Banks still getting sicker

The economy may have turned, but banks will be cleaning up after their lending mistakes for years. Several big banks may already be doomed to fail.

|

| FDIC chief Sheila Bair has seen bank failures surge to their highest level in 17 years. |

|

| Guaranty's stock has sat out the bank rally. |

NEW YORK (Fortune) -- The economy may have pulled out of its plunge, but you'd never know by a look at many big banks.

Even after a rousing market rally that spurred new capital into giant institutions such as Wells Fargo (WFC, Fortune 500) and Bank of America (BAC, Fortune 500), numerous large banks around the country are still struggling with deteriorating finances.

Two dozen banks with at least $5 billion in assets get the lowest one-star rating on Bankrate.com's safety and soundness test, which is based on an assessment of regulatory filings for the quarter ended March 31.

More than half of those banks are ranked "troubled" or worse by research firm Bauer Financial, using the same data. Three of these banks, with a total of $45 billion in assets, have made public statements indicating they could soon collapse.

"There are some big ones in fairly dire straits," said Karen Dorway, director of research at Coral Gables, Fla.-based Bauer. "If you see some of these fail, it could add to the stress on local economies."

Many banks have had their capital eroded by losses, while their balance sheets remain bloated with billions of dollars in depreciating real estate investments and construction loans.

These banks have been setting aside more money for future losses, but in many cases the increases in loan loss reserves haven't kept up with the surge in nonperforming assets. That means profits could be pressured even at stronger institutions.

"We don't know when the losses are going to peak, and we don't know how long they're going to stay there," said Chris Whalen of Institutional Risk Analytics, which advises investors. "It's a pretty gruesome picture."

Meanwhile, efforts to remove troubled assets from bank balance sheets have stalled, as banks remain reluctant to sell at the low prices being offered by investors. That leaves banks trying to sell assets and lure in new funds from investors. On those counts, their records are decidedly mixed.

Over the past year, at least eight of the low-rated institutions have agreed with regulators to improve their banking practices. Banks including Pacific Capital Bank (PCBC), Westernbank Puerto Rico (WHI) and the former Lehman Brothers Bank -- now known as Aurora -- have set plans to strengthen their capital bases.

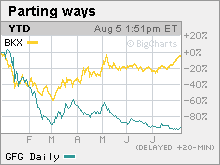

Others have been told to get more capital, but have failed to do so. Among them are condominium construction lender Corus Bankshares (CORS), based in Chicago; Colonial Bancgroup (CNB) of Montgomery, Ala., a troubled mortgage lender whose offices were recently raided by federal agents; and Guaranty Financial Group (GFG) of Austin, Texas.

Guaranty, with $13 billion in assets, said last month it expects to be taken over by regulators. A recent filing from Colonial, with $25 billion in assets, indicated "there is substantial doubt about Colonial's ability to continue as a going concern."

Corus, which has $7 billion in assets and has been told repeatedly to raise new funds, said Friday that "it is highly unlikely that it will be able to obtain additional outside capital that does not include the provision of substantial assistance by the FDIC or other Federal governmental authorities."

While problems at those banks are well known to investors -- a share of all three costs less than a dollar combined -- their failures could strain the federal deposit insurance fund and add to problems in deeply stressed real estate markets.

Corus, for instance, is the lender to 15 Florida condo projects worth at least $100 million each.

"Construction loans are going to be a big part of the challenge, because they're so complex," said Dorway.

The problems at troubled banks could slow the recovery for their healthier counterparts. So far this year, 69 banks have failed -- the most since 1992. The Federal Deposit Insurance Corp. has already imposed a one-time fee on member banks to shore up its deposit insurance fund and has said it may impose another later this year.

The FDIC's so-called problem bank list had 305 institutions -- with $220 billion in assets -- on it at the end of the first quarter. The agency has set aside $22 billion to cover failure-related costs this year. A law enacted this spring gives the FDIC access to up to $500 billion in Treasury credit though 2010.

Even so, the scale of the banking problem will surely test the agency's mettle. Veribanc, another bank rating agency, suggested as much this spring when it reported a raft of first-quarter rating downgrades and forecast 97 bank failures for the year.

"If the past quarter's trend continues, more than half of all banks could be downgraded during the remainder of 2009," Veribanc said. ![]()

-

The retail giant tops the Fortune 500 for the second year in a row. Who else made the list? More

The retail giant tops the Fortune 500 for the second year in a row. Who else made the list? More -

This group of companies is all about social networking to connect with their customers. More

This group of companies is all about social networking to connect with their customers. More -

The fight over the cholesterol medication is keeping a generic version from hitting the market. More

The fight over the cholesterol medication is keeping a generic version from hitting the market. More -

Bin Laden may be dead, but the terrorist group he led doesn't need his money. More

Bin Laden may be dead, but the terrorist group he led doesn't need his money. More -

U.S. real estate might be a mess, but in other parts of the world, home prices are jumping. More

U.S. real estate might be a mess, but in other parts of the world, home prices are jumping. More -

Libya's output is a fraction of global production, but it's crucial to the nation's economy. More

Libya's output is a fraction of global production, but it's crucial to the nation's economy. More -

Once rates start to rise, things could get ugly fast for our neighbors to the north. More

Once rates start to rise, things could get ugly fast for our neighbors to the north. More