BofA earnings beat expectations

Bank of America posts second-quarter profit of $3.2 billion, or 33 cents a share. But CEO Ken Lewis warns of more weakness in the global economy.

|

| BofA chief Ken Lewis has come under fire for his handling of the Merrill Lynch deal. |

|

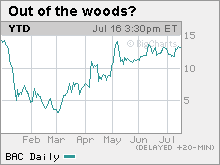

| Bank of America shares have rebounded from an early 2009 trip to $3. |

NEW YORK (Fortune) -- Bank of America joined the ranks of big banks posting better-than-expected first-half profits this week.

The Charlotte, N.C., bank posted second-quarter earnings of $3.2 billion, or 33 cents a share Friday. Bank of America (BAC, Fortune 500) made $3.4 billion, or 72 cents a share, in the second quarter of 2008.

Analysts surveyed by Thomson Financial were looking for a profit of 28 cents a share.

BofA chief executive Ken Lewis said he was "pleased" with the progress the bank has made in its operations over the course of a "tumultuous" year. He also cited BofA's success in raising new capital.

And in a statement Friday, the bank noted that its cushion against future losses gives BofA its "strongest capital position in recent memory."

Lewis told investors on a Friday morning conference call that he expects the bank's loan losses to grow at a slower rate in coming quarters. But he added that profitability will be "much tougher in the second half of the year," given high unemployment and falling house prices, as well as the absence of one-time gains that padded first-half numbers.

Fans of the stock were buoyed by signs that credit losses may soon peak. Morgan Stanley analyst Betsy Graseck, who rates the stock an "overweight", focused on signs that the growth of nonperforming loans is slowing -- which should bring down credit costs and boost earnings in coming quarters.

She counseled clients to "buy on weakness" in spite of soft second-quarter net interest income and fee numbers, saying in a research note that the deceleration in nonperforming loans should lead to higher earnings growth over the next year.

Even so, shares of BofA fell 2% Friday.

The solid report from BofA comes on the heels of strong numbers out this week from BofA rival JPMorgan Chase (JPM, Fortune 500) and trading titan Goldman Sachs (GS, Fortune 500).

Like those two, Bank of America benefited from heavier second-quarter trading activity. Global markets earnings jumped to $1.38 billion from $298 million a year earlier, reflecting the addition of the capital markets business of investment bank Merrill Lynch in the latest period.

Profit in the global banking unit rose to $2.49 billion from $1.43 billion a year earlier, as the company took a $3.8 billion pretax gain on the sale of a merchant processing business and recorded higher fees in its investment banking business, even as it surrendered some market share during the first half to JPMorgan.

And BofA continues to draw in new deposits. The bank's average retail deposit base rose 26% from a year ago, mostly reflecting the acquisitions of Merrill Lynch and mortgage lender Countrywide Financial. Deposits rose 6% from a year ago at the core BofA franchise.

But BofA's big credit card business swung to a second-quarter loss of $1.62 billion from a profit of $582 million a year ago, as the amount the bank set aside for credit losses soared 82%. Meanwhile, the home loans unit led by the former Countrywide posted a $725 million second-quarter loss, as loan loss provisions jumped 34%.

All told, the bank set aside $13.4 billion for credit costs, flat with first-quarter levels. This included a $4.7 billion addition to loan loss reserves. Nonperforming assets rose 20% from the first quarter, to $31 billion.

Still, the better-than-expected overall profit comes at a welcome time for Lewis, BofA's longtime CEO. He has come under fire from shareholders over the past year for the acquisitions of the deeply troubled Countrywide and Merrill Lynch.

BofA's poor performance in the past year -- the firm has needed $45 billion in loans from the Treasury Department to cope with losses -- and the hubbub over the Merrill deal cost Lewis his chairmanship this spring.

Congress has held three hearings on the behind-the-scenes jockeying that took place in December, in which then Treasury Secretary Henry Paulson told Lewis he would be sacked if he walked away from Merrill as losses there soared.

Meanwhile, shareholders continue to pay for the support the bank has taken from taxpayers. While profits fell just over 5% in the second quarter, per-share earnings tumbled 54%, reflecting the blizzard of shares issued in recent capital raises and the cost of preferred stock dividends paid to Treasury.

That said, the banking industry has appeared to stabilize following a round of capital-raising this spring. BofA has raised some $33 billion in recent months, and the bank's shares have quadrupled off their March lows. ![]()

-

The retail giant tops the Fortune 500 for the second year in a row. Who else made the list? More

The retail giant tops the Fortune 500 for the second year in a row. Who else made the list? More -

This group of companies is all about social networking to connect with their customers. More

This group of companies is all about social networking to connect with their customers. More -

The fight over the cholesterol medication is keeping a generic version from hitting the market. More

The fight over the cholesterol medication is keeping a generic version from hitting the market. More -

Bin Laden may be dead, but the terrorist group he led doesn't need his money. More

Bin Laden may be dead, but the terrorist group he led doesn't need his money. More -

U.S. real estate might be a mess, but in other parts of the world, home prices are jumping. More

U.S. real estate might be a mess, but in other parts of the world, home prices are jumping. More -

Libya's output is a fraction of global production, but it's crucial to the nation's economy. More

Libya's output is a fraction of global production, but it's crucial to the nation's economy. More -

Once rates start to rise, things could get ugly fast for our neighbors to the north. More

Once rates start to rise, things could get ugly fast for our neighbors to the north. More