GM stock touches $1, lowest since Depression

The automaker's shares recover and steady above a buck after hitting a 76-year bottom that followed executives' sale of stock.

NEW YORK (CNNMoney.com) -- General Motors Corp. stock briefly plunged to $1 a share in Wednesday trading, flirting with its lowest levels since the Great Depression, before it managed a recovery.

GM's (GM, Fortune 500) stock price dipped to $1 shortly after the start of trading. The stock hasn't closed that low since April 19, 1933, according to split-adjusted calculations from the Center for Research in Security Prices.

Shortly after the opening bell, the battered, Detroit-based auto giant managed to recover slightly, hovering near its Tuesday close of $1.15. In midday trading, the stock managed to gain about 15 cents.

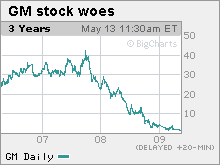

Stock in GM, which shares Big Three status with Ford Motor Co (F, Fortune 500). and Chrysler LLC, has plunged precipitously in the last two years.

As recently as 2007, the stock was trading above $40 a share and has lost about 95% of its value since one year ago, when it closed at $20.20.

The automaker's stock price peaked on April 28, 2000, when it closed at $93.625. Auto sales were at a record high.

David Silver, analyst for Wall Street Strategies, said that $1 is a "big mental barrier for a stock" and he expects GM to plunge much further.

"My price target is zero right now because I think the company's going bankrupt," he said.

Silver described GM as a day trader's stock and said it's one of the 10 most short-sold companies on the New York Stock Exchange.

The latest slide in the stock began Tuesday, when GM plunged more than 20%. It occurred after a half-dozen GM executives, including vice chairman Bob Lutz, disclosed Monday that they'd sold off $315,000 worth of shares.

The money-losing automaker -- which has experienced healthier sales overseas than in the United States in recent years -- has until the end of May to meet the federal government's demands to cut costs and come up with a new plan for viability.

GM has received $15.4 billion in government assistance so far this year. The company lost $6 billion in the first quarter and burned through $10 billion in cash.

One of its U.S.-based rivals, Chrysler, which is owned by the private equity firm Cerberus Capital Management, recently filed for bankruptcy as part of a plan that will give control to Italian automaker Fiat and the company's unions.

GM Chief Executive Fritz Henderson has said that a bankruptcy filing, which would likely wipe out current shareholders, is the most probable option for the company.

GM was founded Sept. 16, 1908 as the General Motors Company of New Jersey, and began trading on the NYSE in 1916 as the General Motors Corporation. ![]()