Stocks end choppy day lower

Wall Street seesaws in a volatile trading session on weaker GDP reading and mixed housing report, one day after the Dow surged to a 13-month high.

NEW YORK (CNNMoney.com) -- Stocks ended a volatile session with modest losses Tuesday, as the Fed's improved outlook and some signs of improvement in housing tempered a weaker revision on economic growth released in the morning.

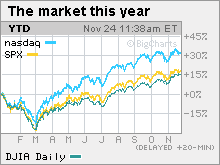

The Dow Jones industrial average (INDU) lost 17 points, or 0.2%. The Dow ended the previous session at its highest level since Oct. 2, 2008.

The Nasdaq composite (COMP) lost 7 points, or 0.3%, while the S&P 500 (SPX) was barely changed.

Stocks slipped Tuesday morning after a report showed third-quarter GDP grew at a slower pace than initially reported. But the market cut losses in the afternoon as the dollar went from mixed to weak, a boon for commodity stocks and the stocks of multinational companies that benefit from a weak currency.

The economic forecast attached to the minutes from the last Federal Reserve policy meeting also helped investors recover from bigger morning losses.

Nonetheless, stocks aren't likely to advance in this thinly-traded pre-Thanksgiving week, said David Levy, portfolio manager at Kenjol Capital Management.

"Stocks have had a massive run off the March lows and some participants are going to want to lock in profits ahead of the holiday," he said. In addition, investors will be awaiting the results from Black Friday, the day after Thanksgiving and the start of the crucial holiday shopping period, he said.

Since bottoming at a 12-year low on March 9, the Dow has gained 59.4% as of Tuesday's close. In that same period, the Nasdaq gained 69% and the S&P 500 gained nearly 64%.

Trading was volatile and trading volume was low Tuesday, a trend likely to continue through the holiday-shortened trading week. All financial markets are closed Thursday for Thanksgiving. Stocks trade in an abbreviated session Friday.

Market breadth was light. On the New York Stock Exchange, losers beat winners eight to seven on volume of 960 million shares. On the Nasdaq, decliners beat advancers eight to five on volume of 1.88 billion shares.

Wednesday brings reports on personal income and spending, durable goods orders and new home sales, all for October. The weekly jobless claims report is also on tap.

Fed forecast: The Fed lifted its estimate for growth next year and cut its forecast for the unemployment rate. However, the central bank also lifted its forecast on the unemployment rate for 2011 and 2012, with job growth likely to be modest amid a slowly-recovering economy.

GDP: The broadest measure of the nation's economic growth grew at a slower pace last quarter than initially thought, adding to bets that the recovery will be sluggish.

GDP grew at a 2.8% annual rate in the third quarter, the Commerce Department said Tuesday. That figure met analysts' estimates but was short of the 3.5% initially reported.

Housing: Home prices rose 3.1% in the third quarter versus the second, but remained almost 9% lower versus a year ago, according to an S&P/Case-Shiller study of the 20 largest metropolitan areas.

Prices rose 0.3% in September versus August, but fell versus a year ago.

Confidence: The third big economic report of the morning was the Consumer Confidence index from the Conference Board. The index rose to 49.5 in November from 48.7 in October versus forecasts for a reading of 47.5.

Corporate news: After the close Monday, Dow component Hewlett-Packard (HPQ, Fortune 500) reported higher quarterly earnings of $1.14 per share, in line with its raised forecast released last week. The computer maker reported a drop in revenue. HP also said that it was tripling its share repurchase program to $12 billion.

World markets: Global markets were mostly weaker. In Europe, London's FTSE 100, the German DAX and France's CAC 40 all lost about 0.2% in late trading. Asian markets tumbled.

Currency and commodities: The dollar slipped against the euro and the yen.

U.S. light crude oil for January delivery fell $1.11 to settle at $76.45 a barrel on the New York Mercantile Exchange.

COMEX gold for December delivery rose $1.90 to settle at $1,166.60 an ounce, a new record settle. Gold touched a record trading high of $1,174 in the previous session.

Bonds: Treasury prices rose, lowering the yield on the 10-year note to 3.31% from 3.33% Monday. Treasury prices and yields move in opposite directions. ![]()