Search News

The SEC has punished eight employees for their handling of the Madoff case.

NEW YORK (CNNMoney) -- The Securities and Exchange Commission said Friday that it had disciplined eight employees for their failure to detect the infamous Madoff Ponzi scheme, a major embarrassment for the agency.

SEC spokesman John Nester said the punishments ranged from pay reductions and suspensions to simple "counseling memos." No employees were fired.

"We analyzed their performance based on what each person's responsibilities were, and whether, on an individual basis, each lived up to those responsibilities," Nester said.

A 2009 report from the SEC inspector general called into question the performance of 21 agency staffers in their handling of the Madoff case, Nester said. Of that number, 10 are no longer with the agency and not subject to discipline.

Of the remaining employees, nine were ultimately singled out for punishment, though one elected to resign. Among the rest, one received a 6% pay reduction. Others received suspensions without pay for between three and 30 days. Two received counseling memos.

One employee was recommended for termination unless this "would result in adverse impact on the agency's work." SEC officials ultimately concluded that a dismissal would indeed have an adverse impact, and elected only to suspend and reduce the pay of the individual, Nester said.

"The disciplines took place over the course of the past year. The process has essentially been under way since the release of the inspector general report," Nester said.

News of the disciplinary action was first reported by the Washington Post.

In 2009, the SEC inspector general said the agency had overlooked "more than ample" evidence, including complaints dating back to 1992, that flagged the Madoff scheme.

"Despite numerous credible and detailed complaints, the SEC never properly examined or investigated Madoff's trading and never took the necessary, but basic, steps to determine if Madoff was operating a Ponzi scheme," the report said.

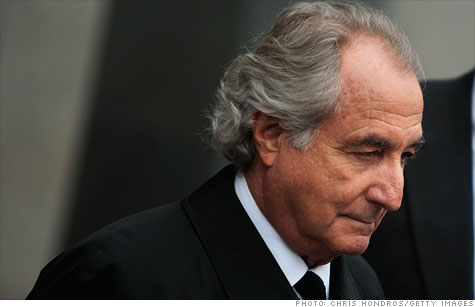

Bernard Madoff cheated more than 16,000 investors out of about $20 billion. He was arrested in December of 2008 and pleaded guilty three months later to running the largest pyramid-style scam in history, receiving a 150-year jail sentence. ![]()