Fortune 500 rank: 481

2010 revenue: $4.6 billion

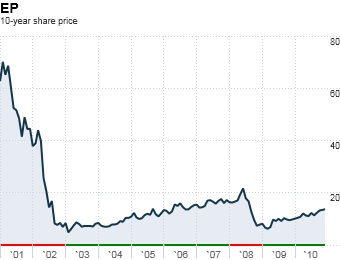

10-year annualized return: -13.4%

When Enron's demise caused energy trading to dissipate in the early 2000's, El Paso, a natural gas pipeline operator that had its own trading operation, became collateral damage. The company spent the next few years shedding billions of dollars worth of assets in an effort to shore up its balance sheet.

Then, in 2002, El Paso was accused of manipulating gas prices in California by withholding delivery (the company denied the charges, but later settled for more than $1 billion). In 2004, it admitted that it had overstated its oil and gas reserves, and took a $1 billion charge.

El Paso's earnings eventually rebounded, but low natural gas prices in recent years have slowed growth.

NEXT: 16. Interpublic Group

Last updated May 05 2011: 2:52 PM ET