Bank shares boost market

A late-session rally in the financial sector helps Wall Street trim losses as Dubai contagion fears ease. The tepid holiday sales and weak dollar were also in focus.

NEW YORK (CNNMoney.com) -- A rally in bank shares helped take Wall Street higher Monday, at the end of a choppy session, as investors bet that the fallout from Dubai's debt problems won't have a major impact on U.S. institutions.

A weak dollar, rising commodity prices and the first wave of holiday retail sales reports were also in play during a tumultuous session on Wall Street.

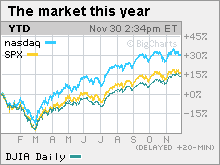

The Dow Jones industrial average (INDU) added 35 points, or 0.3%. The S&P 500 (SPX) index gained 4 points, or 0.4%. The Nasdaq composite (COMP) rose 6 points, or 0.3%.

Stocks were flat to weaker through most of the session, but managed a late-day run up, led by financials. The bank sector as a whole was taken down late last week on Dubai worries. But bets that any damage will be contained gave those stocks a lift late Monday.

"The market is really showing resilience," said Dave Hinnenkamp, CEO at KDV Wealth Management. "It's amazing that even with the Dubai situation, stocks are managing to rise."

The KBW Bank (BKX) sector index jumped 3.4%, thanks to a rally in components JPMorgan Chase (JPM, Fortune 500), Bank of America (BAC, Fortune 500), Wells Fargo (WFC, Fortune 500) and Fifth Third Bancorp (FITB, Fortune 500).

Monday marked the first full trading session in five days, with all financial markets closed for Thanksgiving and stocks only trading in a half-session Friday.

Stocks tumbled in Friday's shortened session on the problems in Dubai. The major indexes were also vulnerable to a selloff after touching 13-month highs in the previous session. That vulnerability stuck around through most of Monday's session, until the last-hour run up.

Stocks are likely to remain range-bound for the time being, said Dean Barber, president at Barber Financial Group. "I wouldn't be surprised if we are talking about the Dow 10,000 for a while."

Retail: The first wave of reports for the critical Thanksgiving holiday weekend indicate that more Americans turned out this year to take advantage of deals, but the shoppers spent less than a year ago, on average.

According to the National Retail Federation, around 195 million people shopped in stores and online between Thanksgiving and Sunday, versus 172 million a year ago. But average spending per person dropped to $343.31 from $372.57 a year ago. Total spending for the holiday was $41.2 billion, up around 0.5% from the $41 billion spent last year.

On Monday, the retail focus turned to the Internet, for a day called Cyber Monday, when shoppers at home and at work take to the Web to scour for further deals.

Dubai and global markets: The United Arab Emirates said Sunday that it will provide emergency support for banks in Dubai, cooling some worries that a debt default in the city-state could challenge the global economic recovery.

Stocks around the globe slumped last week after the Dubai government asked to defer payments on $60 billion in debt owed by Dubai World and Nakheel. Dubai World is the city-state's main investment arm and Nakheel is its real estate arm.

Dubai's construction boom has helped turn the Emirate into a world financial center and tourist hot spot. But Dubai has suffered from the same sort of real estate collapse that battered the U.S. economy, with values plummeting even as pricey projects continue to get underway.

Dubai stocks plummeted Monday, the first trading day in the region after a 4-day religious holiday. Asian markets managed gains Monday, after tumbling last week. European markets tumbled, with London's FTSE 100, Germany's DAX and France's CAC 40 all losing at least 1%.

"What's happening in Dubai right now is another verification that the mountain of debt we've accrued in the world is unsustainable," Barber said.

AIG: AIG bucked the trend, missing out on the financial sector stock advance after an analyst at Sanford Bernstein cut its price target on the stock, saying that the insurer's loss reserves are too low.

Economy: The Chicago PMI, a regional read on manufacturing, rose to 56.1 in November from 54.2 in October. Economists surveyed by Briefing.com thought the index would fall to 53.3. Any reading over 50 indicates expansion.

Mortgage regulation: In other news, the Obama administration said it will up the pressure on mortgage companies that aren't doing enough to help borrowers who are at risk of foreclosure -- including imposing fines and sanctions.

Currency and commodities: The dollar gained versus the euro and fell against the yen.

COMEX gold for December delivery rose $6.90 to settle at $1181.10 an ounce, not far from an all-time high of $1,187 an ounce hit last week.

U.S. light crude oil for January delivery rose $1.23 to settle at $77.28 a barrel on the New York Mercantile Exchange.

Bonds: Treasury prices rose modestly, with the yield on the 10-year note holding steady at 3.20%, unchanged from Friday. Treasury prices and yields move in opposite directions.

Market breadth was negative. On the New York Stock Exchange, advancers beat decliners four to three on volume of 1.35 billion shares. On the Nasdaq, winners topped losers by a narrow margin on volume of 2.03 billion shares. ![]()