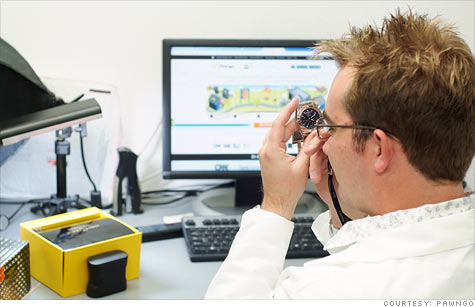

A Pawngo employee checking a watch to ensure its authenticity.

NEW YORK (CNNMoney) -- Squeezed by tight credit and tempted by record high gold prices, small business owners are finding an alternative to the bank: the pawn shop.

More than half of the customers at online pawn shop, Pawngo, are small business owners, said Todd Hills, CEO of the Denver-based company.

"These guys can't wait. They have businesses. They have employees they need to pay," said Hills, who launched Pawngo in June. "This is a great way to solve a short-term need."

Pawning is a relatively no muss, no fuss process, especially when compared to getting a bank loan. A customer brings in an item of value -- such as gold, jewelry, or electronics -- to a pawn shop and gets a loan based on the value of the object. Like a bank loan, the customer is charged interest. Once the loan is repaid, the pawnbroker returns the item to the customer. If the customer can't repay the loan, the pawnbroker keeps the object, with the aim of selling it to recover the loan amount.

With pawning, there are no applications, credit checks or dings to the credit report if the customer defaults on the loan. "You can still bring your stack of papers into the bank, it doesn't guarantee you will get a loan," said Hills.

While individual consumers may walk into a pawn shop with a couple hundred dollars worth of jewelry looking for cash to fill up the gas tank or the refrigerator, small business owners tend to come in with more expensive items, said Ray Shaffman, a salesman at Gables Pawn and Jewelry in Miami.

Gables Pawn and Jewelry has seen customers come in with watches made by Rolex, Cartier and Patek Philippe. It pays between $5,000 and $10,000 each for them, said Shaffman.

"To make payroll is the number one reason" small business owners come to the shop, said Shaffman. "They don't have enough flow, enough cash, to pay their employees. And they got to pay their employees. Otherwise, they have much more complicated problems."

Shaffman noticed a surge in the number of customers pawning their gold about a year and a half to two years ago. He said that about 70% of clients pawn their gold because they need money; while the remaining 30% are lured by the high price of gold.

There are about 10,000 pawn shops across the country. The combination of tight credit, high gold prices and increased awareness about the industry has attracted more middle-class patrons, affluent customers and small business owners. "The pawn industry is really having a renaissance of sorts in the past two years," said Emmett Murphy, spokesperson for the National Pawnbrokers Association.

No other options: Some business owners turn to pawning their valuables because they have no other option.

"We have lost a trillion in credit card lines. We have lost a trillion in home equity lines. And those are -- or were -- the two primary sources of financing," said Bob Coleman, editor of the small business lending industry publication, "Coleman Report." "There are different things that are filling that void until banks ramp up."

Fabian Videla, the owner of Slim Protein in Jacksonville, Fla., went to Pawngo after he ran out of savings and when a bank would not lend to him.

"By the time that I contacted them, I was kind of running out of options and that was a good one," said Videla, whose company sells a weight-loss program.

Videla pawned two diamond rings -- his wife's engagement ring and a ring of his that was a gift from his wife -- for $7,000. The loan had a monthly interest rate of 6% for three months, or $420 per month. "The loans from Pawngo are not cheap, but the cost of doing nothing, and waiting for something to fall in your lap, it might cost you your business," said Videla. He intends to repay the loan and get the diamond rings back.

If a small business owner is in a bind, pawning valuables can be a legitimate option, said Coleman. "It is certainly not a recipe for long-term success," because the loans are too expensive.

It's also better than using credit cards to finance your business. That option can put an entrepreneur further into debt. With pawning, "the worst case scenario is you lose your assets," said Coleman.

The high price of gold: While some small business owners are turning to pawn shops to keep their business afloat, others are going to them to take advantage of surging gold prices.

David Scantling, president and CEO of the angel investing firm Scantling Technology Ventures, in Akron, Ohio, watched the price of gold climb to record highs and realized that his gold stash could be turned into a considerable sum of cash that he could invest into his business.

Scantling's first thought was to sell his gold. But decided against it, because he didn't want to lose it and pay a huge capital gains tax.

"I would rather just keep my items and take a loan against it," said Scantling. "It was an attractive way to get cash out of those assets without having to sell them at this particular time."

He shipped a combination of gold coins and jewelry to Pawngo on a Friday, and by Tuesday morning, he had a loan of slightly less than $20,000 in his bank account. He has to pay a monthly interest rate of 5%.

Scantling said he doesn't mind the hefty charge. The convenience of the transaction and the fact that he will not have to pay a capital gains tax makes it worthwhile.

"My sense is that my capital gains tax would be higher than the interest that I would pay for a 30-, 60-day loan," he said. ![]()