It's B-Day.

Federal Reserve chairman Ben Bernanke takes center stage Wednesday. At a highly anticipated afternoon press conference, he's expected to discuss when the central bank could begin tapering the pace of its bond purchases.

The Fed's bond-buying program has been a boon to equity markets, supporting U.S. and global stock indexes and driving them to recent record highs.

Any comments from Bernanke suggesting that the program's end is near would likely lead to significant declines.

"Bernanke has to address asset purchases and every nuance in his replies will be seized upon by markets," said Deutsche Bank economist Jim Reid, in a research note.

Bernanke is scheduled to speak at 2:30 p.m. ET, following the conclusion of the Fed's latest two-day monetary policy meeting.

Related: Bond investors bracing for Bernanke

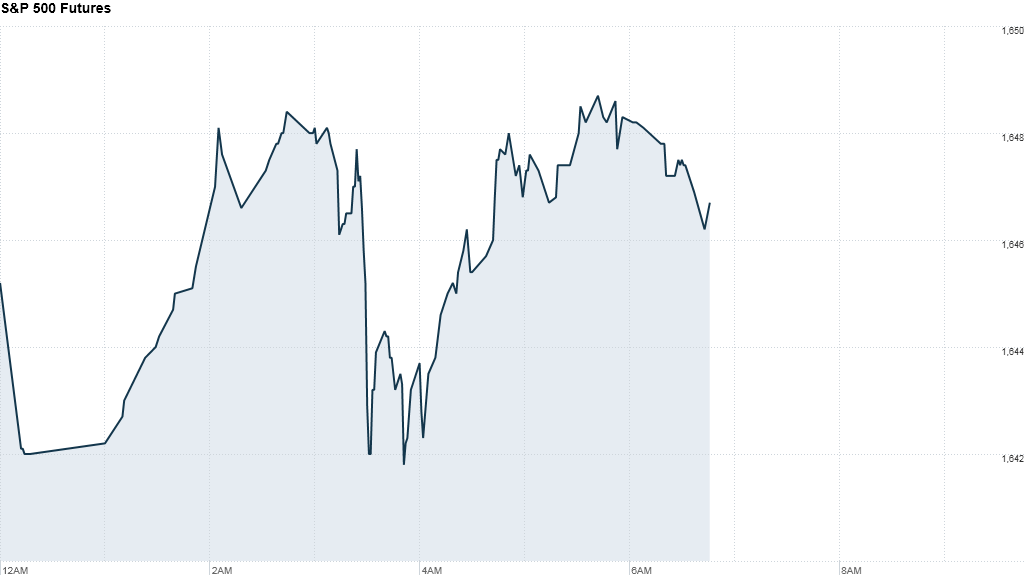

U.S. stock futures were little changed early Wednesday. But stocks rose for a third day in a row on Tuesday.

"Investors this week have scaled back expectations of an immediate unwinding of stimulus by the Fed, hopeful that the patchy run of data from the U.S. economy will prevent a reduction in asset purchases in the near term," said Ishaq Siddiqi, a market strategist at ETX Capital in London.

Related: Fear & Greed Index, still languishing in fear

In corporate news, shares of Tesla Motors (TSLA) dipped 2% after the automaker announced a recall of some of its Model S cars for a non-mechanical defect.

Shipping giant FedEx (FDX) reported quarterly earnings the blew pas forecasts, though revenue was roughly in line with estimates. The company is often seen as a bellwether for the global economy given the nature of its delivery business and its international footprint.

Related: Fed watchers say Bernanke won't act now

Adobe (ADBE) shares rose nearly 7% after the software company reported quarterly earnings that beat expectations.

Dish Networks (DISH) dropped its pursuit of Sprint (S), clearing the way for Japan's Softbank (SFTBF) to continue with its offer. Dish said it would instead focus on its tender offer for Clearwire (CLWR).

On the international stage, European markets were flat in early trading. London's benchmark FTSE 100 index slipped slightly, while the DAX in Frankfurt managed tepid gains and the CAC 40 in Paris was little changed.

Asian markets ended mixed. Japan's Nikkei index rallied by 1.8%, helped by strong export data. But the Hang Seng in Hong Kong moved in the opposite direction, sinking by 1.1%. The Shanghai Composite index also dipped down by 0.7%.