Hold tight and get ready for stock markets to take a tumble.

Here are the four things you need to know before the opening bell rings in New York:

1. Fighting to stay positive: Global markets were all negative as investors worry about America's military moves in Iraq and an escalating trade war with Russia.

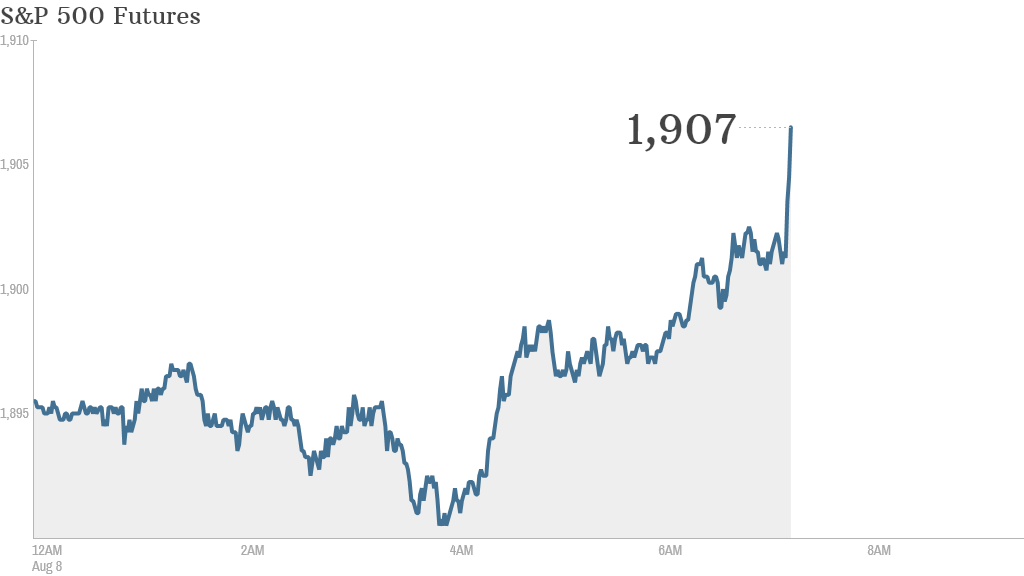

U.S. stock futures bounced back and were slightly positive.

The Dax in Germany fell into correction territory. The benchmark index has fallen by about 11% since its peak in late June as investors worry about the effects Russian sanctions will have on the German economy.

Nearly every Asian stock market index also closed in negative territory. The Nikkei in Japan dropped by 3%.

U.S. President Barack Obama has authorized "targeted airstrikes" in Iraq to protect American personnel and help Iraqi forces. Concerns are growing about a humanitarian crisis in Iraq where minority groups are facing possible slaughter by Sunni Muslim extremists.

"It's coming on top of geopolitical tensions that are already high," said Tom Beevers, CEO of StockViews, referring to U.S. versus Russia sanctions and the war in Israel and Gaza. "This is something that the market didn't really need."

"When you have this much uncertainty in the market which is due to geopolitical tensions, this not only makes the ordinary investor nervous but the professionals take a back step as well," said Naeem Aslam, chief market analyst at foreign exchange broker AvaTrade.

Related: How to stay safe in a scary market

2. Thursday market recap: U.S. stocks fell over the previous trading session. The Dow Jones industrial average closed down 75 points while the S&P 500 and Nasdaq both lost about 0.5%.

It's worth noting that the Dow has fallen by about 5% since mid-July.

3. Stock market movers -- Lululemon, Fox, Zynga, tech stocks: Lululemon Athletica (LULU) jumped 6% in premarket trading after founder Dennis Wilson agreed to sell half his stake, of $845 million in stock, to private equity firm Advent.

What the Fox? Shares in 21st Century Fox (FOX) were falling by 7% premarket. The company announced this week it was dropping its bid to buy Time Warner (TWX) and shares had jumped by about 6%.

Shares of game maker Zynga (ZNGA) plunged 8% in premarket trading after the company reported a loss for its second quarter.

A variety of big tech companies including Google (GOOGL) were also seeing their shares decline in premarket trading, in line with market sentiment.

Tesla (TSLA) was down slightly despite resolving a trademark dispute that threatened its growth in China.

Related: CNNMoney's Tech 30 index

4. Earnings and economics: Sotheby's (BID) is among the key companies reporting second quarter earnings before the opening bell.

On the economic front, the Bureau for Labor Statistics will release a report on worker productivity for the second quarter at 8:30 a.m. ET.