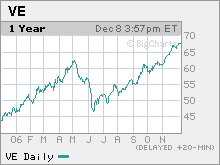

NYSE: VE

Price: $67

52-week low: $43

52-week high: $68

P/E ratio: 29

Yield: 1.4%

Although Veolia has been in business in France for more than 150 years, its name may be unfamiliar even to investors who follow European business. Formerly the water-supply and environmental- services division of Vivendi, Veolia was split off and renamed in 2003. Since the split from the entertainment side of the business (which retains the Vivendi name), Veolia has thrived, nearly doubling over the past two years on strong growth in its utility business in France and around the world. In the U.S., for example, Veolia supplies drinking water in Indianapolis and wastewater treatment at Kentucky's Fort Knox. Earnings growth for 2006 is expected to top 30%, while revenues are rising at a 20% rate.

For long-term investors, the appeal of Veolia is that it's a great way to play the growing demand for a commodity that in many parts of the world is scarcer than oil - fresh drinking water. In India, China and other emerging markets, population growth and environmental pressures offer Veolia tremendous opportunities in areas like water treatment and desalinization. The company already provides water to nearly 19 million people in China and has also won new contracts recently in the Persian Gulf and in Yerevan, the capital of Armenia. Shares of Veolia have rallied since the summer, when management abandoned plans to merge with French construction company Vinci, but HSBC analyst Verity Mitchell still sees 20% upside in the stock, which currently trades at $66.