Search News

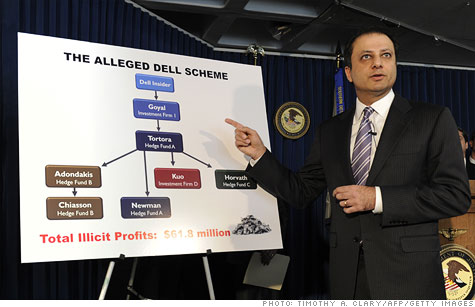

Preet Bharara, the U.S. Attorney for the Southern District of New York, outlines the alleged insider trading scheme that led to the arrests of four investment professionals last week.

New York (CNNMoney) -- Hedge fund Diamondback Capital has agreed to pay $9 million to settle insider trading charges announced last week, the Securities and Exchange Commission said Monday.

The settlement follows the arrest last week on related charges of former Diamondback portfolio manager Todd Newman, one of four investment professionals arrested in the case. Three others, including former Diamondback analyst Jesse Tortora, have pleaded guilty and are cooperating with the government.

Under the proposed settlement, still subject to court approval, the Connecticut-based Diamondback will forfeit more than $6 million in alleged illegal profits and pay a $3 million fine. The fund has also entered into a non-prosecution agreement with the U.S. Attorney's Office in Manhattan.

In a submission to the government, Diamondback acknowledged that Tortora and Newman had engaged in insider trading but said that other employees at the firm were not involved.

A spokeswoman for Diamondback declined to comment, though in a letter to investors dated Monday, the firm said its fine was "unusually low... due to Diamondback's extensive and proactive assistance to the government in its investigation."

"We are gratified finally to have reached closure on the Government Proceedings, and deeply regret the difficulties caused to our investors during the last fourteen months," the firm said.

The SEC said in a statement Monday that the proposed settlement "appropriately sanctions the misconduct while giving due credit to Diamondback for its substantial assistance in the government's investigation."

Diamondback was raided by law enforcement officials in November 2010 as part of the probe that culminated with the arrests and the criminal complaint unsealed last week.

According to the complaint, Sandeep Goyal, a former Dell (DELL, Fortune 500) employee, repeatedly obtained inside information from a contact at the firm and passed it to his friend Tortora at Diamondback. Tortora and Newman allegedly paid Goyal at least $175,000 for this information, which investigators say was then disseminated to the other investment professionals named in the complaint.

All told, the scheme allegedly netted $78 million in illegal profits, according to the SEC, including more than $50 million for hedge fund Level Global alone based on tips ahead of Dell's August 2008 earnings announcement.

In a news conference last week, Preet Bharara, the U.S. Attorney for the Southern District of New York, called the case "a stunning portrait of organized corruption on a grand scale." Law enforcement officials have compared the case in scale to that of Raj Rajaratnam, the former manager of the defunct hedge fund Galleon Group who was sentenced to 11 years in prison after netting $64 million in a long-running insider trading scam.

The government is in the midst of a more-than-two-year crackdown on insider trading known as "Operation Perfect Hedge" that has led to charges against more than 60 people. ![]()