1. Trump vs. Canada: The United States and Mexico have reached an agreement to change parts of NAFTA. But where does that leave Canada?

The deal announced by President Donald Trump on Monday left open the question of whether Canada, the third country in the free trade deal, would agree to the changes.

"They used to call it NAFTA," Trump said. "We're going to call it the United States-Mexico trade agreement. We're going to get rid of NAFTA because it has a bad connotation."

Canada's Minister of Foreign Affairs Chrystia Freeland will travel to Washington on Tuesday to continue negotiations. Mexico and Canada have stood firm on the importance of maintaining the deal's trilateral format.

"Progress between Mexico and the United States [was] a necessary requirement for any renewed NAFTA agreement," said a spokesperson for the Canadian government. "We will only sign a new NAFTA that is good for Canada and good for the middle class."

US stocks reacted positively to the Mexico breakthrough, and shares in automakers shot higher. European automakers advanced Tuesday, with Volkswagen (VWAGY) shares adding 2.5%.

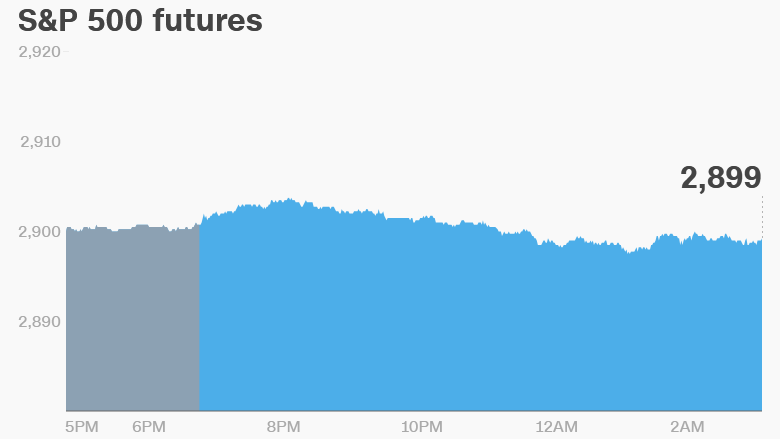

2. Global stock market overview: US stock futures were steady on Tuesday.

European markets were higher. Most Asian markets ended with modest gains.

The Dow Jones industrial average surged 1% on Monday to close above 26,000 for first time since early February. The S&P 500 and Nasdaq closed at record highs.

Before the Bell newsletter: Key market news. In your inbox. Subscribe now!

3. Toyota and Uber: Toyota is investing $500 million in Uber and working more closely with the company to accelerate the development of self-driving vehicles.

"This agreement and investment marks an important milestone in our transformation to a mobility company," Shigeki Tomoyama, president of Toyota Connected Company, said in a statement.

Uber plans to retrofit Toyota Sienna minivans with its autonomous technology and begin real-world testing in 2021. Shares in Toyota (TM) added 0.9% in Tokyo.

4. Earnings and economics: Best Buy (BBY), BJ's Wholesale (BJ) and Tiffany & Co (TIF) will release earnings before the open.

H & R Block (HRB) and Hewlett Packard Enterprise (HPE) will follow after the close.

The S&P Case-Shiller Home Price Index for June will be released at 9 a.m. ET, giving insight into the state of the American housing market.

The Conference Board's Consumer Confidence Index for August will be published at 10 a.m.

Markets Now newsletter: Get a global markets snapshot in your inbox every afternoon. Sign up now!

5. Coming this week:

Tuesday — Best Buy (BBY) and H&R Block (HRB) earnings

Wednesday — Salesforce (CRM) and Brown-Forman (BFA) earnings

Thursday — Abercrombie & Fitch (ANF), Campbell Soup (CPB), Lululemon (LULU) and Dollar Tree (DLTR) earnings

Friday — Eurozone unemployment data released for July