Fears of big bank problems return

A key market measure of credit risk is deteriorating again, as investors fret over the side effects of giant federal bailouts for the nation's largest banks.

|

| Bets against the biggest banks are on the rise. |

|

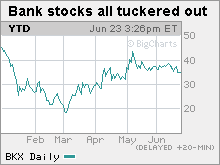

| After a sharp rise from March trhough May, the KBW Bank Index has pulled back in recent weeks. |

NEW YORK (Fortune) -- Betting against the banks is back in fashion.

A key market measure of the health of the biggest global financial institutions has deteriorated this month, after showing sharp improvement in April and May.

The price of betting that big banks will default on their debt -- made via derivatives known as credit default swaps -- has risen 17% in June, according to data from New York-based Credit Derivatives Research.

The uptick in wagers against banks such as Bank of America (BAC, Fortune 500), Goldman Sachs (GS, Fortune 500) and Morgan Stanley (MS, Fortune 500) comes as the spring's scorching stock market rally peters out and doubts about the health of the global economy and the banking sector re-emerge.

The blue-chip S&P 500 has dropped 6% over the past two weeks, with half of that loss coming this week. The KBW Bank index has slid 20% since hitting a recent high May 11.

Some selling is no doubt inevitable after a strong rally. But a World Bank report Monday that predicted the global economy will shrink 2.9% this year "touched a raw nerve," said Mauro Guillen, director of the Lauder Institute at the University of Pennsylvania's Wharton School.

"We have been too optimistic for too long, and we still haven't done the dirty work of fixing the financial system," he said.

Guillen said the U.S. will have to take action to restore the credit system before the economy can resume expanding in earnest.

That will mean actually implementing plans such as the one the government proposed this spring to attract private sector buyers of troubled bank assets, Guillen said. Regulators shelved one such program earlier this month.

Guillen also advocates pushing financial regulatory reform program through Congress.

But Robert Claassen, chair of the derivatives and structured products practice at international law firm Paul Hastings, said he senses the momentum for sweeping change has ebbed in recent weeks.

"There's a lot less public outrage right now," he said.

Guillen shares that view, and said it bodes ill for the long anticipated economic rebound. He notes that the economy must start growing again before unemployment -- rapidly approaching 10% -- comes down to a more moderate level.

"We have reached this period of apathy, and there's a real danger that the economy will languish with the underlying problems unaddressed," he said.

Given the extensive government support for big financial firms, ranging from Treasury loans to Federal Deposit Insurance Corp. debt guarantees, investor worries about the banks now focus less on their collapse than on anemic profit growth and gnawing credit losses.

"Consumers continue to face challenges in the form of reduced liquidity, higher unemployment and lower home prices," banking analyst Meredith Whitney wrote this month in a note to clients. "We believe, at a minimum, consumer spending will remain under pressure thereby challenging hopes for a solid second half rebound currently baked into market expectations."

In recent weeks, market sentiment has shifted toward this view. Accordingly, CDR's counterparty risk index, or CRI -- which measures the cost of insuring against default on a basket of the 14 biggest derivative-dealing banks -- recently hit 178. That means it costs an investor $178,000 annually to protect $10 million worth of bonds against default for five years.

That's up from $135,000 earlier this month, when the CRI hit its lowest level since the collapse of Lehman Brothers and AIG in September.

The CRI is still well below its stressed levels of this spring. The index hit its all-time high March 9, when it cost $305,000 to insure against a default on major dealer debt. The previous high was reached in September, following the collapse of Lehman and the government rescue of AIG. CDR has been tracking the data since the beginning of 2006.

March 9 was also the day Citigroup (C, Fortune 500) chief Vikram Pandit spurred the three-month-long rally in bank stocks by telling staff in a memo that Citi, then thought to be on its way to a possible government takeover, was profitable in the first two months of the year.

Though there is now widespread relief that a depression has been avoided, Guillen said he's still very worried.

"The administration seems to be getting distracted, and there's an awful lot left to do," he said. ![]()

-

The retail giant tops the Fortune 500 for the second year in a row. Who else made the list? More

The retail giant tops the Fortune 500 for the second year in a row. Who else made the list? More -

This group of companies is all about social networking to connect with their customers. More

This group of companies is all about social networking to connect with their customers. More -

The fight over the cholesterol medication is keeping a generic version from hitting the market. More

The fight over the cholesterol medication is keeping a generic version from hitting the market. More -

Bin Laden may be dead, but the terrorist group he led doesn't need his money. More

Bin Laden may be dead, but the terrorist group he led doesn't need his money. More -

U.S. real estate might be a mess, but in other parts of the world, home prices are jumping. More

U.S. real estate might be a mess, but in other parts of the world, home prices are jumping. More -

Libya's output is a fraction of global production, but it's crucial to the nation's economy. More

Libya's output is a fraction of global production, but it's crucial to the nation's economy. More -

Once rates start to rise, things could get ugly fast for our neighbors to the north. More

Once rates start to rise, things could get ugly fast for our neighbors to the north. More