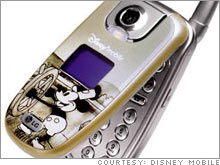

Selling cells to 8 year-oldsWireless companies have set their hungry sights on tweens. From finicky youngsters to wary parents, it's not been an easy market to crack.(Business 2.0 Magazine) -- How many 8 year-olds do you see running around, gabbing or furiously text-messaging on their cell phones? Exactly. Faced with diminishing growth prospects, the mobile phone industry is chasing after one of the few demographics still walking the streets largely handset-free: the 12 and under crowd. The number of American tweens armed with cell phones is expected to grow 60 percent by 2010, to 10.5 million, according to the Boston research firm Yankee Group. That means that half the tween population will one day soon be buying handsets en masse and racking up lucrative fees from text messaging, gaming, and watching videos. Not to be left behind, mega-mobile companies and niche players alike are racing to seize the opportunity. But here's the catch: selling to Harry Potter's biggest fans, or their parents, hasn't been easy. Tweens shun devices that look like kids' toys, pining instead for the "adult" devices so they can text message, play music, and browse the mobile Web--just like grownups. They want the iPod, not the tykePod. "Tweens want a phone that looks like the one their older brother or sister uses," says Julie Ask, a senior analyst with Jupiter Research. "They think they're more sophisticated than a five-button phone." That's the mistake both AT&T (Charts, Fortune 500) and Verizon Wireless (Charts, Fortune 500) have made recently with child-centric phones. The country's No. 1 and No. 2 wireless carriers, respectively, have both pulled tween phones from store shelves due to what analysts say were lackluster sales. But it's not just about designing devices kids want. It's also about placating moms and dads worried about whether their children are mature enough to handle a cell phone--and whether there are sufficient safeguards against predators. For many parents, 11 is just too young. Appealing to both kids and parents is no small feat. Verizon and AT&T had the right parental controls, but blundered with overly simplistic phones. Meanwhile, Disney Mobile, a unit of the Walt Disney Company (Charts, Fortune 500), has what analysts say are the right phones, but the wrong pricing model. Enter Daniel Neal and his two partners. The trio has spent nearly four years watching closely as mobile carriers have crashed and burned in the tween market. With $27 million in funding, they launched Kajeet, a Bethesda, Maryland-based company that, in March, began selling four phones aimed at kids. At Kajeet, you won't find a cute polka-dotted handset with a dedicated "Call Mom" button anywhere. Instead, the cofounders stocked Kajeet with existing phone models from LG, Nokia (Charts), and Sanyo. The handsets look like 'grownup' phones. On the inside, however, they've got all the trappings aimed at appealing to kids and their parents. Kajeet devices come preloaded with age-appropriate games, applications, startup screens, and sounds. But just like other tween-targeted cell phones, Kajeet's wireless service also comes with a slew of parental controls. These include restrictions on spending, usage times, and incoming and outgoing phone numbers. Kajeet is betting that another unique feature will help it crack the kid market: "Pay-as-you-go," which eschews long-term contracts, activation fees, and termination penalties in favor of a service that charges based on the prior month's use and can be canceled at any time. Kajeet charges 10 cents a minute for calls. Analysts say the pricing model could work in Kajeet's favor. Unlike competitors, "Kajeet's advantage is that parents can exit without early termination fees," says William Ho, a wireless analyst with research firm Current Analysis. Ho also likes the look and price of Kajeet's phones, which run from $50 to $100. "Disney Mobile launched with decent ideas about parental controls, location, and intra-family communications," continues Ho. "But they have yet to get any real traction." On top of pricing, which has come down since Disney Mobile launched 10 months ago, Ho says the company hasn't done enough marketing of its service. George Grobar, Disney Mobile's general manager, declined to disclose subscriber numbers, but indicated that the 10-month-old company is meeting expectations. "We're pleased with the pace of subscriber growth and believe we have momentum," wrote Grobar in an e-mail message. To be sure, Kajeet faces plenty of challenges too. Ho, the analyst, warned that the startup will need to be heavily marketed to lure customers. It helps that Kajeet has struck a content and marketing deal with Nickelodeon, he said. And even if kids embrace Kajeet's adult-looking phones and parents like the price, there's still the question of whether parents will embrace the notion that kids, no matter their age, should have their own cell phones. There's some hope. Asaf Degani, a Palo Alto, Calif. research scientist for NASA, bought handsets for his daughters when they each started middle school at the age of 11. Degani says his reasons were purely practical. "The girls started going to a school that was three miles away instead of three blocks," he says. Like Degani, many parents still see cell phone ownership as a rite of passage. But if Kajeet and other carriers start playing their cards right, that magic age may just get younger and younger. _______________________________ To send a letter to the editor about this story, click here. |

Sponsors

|