Inspired by a doctor friend working in Swaziland, she found a nonprofit group called Young Heroes, started by the country's government and the Peace Corps, that helps feed and clothe children whose parents have died of AIDS.

She hopes to retire by 2009 and start spending two months a year volunteering with the group, traveling to and from Swaziland twice annually.

The reality: McKinney has a portfolio worth more than $1 million, plus $200,000 in a 401(k), and she'll get $400,000 more when she cashes out of her business in two years.

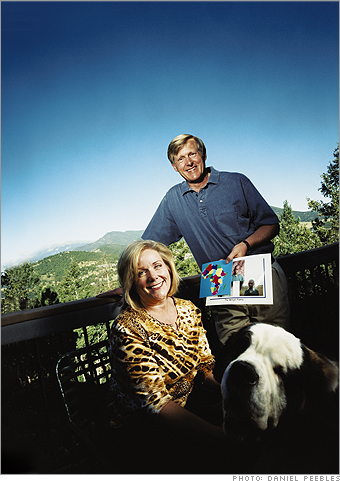

She and second husband Mark, 54, a software developer (pictured here), are debt-free. But with no more earnings, McKinney will need to draw on investment income to replace her $34,000 salary. (Mark earns close to six figures but has only $150,000 in savings.) She'll have to factor in the costs of volunteering too, such as travel and insurance.

The plan: Holly Hunter, a financial planner in Portsmouth, N.H., says McKinney can do it with these steps:

- Create a steady income stream. More than 95 percent of McKinney's portfolio is in stocks - too risky for her situation. Hunter recommends a mix of 60 percent equities and 40 percent bonds, which will generate more income and be less volatile. That strategy should allow her to spend up to $70,000 a year without having to worry about outliving her money.

- Buy emergency insurance. McKinney is covered by Mark's health insurance, but many insurers offer spotty coverage overseas. She should buy medical evacuation insurance ($200 to $300 a year) so she can be airlifted out of Africa in case of an emergency. Check out options at insuremytrip.com.

- Research tax breaks.To make her funds go still further, McKinney should take full advantage of tax breaks for volunteering. For example, she can deduct reasonable out-of-pocket expenses such as transportation and lodging.