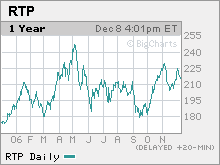

NYSE: RTP

Price: $214

52-week low: $171

52-week high: $253

P/E ratio: 11

Yield: 1.4%

Rising oil prices may have grabbed the spotlight in recent years, but they're only a small part of the global commodities boom. Metals have appreciated even faster. Copper has nearly tripled over the past year, as demand from China and other emerging markets has soared. Mining stocks have jumped as well, but few companies are better positioned to benefit than Britain's Rio Tinto. With huge operations in Australia (shares are listed in both London and Sydney), Africa and the Americas, Rio Tinto expects revenues this year to grow 25% compared with last year's, while profits should finish up more than 50%.

Copper and iron ore account for 75% of earnings, but the company also has valuable exposure to other hot metals, such as uranium. Even better, it has deep reserves, including an interest in four of the world's top ten undeveloped copper projects. Iron ore production is also growing rapidly, says J.P. Morgan analyst David George, which should help earnings even if copper prices cool off. And with a P/E ratio of ten and minimal debt, Rio Tinto is cheaper than such rivals as BHP Biliton, which trades at more than 12 times earnings. George sees a 30% upside in Rio Tinto shares, which have pulled back recently to $215 amid global fears of an economic slowdown.