Dow at 14-month high

Wall Street advances on Dubai debt relief, better-than-expected housing and construction readings, and talk of a GE-Comcast deal.

NEW YORK (CNNMoney.com) -- Stocks rallied Tuesday as worries about Dubai's debt problems eased, gold hit a record above $1,200 and GE and Comcast moved closer to a deal on NBC Universal.

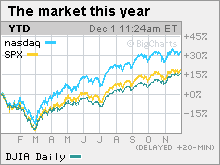

The Dow Jones industrial average (INDU) added 127 points, or 1.2%, closing at the highest point since Oct. 2, 2008. The S&P 500 (SPX) index gained 13 points, or 1.2%, and closed just short of a 14-month high. The Nasdaq composite (COMP) rose 31 points, or 1.5%, and remained short of a 14-month high hit a week ago.

Bets that Dubai's debt problems won't have a major impact on U.S. institutions lifted stocks late Monday and through Tuesday's session. Stocks also reacted to the day's better-than-expected economic readings on construction spending and pending home sales.

"The market is treating Dubai like a non-event and continuing to trade on momentum," said Joe Clark, market analyst at Financial Enhancement Group.

He said that the momentum is likely to keep stocks aloft or even push them higher through year-end, despite the already substantial run up since the March lows.

Since bottoming at a 12-year low March 9, the Dow has gained nearly 60%, the S&P 500 has gained 64% and the Nasdaq has gained 72%.

Investors also kept an eye on auto sales, which were down from October but mostly higher from a year ago. After the close, GM said CEO Fritz Henderson has resigned and will be temporarily replaced by Chairman Ed Whitacre, until a successor is found.

The weak dollar also played a role in the day's advance, boosting commodity prices and stocks, continuing a trend that's been in place all year.

Gold touches $1,200: COMEX gold for December delivery rallied $18 to settle at $1,199.10 an ounce, after rising as high as $1,202.70. It's the first time the precious metal has ever traded at this level.

Company news: AIG (AIG, Fortune 500) said it is wiping out $25 billion of its government debt by selling stakes in two of its life insurance subsidiaries to the Federal Reserve Bank of New York. Shares gained 8.6%.

General Electric (GE, Fortune 500) has reportedly reached a deal to buy Vivendi SA's 20% stake in NBC Universal for about $5.8 billion, moving GE closer to its goal of partnering with Comcast (CMCSA, Fortune 500) to create one of the largest U.S. media companies.

GE is looking to sell a 51% stake in NBC Universal to Comcast, while retaining a 49% stake in the company that is valued at around $30 billion.

Dubai and world markets: Dubai World, the city-state's main investment arm, said it is in talks to restructure $26 billion in debt, cooling worries that it might go into default and wipe out the investment of its creditors.

Global markets slumped last week after the Dubai government asked to defer payments for at least six months on $60 billion in debt owed by Dubai World and Nakheel, its real estate arm.

Overseas markets surged, with London's FTSE 100, Germany's DAX and France's CAC 40 all closing with gains of more than 2%. Asian markets rallied too, with Japan's Nikkei ending 2.4% higher.

Autos: Major automakers reported sales in November that met or topped expectations. But any improvements year-over-year were easy, given the dismal results in November 2008. On a monthly basis, sales slumped from October levels.

Among the standouts: General Motors reported a 1.8% drop in November sales from a year ago, versus forecasts for a drop of 1.3%. But sales were down 15% from October levels. Ford Motor's sales were little changed from a year ago and down 10% from October.

ISM index: The November manufacturing index from the Institute for Supply Management fell to 53.6 from 55.7 in October, surprising economists who were looking for ISM to fall to 55. However, any reading over 50 implies expansion in the sector.

Pending home sales: Signed contracts to buy homes rose 3.7% in October, the ninth monthly increase in a row, according to a National Association of Realtors report released Tuesday. Pending home sales were expected to have fallen 1% after rising 6% previously.

Other economic news: Construction spending in October was unchanged, the government reported. Spending fell 1.6% in September and was expected to have fallen 0.5% in October, according to analysts' estimates.

President Obama is due to announce his strategy on Afghanistan in a speech Tuesday night from West Point.

The dollar and oil: The dollar fell versus the euro and gained against the yen.

U.S. light crude oil for January delivery rose $1.47 to $78.75 a barrel on the New York Mercantile Exchange.

Bonds: Treasury prices tumbled, raising the yield on the 10-year note to 3.27%, from 3.20% late Monday. Treasury prices and yields move in opposite directions.

Market breadth was positive. On the New York Stock Exchange, winners beat losers four to one on volume of 1.13 billion shares. On the Nasdaq, advancers topped decliners by two to one on volume of 2.20 billion shares. ![]()