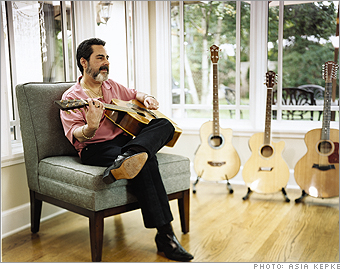

He got his start in a junior-high band, played gigs on his native Long Island, and earned an associates degree in music. Now he works at a company that sells child identification kits to law-enforcement agencies.

But he continues to write and play, hitting open-mic nights now and then. He earns about $75,000 a year, better and steadier money than before, and he has no wife or children to support. Within 10 years, he'd love to open a club where he can play with other musicians, and he'd like to cut a professional recording. "I don't have anything concrete of my work," he says.

The reality: His dreams have two different price tags. Berkowitz figures that the club would probably cost more than $100,000 to start. The recording project would be cheaper - $30,000 or so.

Meanwhile, Berkowitz, who earns $75,000 a year, is working on one other big financial goal: Save enough to retire with $53,000 in annual income by age 65, 13 years from now. He has socked away only about $100,000 so far.

The Plan: Keith Newcomb, a financial planner in Nashville, says Berkowitz's retirement and recording goals are both doable. The club dream? Not so much. Opening a small business with expensive start-up costs in an industry that has a high failure rate is risky, and Berkowitz just doesn't have the cash to lose.

- Focus on financial security first. If he keeps contributing the max to his employer's IRA, his savings should grow to about $400,000 by the time he's 65. Combined with an expected $2,400 a month in Social Security payments, that should give him the retirement income he wants.

- Start saving for the recording now. The $30,000 is a good estimate, but Berkowitz should get quotes from recording studios, musicians and designers to see if that number is realistic, then bump it up a bit for inflation. If he puts away $300 a month at 6 percent interest, he'll have $35,000 in eight years. Because he'll be older than 59 1/2 by then, he should use a Roth IRA as his savings vehicle: Both the earnings and the withdrawals will be tax-free.