Can Sprint bounce back?

No. 3 wireless carrier bets restructuring and a cool new phone will pay off.

(Fortune) -- It's been clear for some time that Sprint Nextel needs a major turnaround. Lots of Sprint users switch to AT&T and Verizon -- not many move in the opposite direction. And with the news this week that No. 3 wireless carrier in the U.S. is laying off 8,000 employees, the resurrection of Sprint won't be easy or painless.

But some analysts are starting to rethink Sprint: A cool device exclusive to Sprint is coming soon, and the company is getting aggressive on pricing to pursue the youth market. If these moves pay off, the wireless carrier just might find itself attracting new customers -- and winning back some old ones.

A few years ago it would have been hard to imagine that Sprint would have lost so much ground to the wireless units of former monopolies. AT&T (T, Fortune 500) and Verizon (VZ, Fortune 500). Sprint Nextel (S, Fortune 500), formed by the 2005 merger of Sprint and Nextel was heralded as a "pure play" wireless deal that married Sprint's scale with Nextel's entrepreneurial zeal.

But management never brought the two corporate cultures together, and Sprint lost Nextel customers by letting network quality lapse. Right before the merger Nextel had 16 million subscribers. By the end of last year, there were 10 million. (Nextel traditionally served business users.)

Meanwhile in Sprint's consumer-oriented wireless business, the company never focused on one, clear marketing strategy. While Verizon became known for the strength of its network, AT&T for its cool devices, and T-Mobile for its low prices, Sprint struggled to find its niche. You've probably seen the new black and white ads showing CEO Dan Hesse strolling through New York City with tasteful strings playing in the background. But there still isn't a sharp message behind the product.

"They've tried different strategies, different taglines, different messages, and quite frankly nothing has really worked," says Michael Gary Nelson, an analyst at Stanford Group Co. "In reality, there's very little difference between the various wireless carriers, and a lot of the success really comes down to the marketing message and how they position themselves.

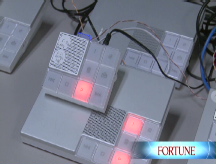

There are reasons for optimism, though. The company has inked an exclusive deal with a phone that's getting hyped to near-iPhone levels: the Palm (PALM) Pre. It has a touch screen and slide-out keyboard and can run more than one application at once. Release dates are hazy (per usual for new devices like this) but the phone is expected to make its formal debut in the next few months.

"The Palm Pre does provide the company with an opportunity to launch a new marketing campaign around a hyped up device," says Nelson. "And now it really comes down to, can they successfully execute on that?"

Sprint is also going after consumers in search of cheaper plans. It just unveiled a new $50 unlimited plan under its division Boost Mobile. There's concern that Boost could cannibalize Sprint's business, just as they're trying to lure more customers. But Boost's competitors are more likely to be choosing between other cheap services like Leap and MobilePCS, rather than the bigger companies.

Given Sprint's underdog status, most analysts are keeping their expectations low. But Walter Piecyk with Pali Research thinks it is a stock worth looking at, precisely because competitors are treating them like they're dead. "Everyone takes these guys for granted because they haven't done anything in two years," Piecyk says. "Now, all of a sudden, they say they''re going to get new customers, and incentivize [employees]. They've got the new phones. They're ready to go."

Still, with AT&T and Verizon (which this week posted strong wireless results) still running far ahead in the race for subscribers, management is going to have to (ahem) sprint if it hopes to catch up. ![]()

-

The retail giant tops the Fortune 500 for the second year in a row. Who else made the list? More

The retail giant tops the Fortune 500 for the second year in a row. Who else made the list? More -

This group of companies is all about social networking to connect with their customers. More

This group of companies is all about social networking to connect with their customers. More -

The fight over the cholesterol medication is keeping a generic version from hitting the market. More

The fight over the cholesterol medication is keeping a generic version from hitting the market. More -

Bin Laden may be dead, but the terrorist group he led doesn't need his money. More

Bin Laden may be dead, but the terrorist group he led doesn't need his money. More -

U.S. real estate might be a mess, but in other parts of the world, home prices are jumping. More

U.S. real estate might be a mess, but in other parts of the world, home prices are jumping. More -

Libya's output is a fraction of global production, but it's crucial to the nation's economy. More

Libya's output is a fraction of global production, but it's crucial to the nation's economy. More -

Once rates start to rise, things could get ugly fast for our neighbors to the north. More

Once rates start to rise, things could get ugly fast for our neighbors to the north. More