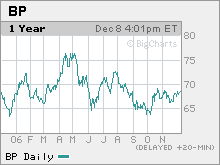

NYSE: BP

Price: $69

52-week low: $63

52-week high: $77

P/E ratio: 10

Yield: 3.5%

For Britain's BP, 2006 has been what Queen Elizabeth II once called an annus horribilis. From a pipeline leak that forced the company to close its Prudhoe Bay oilfield in Alaska in the summer to billions in legal claims stemming from a disaster at a Texas refinery, the past 12 months have been an exercise in what analysts call "headline risk." But while those problems have been a major headache for CEO John Browne and have revealed deep management failures at BP's North American unit, the long-term outlook remains solid. The company is still the second largest of Big Oil's super-majors in terms of production (only Exxon Mobil is bigger), with huge untapped reserves stretching from Russia to West Africa to the Gulf of Mexico.

For investors there's a silver lining to BP's stormy year. Despite bumper profits from record oil prices, BP shares have underperformed rivals such as Exxon, Chevron and Royal Dutch Shell, making the British giant an appealing value proposition. While Exxon is trading at 11.8 times next year's earnings, BP carries a multiple of only 9.8. "At the end of the day, BP has reasonable growth prospects and no longer trades at a premium," says Putnam's Byrne. Meanwhile, BP's multibillion- dollar stock-buyback plan and its 3.5% dividend offer further downside protection. Even if oil prices moderate, says Bear Stearns analyst Nicole Decker, "BP is among the rare few companies that will continue to grow organically at a reasonable cost." Plus, says Decker, 2007 should see a recovery in both the company's image and its financial performance as it puts Alaska, Texas and other trouble spots behind it. She thinks BP shares could hit $82 by the end of 2007, a 21% gain over the current $68.