Stocks take a big slide

Wall Street retreats in a broad-based selloff at the end of a down week and mixed month.

NEW YORK (CNNMoney.com) -- Stocks tumbled Friday, more than erasing the previous session's gains, as investors dumped a variety of shares at the end of a rough week and choppy month on Wall Street.

Bond prices rallied, sending yields lower, in a classic flight-to-quality. The dollar was mixed versus other major currencies. Oil and gold prices fell.

The Dow Jones industrial average (INDU) lost nearly 250 points, or 2.5% to close at 9,712.73. The Dow lost as much as 278 points earlier. It was the Dow's biggest one-day selloff on a point basis since April 20.

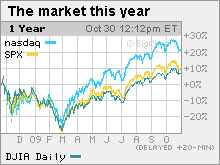

The S&P 500 (SPX) index fell 30 points, or 2.8% to close at 1036.18 and the Nasdaq composite (COMP) shed 52 points, or 2.5% to close at 2045.11.

The selloff was broad based, with all 30 Dow components declining. Energy prices and stocks were hit hard as the dollar turned mixed and the financial sector erased the 4% gain it accrued Thursday.

"We might finally be seeing the 5% to 15% correction that many people have been calling for since the summer," said Ron Kiddoo, chief investment officer at Cozad Asset Management.

Since peaking on Oct. 19, the S&P 500 has lost 5.6% as of Friday.

"I think the run has just gotten tired," he said. "A lot of people who wanted to get in over the last two months have done that, so maybe we need to sell off more to get more people back in."

Since bottoming at a 12-year low on March 9, the S&P 500 has rallied 57.6% as of Thursday's close. But the gains had been more robust until about a week ago, when enthusiasm about the better-than-expected quarterly results gave way to worries about the pace of the recovery.

"I think there was a high level of complacency and confidence about the rally ahead of this week," said Larry Glazer, managing director at Mayflower Advisors.

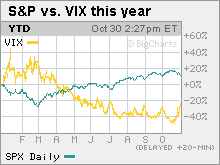

He said that the complacency was demonstrated by the CBOE Volatility (VIX) index, or the VIX, which had fallen to 14-month lows at the end of last week as investors bet that the stock advance was likely to keep charging.

The VIX and the market tend to move in opposite directions. On Friday, the VIX surged 24% as stocks tumbled.

Down week on Wall Street: The major indexes were lower or flat for the first three days of the week, finally rallying Thursday after a better-than-expected third-quarter GDP report. It was the first positive reading for the economy in a year, reassuring investors that the recovery is on track.

The Dow jumped 2% and the S&P 500 soared 2.3%, both posting the biggest one-day percentage jumps in three months. The Nasdaq gained 1.8%.

But Thursday was an exception in an otherwise volatile week that saw positive earnings and economic news mostly treated with indifference.

Glazer said the firming up of the dollar has played a role in some of the market's problems this week. The weak dollar had boosted dollar-traded commodity prices and commodity stocks over the last few weeks. But the greenback has recovered some this week, pressuring oil and gold stocks as well as multi-national companies that benefit from a weak dollar.

For many mutual funds and hedge funds, the end of October is also the end of the fiscal year, so last-minute rebalancing may have added to the volatility.

All three major gauges ended lower for the week. For the month, the Dow ended virtually unchanged, while the S&P 500 and Nasdaq both posted slim declines.

Economy: Friday brought a heavy batch of economic news, including readings on personal income and spending, consumer sentiment and manufacturing.

Personal income was unchanged in September, in line with economists' forecasts, after rising 0.1% in the previous month. Personal spending fell by 0.5%, as expected, after rising 1.4% in the previous month.

The core PCE, the report's inflation component, rose 0.1%, as it did in August. Economists thought it would rise 0.2%.

The Chicago PMI, a regional read on manufacturing, rose to 54.2 in October from 46.1 in September, crossing above the 50 mark that signifies expansion. Economists thought it would rise to 49.

The University of Michigan's consumer sentiment index was revised up to 70.6 from 69.4 earlier this month. Economists expected a reading of 70.

Quarterly results: With 69% of the S&P 500 having already reported results, profits are on track to have fallen 17.5% from a year ago, according to the latest results from Thomson Reuters.

Dow component Chevron (CVX, Fortune 500) reported a 51% drop in quarterly profit due to lower oil and gas prices. Earnings slipped from a year ago, but nonetheless beat analysts' expectations. Revenue fell from a year ago and missed analysts' forecasts. Shares fell 1.8%.

Other energy stocks fell too, including Exxon Mobil (XOM, Fortune 500), Halliburton (HAL, Fortune 500) and Schlumberger (SLB).

On the move: All 30 Dow stocks retreated, led by Chevron and Exxon, 3M (MMM, Fortune 500), IBM (IBM, Fortune 500), Caterpillar (CAT, Fortune 500), United Technologies (UTX, Fortune 500) and financial shares American Express (AXP, Fortune 500), JPMorgan Chase (JPM, Fortune 500), Travelers Companies (TRV, Fortune 500).

Currency and commodities: The dollar gained versus the euro, after falling to a 14-month low last week. The greenback tumbled versus the yen.

U.S. light crude oil for December delivery retreated $2.87 to settle at $77 a barrel on the New York Mercantile Exchange after rallying 3% in the previous session.

COMEX gold for December delivery fell $6.70 to settle at $1,040.40 an ounce.

World markets: Global markets were mixed. European markets declined in afternoon trading and Asian markets ended higher.

Bonds: Treasury prices rallied, lowering the yield on the 10-year note to 3.38% from 3.49% Thursday. Treasury prices and yields move in opposite directions.

Market breadth was negative. On the New York Stock Exchange, losers topped winners by five to one on volume of 1.65 billion shares. On the Nasdaq, decliners topped advancers four to one on volume of 2.69 billion shares. ![]()