China's amazing new bullet train

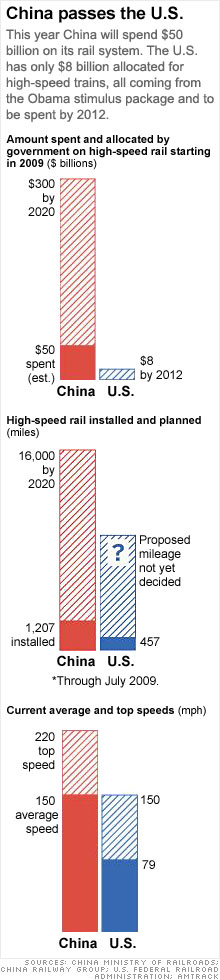

This year Beijing will spend $50 billion on what will soon be the world's biggest high-speed train system. Here's how it works.

|

| The train from Beijing to Shanghai. |

(Fortune Magazine) -- When lunch break comes at the construction site between Shanghai and Suzhou in eastern China, Xi Tong-li and his fellow laborers bolt for some nearby trees and the merciful slivers of shade they provide. It's 95 degrees and humid -- a typically oppressive summer day in southeastern China -- but it's not just mad dogs and Englishmen who go out in the midday sun.

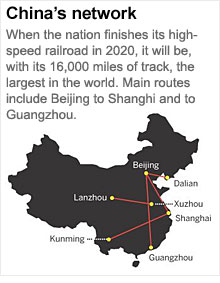

Xi is among a vast army of workers in China -- according to Beijing's Railroad Ministry, 110,000 were laboring on a single line, the Beijing-Shanghai route, at the beginning of 2009 -- who are building one of the largest infrastructure projects in history: a nationwide high-speed passenger rail network that, once completed, will be the largest, fastest, and most technologically sophisticated in the world.

Creating a rail system in a country of 1.3 billion people guarantees that the scale will be gargantuan. Almost 16,000 miles of new track will have been laid when the build-out is done in 2020. China will consume about 117 million tons of concrete just to construct the buttresses on which the tracks will be carried. The total amount of rolled steel on the Beijing-to-Shanghai line alone would be enough to construct 120 copies of the "Bird's Nest" -- the iconic Olympic stadium in Beijing. The top speed on trains that will run from Beijing to Shanghai will approach 220 miles an hour. Last year passengers in China made 1.4 billion rail journeys, and Chinese railroad officials expect that in a nation whose major cities are already choked with traffic, the figure could easily double over the next decade.

Construction on the vast multibillion-dollar project commenced in 2005 and will run through 2020. This year China will invest $50 billion in its new high-speed passenger rail system, more than double the amount spent in 2008. By the time the project is completed, Beijing will have pumped $300 billion into it. This effort is of more than passing historical interest. It can be seen properly as part and parcel of China's economic rise as a developing nation modernizing at warp speed, catching up with the rich world and in some instances -- like high-speed rail -- leapfrogging it entirely.

But this project symbolizes even more than that. This monumental infrastructure build-out has become the centerpiece of China's effort to navigate the global financial crisis and the ensuing recession.

Last November, as the developed world imploded -- taking China's massive export growth and the jobs it had created with it -- Beijing announced a two-year, $585 billion stimulus package -- about 13% of 2008 GDP.

Infrastructure spending was at its core. Beijing would pour even more money into bridges, ports, and railways in the hope that it could stimulate growth and -- critically -- absorb the excess labor that exporters, particularly in the Pearl River Delta, were shedding as their foreign sales shrank more than 20%.

A single province, Guangdong, was thought at the end of 2008 to have more than 20 million unemployed workers, many of whom appeared intent on heading back home to poorer, rural provinces with nothing much to do. Little focuses minds in Beijing more than the prospect of huge numbers of idle young men. It conjures up images of social instability that could conceivably strip the Communist Party of its primary source of legitimacy: economic growth and the improving living standards it has been providing for nearly 30 years. Beijing, in other words, had a lot riding on the bet that a massive boost to infrastructure spending could ameliorate the downturn.

