence | Aug 28 |

| GDP | Aug 29 |

| Manufacturing (ISM) | Sept 4 |

| Jobs | Sept 7 |

| Inflation (CPI) | Sept 14 |

| Retail sales | Sept 14 |