|

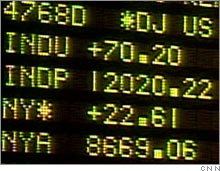

Dow eases after breaking 12,000 Strong earnings news, tame inflation, surprising housing numbers push the blue-chip average to a landmark. NEW YORK (CNNMoney.com) -- Stocks gave back gains Wednesday after the Dow Jones industrials jumped past the 12,000 mark on a tame reading on inflation, surprisingly solid housing numbers and strong earnings. The 30-share Dow (up 20.09 to 11,970.11, Charts) climbed about 0.2 percent about an hour and a half into the session.

The world's most widely watched stock market gauge hit a high of 12,049 earlier in the session, a new record and the first time the benchmark has crossed the 12,000 line. The broader S&P 500 (up 1.19 to 1,365.24, Charts) index slipped 0.1 percent while the tech-fueled Nasdaq composite (down 6.68 to 2,338.27, Charts) fell around 0.3 percent. Analysts had said earlier in the week that once the Dow crossed the 12,000 mark there would be lots of people looking to take profits by selling. Stocks have been rallying as investors bet that the economy, which is slowing, won't tip into recession, and that corporate earnings will keep growing. Worries about the slowdown in housing have also lessened. "The economic numbers support the idea of a soft landing," Jay Suskind, a trader at the New Jersey-based brokerage Ryan Beck & Co, said earlier in the session. "Moderation is the word and the market really likes that." The Dow had been flirting with the 12,000 mark since last week, but lost sight of it Tuesday on renewed inflation fears. Those fears dissipated Wednesday. Before the market opened, the government said that the Consumer Price Index, a key inflation reading, fell an unexpectedly steep 0.5 percent in September but the core CPI, which excludes food and energy prices, rose 0.2 percent, in line with estimates. Analysts had predicted a fall of 0.3 percent for overall CPI. The relatively tame inflation reading eased concerns from Tuesday, when a measure of wholesale prices rose much faster than estimated and renewed concerns that the Federal Reserve might start raising interest rates again. The central bank has held rates steady at its last two meetings after two years of rate hikes. A separate government report showed housing strength. The pace of home building unexpectedly strengthened in September as new housing starts rose 5.9 percent. But new building permits fell to a near five-year low. Earnings news was also strong. J.P. Morgan Chase (down $1.14 to $46.85, Charts), the nation's No. 3 financial services company and a Dow component, continued the trend of strong earnings as it reported better-than-expected results before the bell Wednesday. After the bell Tuesday, No. 1 chipmaker Intel (up $0.29 to $21.19, Charts) reported lower earnings that nonetheless beat estimates, as the company said it is winning back lost market share. Intel shares rose 1 percent Wednesday. Computer maker IBM (up $3.56 to $90.51, Charts) also beat forecasts on improved earnings. IBM shares were upgraded by Goldman Sachs to a "buy" recommendation from neutral early Wednesday. IBM shares jumped over 5 percent Wednesday. Internet firm Yahoo (down $0.54 to $23.61, Charts) reported disappointing results and shares fell 2 percent. But Yahoo CEO told investors during a conference call late Tuesday call that its long-awaited new search technology was now live. But shares of cell phone maker Motorola (down $1.41 to $23.44, Charts) fell 5 percent after the cell phone maker posted disappointing results after the bell Tuesday. Treasury bonds edged higher on the economic news, pushing the yield on the 10-year note down to 4.76 percent from 4.77 percent late Tuesday. Bond prices and yields move in opposite directions. The dollar rose against the yen and euro. Oil prices turned higher after the government reported a big build in crude stocks but a fall in gasoline supplies. U.S. light crude for November delivery rose 32 cents to $59.25 a barrel on the New York Mercantile Exchange. Stocks in Asia closed mostly higher while stocks in Europe rose in late-day trade. Market breadth was positive. On the New York Stock Exchange, winners beat losers three to two on volume of 415 million shares. On the Nasdaq market breadth was even as 701 million shares changed hands. _____________ GM seen set for Kerkorian fight |

|