Stocks: Trying to recharge the rally

Better-than-expected earnings have reassured investors, but last week, the market stalled. Can this next big batch of results get the engine going again?

NEW YORK (CNNMoney.com) -- The quarterly reporting period has gotten off to a bang-up start, with 81% of companies outshining analysts' forecasts. But with expectations now raised, the latest crop of strong results has had little impact on the broad market.

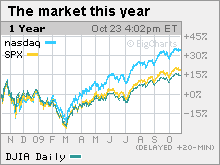

Stocks ended last week lower, breaking a two-week run that was in itself part of a longer multi-month rally. After falling to 12-year lows in March, the S&P 500 has risen 60% as of Friday's close, thanks to a mix of signs of an improving economy and trillions in fiscal and monetary stimulus.

"We've had this massive 60% rise off the March bottom because of all the excess liquidity," said Timothy Holland, co-portfolio manager of the Aston/TAMRO Diversified Equity Fund (ATLVX). "Short term I'm optimistic it can continue, but longer term, I'm wary," he said.

He said that assuming third-quarter results continue to impress, the S&P 500 will have registered three straight quarters of better-than-expected earnings, even if it's mostly been driven by cost cutting and no growth in revenues.

The improving quarterly results and better economic data should help stocks keep rising, he said. Also helping: ongoing impact of the government stimulus and the eventual point at which some of the trillions sitting in money market funds get put to work.

"I think we're likely to build on the gains from here, but it's not going to be at the same rapid pace we've seen," said Gary Webb, CEO at Webb Financial Group.

Longer term, stocks could be vulnerable, particularly amid a lack of clarity about the economic outlook a year from now.

"Getting into next year, we could have problems as we move past the liquidity and cost cutting and improved sentiment that's been driving the advance," Holland said. "No one is clear on what the economy is going to look like when all that is removed."

Last week stocks declined. And while the selloff was minimal, it was a surprise considering that it happened in a week that brought better-than-expected profits from Apple (AAPL, Fortune 500), Microsoft (MSFT, Fortune 500), Amazon.com (AMZN, Fortune 500), 3M (MMM, Fortune 500), AT&T (T, Fortune 500), McDonald's (MCD, Fortune 500) and others.

The week ahead: The week ahead is equally busy for quarterly reports and also brings key readings on housing, jobs, income and - most notably - the first reading on whether third-quarter gross domestic product grew. GDP is expected to have risen at a 3.1% annualized rate, after sliding in the previous quarter.

On the earnings front, 137 of the S&P 500 are due to report this week. While it's the biggest number yet in terms of sheer volume, it's lighter in terms of the kinds of companies that drive the market. Standouts include Dow components Verizon (VZ, Fortune 500), Procter & Gamble (PG, Fortune 500), Exxon Mobil (XOM, Fortune 500) and Chevron (CVX, Fortune 500).

So far, 199 companies, or 40% of the S&P 500, have reported results. Profits are currently on track to have fallen 18.2% versus a year earlier, according to the latest from Thomson Reuters. Revenue is expected to have dropped more than 10% from a year ago.

Of the companies that have reported, 81% have beat expectations, 7% have met and 12% have missed.

Here's what else is on tap:

Monday: No market-moving economic news is due Monday.

Tuesday: Durable goods orders, from the Commerce Department report, are expected to have risen 0.7% in September, after falling 2.4% in the previous month, according to a consensus of economists surveyed by Briefing.com.

Durable goods excluding transportation are expected to have risen 0.8% in September, versus no change in August.

The Case Shiller Home Price index, which tracks 20 of the largest housing markets, is expected to show prices fell 11.45% in August after falling 13.3% in July.

The October Consumer Confidence index, from the Conference Board, is expected to have risen to 54.0 in October from 53.1 in September.

Wednesday: Sales of newly constructed homes are expected to have risen to a 440,000 unit annualized rate in September from a 429,000 unit annualized rate in August. The Commerce Department report is due out shortly after the start of trading.

The government's weekly crude oil inventories report is also due in the morning.

Thursday: The first reading on third-quarter Gross Domestic Product (GDP) growth is the dominant economic report of the week.

Due for release in the morning, the government is expected to report that GDP grew 3.1% in the quarter after shrinking 0.7% in the previous quarter, with the economy emerging from a recession that began in December 2007.

Also on tap: The weekly jobless claims report from the Department of Labor is due out in the morning.

The House Oversight Committee holds a hearing on executive compensation that is likely to be widely watched on Wall Street. White House "pay czar" Kenneth Feinberg is set to testify.

Last week, Feinberg called for the seven biggest recipients of federal bailout money to cut in half what they pay their top executives. Also last week, the Federal Reserve proposed a broad overhaul of pay policies at 28 of the largest U.S. banks.

Thursday is also the 80-year anniversary of the 1929 market crash.

Friday: September personal income and personal spending reports are due in the morning and are likely to draw considerable attention, amid worries about the hard-hit consumer.

Income is expected to hold steady after rising 0.2% in the previous month. Spending is expected to have fallen 0.4% after rising 1.3% in August.

Also slated: the Employment Cost Index, the revised reading on consumer sentiment from the University of Michigan and the Chicago PMI, a regional reading on manufacturing. ![]()