Search News

Possible SEC investigation highlights how hard it is for investors to value emerging shale gas companies.

NEW YORK (CNNMoney) -- Recent reports of an investigation by the Securities and Exchange Commission into whether shale gas companies are overstating their gas reserves highlights the challenges investors face in navigating this emerging sector.

Last week a research note from the investment management firm Robert W. Baird, citing industry lawyers, said the SEC is looking into whether shale gas companies may be overestimating the amount of natural gas they hold beneath the ground.

The investigation is most likely politically motivated and not entirely unwelcome, the note said, sparked by congressional calls for SEC action following a scathing report in the New York Times questioning the reserves held by some shale gas firms.

"We view it as appropriate and expected for the SEC to evaluate compliance with new regulations if compliance is publicly questioned," Christine Tezak, an energy and environmental policy analyst at Baird, wrote in the note. "A regulatory investigation may provide a clearer investment horizon than a 'trial' in the press."

The SEC would not confirm or deny if an investigation is underway.

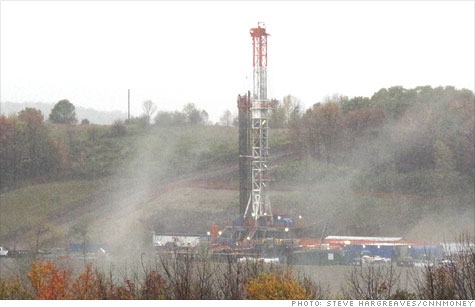

Extracting natural gas from shale is a relatively new phenomenon. It's been made possible in just the last few years thanks to advances in drilling technology and the broader use of hydraulic fracturing. Known as fracking, it's a controversial process that injects water, sand and chemicals deep into the ground to crack the shale rock and unleash the gas. The process has sparked concern over its effects on the water.

Gas from the Northeast's Marcellus shale, Texas's Barnett Shale and Arkansas' Fayettville Shale, among others, promises vast amounts of cleaner-burning fuel for the nation's energy use for decades to come. Its also caused the share price of firms involved in the space to surge over the last few years.

But it may be hard for the SEC, the companies themselves, and investors in general to determine just how much gas these firms hold in the ground - a key metric in determining the stock price for any energy company.

"The history of these wells is so limited," said Neal Dingmann, a Houston-based analyst at investment bank SunTrust Robinson Humphrey. "It's going to be a very touchy call to determine what you can book on these reserves."

Dingmann said it's not uncommon for a shale gas well to see its production fall 70% in the first year. He said the hope is that they then continue to produce gas at the much slower but steadier rate over the next several decades. But until several decades pass, no one will really know for sure.

Most analysts, including Dingmann, believe there is lots of gas there. So do the biggest names in the energy businesses. Exxon Mobil (XOM, Fortune 500) would not have paid $40 billion for shale gas producer XTO last year if it thought the company was spinning a yarn when it came to its reserves.

Interest in shale gas by other oil majors like BP (BP) and Chevron (CVX, Fortune 500) continues, with the smaller shale firms like Chesapeake (CHK, Fortune 500), Range (RRC), Devon (DVN, Fortune 500) and EOG (EOG, Fortune 500) the periodic subject of takeover talk.

But the Times isn't the only one to question the viability of this resource.

Petroleum geologist and noted oil-supply skeptic Arthur Berman has been arguing for years that shale gas estimates are overstated by at least 100%.

"Shale gas in the U.S. is an important and permanent feature of supply," Berman wrote on his blog earlier this week. "But it will not fulfill mainstream expectations of either supply or cost."