Just over half a year later, the medicine appears to be working (at least so far). Railway worker Xi Tong-li, in fact, is one small example of that. Last fall he was toiling in a factory that made industrial fasteners for export in the city of Dongguan in Guangdong province -- a factory that is now closed. When Xi, a native of rural Henan province, lost his job, he called a friend who was working on a spur of the high-speed rail line that will eventually connect Beijing with Shanghai, cutting travel time from around 10 hours today to about four when the line opens in a couple of years. Two months later he was hired at a wage of $250 per month. "I'm happy to have a job so that I can still send money back [to Henan] and help my parents," he says.

It's unclear just how many of those laborers who lost their jobs in the export sector have been absorbed by China's accelerating infrastructure build-out -- the biggest portion of which by far is construction of the high-speed rail network. Unemployment -- estimates range from 10% to 20% -- remains the government's primary economic concern.

As David Li, an economist at Beijing's Tsinghua University, says, there's no doubt that "the acceleration of [the massive railroad build-out] is playing a key role in China's recovery." In mid-July, Beijing announced that second-quarter growth came in at 7.9%, and that the quarter-on-quarter upswing was the fastest the nation had seen since 2003. Economists at Goldman Sachs now believe China will expand at 8.3% this year -- exceeding the 8.1% goal set by Beijing in January, and dismissed then as unrealistic by most private economists.

That the government-led infrastructure spending, as Li says, is driving this growth is beyond dispute. A recent survey by Australia's mining industry shows that China's overall steel production capacity has actually increased by 10% to 12% over a year ago, despite the worst global downturn in decades. But nearly all that production is being used domestically, the survey said.

And across the Chinese landscape, it's pretty easy to see why. Whether in Dalian in the northeast, Wuhan in the west, or Shanghai in the east, one constant is the sight of massive concrete buttresses about 246 feet apart, lined up one after another in rows extending as far as the eye can see. The buttresses support the tracks over which the high-speed trains will run. They weigh 800 tons each and are reinforced by steel cables. There are close to 200,000 of them being built, all across the country.

At a moment when the developed world -- the U.S., Europe, and Japan -- is still stuck in the deepest recession since the early 1980s, China's rebound is startling. And the news comes just as Washington is embroiled in its own debate about whether the U.S. requires -- and can afford -- another round of stimulus, since the first one, earlier this year, has thus far done little to halt the downturn. Tax cuts made up about one-third of the $787 billion package, and only $60 billion of the remaining $500 billion has been spent so far.

Proponents of more stimulus are likely to cite China's example of what a properly designed stimulus program can accomplish. Maybe so. But a closer look at China's high-speed rail program also reveals some risks that should factor into the "Why can't we do that?" debate that's surely coming in Washington.

Xia Guobin, an amiable 51-year-old, is vice president and chief engineer for China Railway Construction Co., the largest of three state-owned companies that are the primary contractors for China's railway build-out. Sitting in the company's Beijing headquarters, I tell him it's likely that U.S. policymakers will look at China and suffer a pronounced case of infrastructure envy. He chuckles and says, "Well, it's not as if we were all standing around here doing nothing when the world financial crisis hit."

He says it jokingly, but it's the first key to understanding why China seems to be getting quick economic traction from its spending. As anyone who lives here knows, the government's massive infrastructure investment has been underway for years. Ports, bridges, airports, highways -- China in three years' time will have more miles of multilane highways than exist in the U.S. The rail program itself began four years ago, and the first spur opened just before the Olympics last year, linking Beijing with the city of Tianjin, 70 miles away -- a ride that now takes just about 30 minutes.

This is the definition, in other words, of "shovel-ready." China, for instance, was able to more than double its rail spending this year because, for the most part, it could simply move up plans that were already in place. That means existing orders for steel and cement and process-control systems and computer chips were all expanded (and given the softness in the export sector, most suppliers have had no trouble meeting the increased demand).

Last year China Railway Construction Co., the nation's largest railroad builder, hired 14,000 new university graduates -- civil and electrical engineers mostly -- from the class of 2008. This year, says Liang Yi, the vice CEO of the CRCC subsidiary working on the Beijing-to-Shanghai high-speed line, the company may hire up to 20,000 new university grads to cope with the company's intensifying workload. But with the private sector cutting way back on hiring -- and university students desperate for work -- taking on that many new engineers and managers hasn't been too difficult.

It's been even less of a problem offering jobs to manual laborers on sites across the country. Liang says his unit alone is absorbing 8,000 more workers this year than it did last. It gives each one five days of basic safety training, which isn't a lot, but in China it's very rare for manual laborers to get any safety training. Says chief engineer Xia: "Yes, we have more pressure on us, but we're not doing anything we weren't doing before. We're just doing more of it."

The other key thing to remember is that China's brand-new high-speed rail network will be the product of the country's economic system. For all the free-market progress China has made in the past 30 years, a heavy "command and control" component still exists. The central government in Beijing holds all the key levers of power. The Railroad Ministry sets the plans, state-owned banks lend the money, and state-owned companies get the projects rolling. In the meantime many private businesses struggle to get bank loans.

Indeed, "command and control" is an especially fitting metaphor for the high-speed railway build-out. Until 1984 the Ministry of Railroads and what are now the construction companies were all part of China's People's Liberation Army. To this day, many of the senior and middle management ranks are made up of former army officers -- conservative executives who are very good at following orders.

The result is that when plans are made, they also get executed. In America, jokes Sean Maloney, the No. 3 executive at Intel, "NIMBY-ism [Not in My Backyard] is still an issue. In China, it's more like IMBY-ism. They plan, they build things, and they move fast."

Occasionally that can stir up trouble. A year and a half ago middle-class residents in a Shanghai neighborhood went public -- a relatively rare event in China -- with a protest against a high-speed rail line being built south to Hangzhou because it was too close to their homes. They created enough of a ruckus that Premier Wen Jiabao himself interceded and forced a change in the line's route.

Still, all things considered, in the midst of the grinding global recession, a little IMBY-ism doesn't seem like such a bad thing to some multinational companies. China's stimulus plan has taken some flak for what some critics perceive to be a "buy China" bias in its spending. But when it comes to the rail program, any number of big foreign players claim to be benefiting directly. Bombardier of Canada got the contract for a signaling system on the network as well as for work on 40 high-speed trains. Altogether, Fortune estimates that foreign companies have won some $10 billion worth of contracts so far, and in a program that extends to 2020, there's more where that came from.

IBM (IBM, Fortune 500) is among the companies aggressively pushing for a share of the historic build-out. It won a contract to provide the software for the high-speed train spur (as well as a local intracity rail system) in Guangdong province. High-speed rail systems are as much about silicon chips and software as about cement and steel. So-called smart train networks -- and the software systems that run them -- can boost on-time performance, speed up maintenance, and improve safety. And Big Blue, for its part, has already decided not only where the future is for this industry but also where the present is.

How so? Consider that the Northeast Corridor, between Boston and Washington, D.C., is served by Amtrak's Acela train, which clips along at a stately average speed of 79 miles an hour. There's a lot of talk now, as part of President Obama's stimulus plan, about upgrading the system and building new, faster lines all across the nation. In his stimulus bill Obama has allocated $8 billion over three years for high-speed rail, and 40 states are now bidding for the funds, with results to be released in September. Among the possibilities, California wants to link San Francisco with L.A. via a high-speed link. Senate Majority Leader Harry Reid (D-Nev.) wants the private sector to get into the act, proposing a high-speed spur to connect Las Vegas with L.A.

Maybe, after environmental reviews are finished and eminent domain issues settled, those lines will be built. Meanwhile, IBM opened its new global high-speed-rail innovation center last month.

In Beijing.

Zhang Dan and Josh Glasser contributed to this article. ![]()

-

The retail giant tops the Fortune 500 for the second year in a row. Who else made the list? More

The retail giant tops the Fortune 500 for the second year in a row. Who else made the list? More -

This group of companies is all about social networking to connect with their customers. More

This group of companies is all about social networking to connect with their customers. More -

The fight over the cholesterol medication is keeping a generic version from hitting the market. More

The fight over the cholesterol medication is keeping a generic version from hitting the market. More -

Bin Laden may be dead, but the terrorist group he led doesn't need his money. More

Bin Laden may be dead, but the terrorist group he led doesn't need his money. More -

U.S. real estate might be a mess, but in other parts of the world, home prices are jumping. More

U.S. real estate might be a mess, but in other parts of the world, home prices are jumping. More -

Libya's output is a fraction of global production, but it's crucial to the nation's economy. More

Libya's output is a fraction of global production, but it's crucial to the nation's economy. More -

Once rates start to rise, things could get ugly fast for our neighbors to the north. More

Once rates start to rise, things could get ugly fast for our neighbors to the north. More