Search News

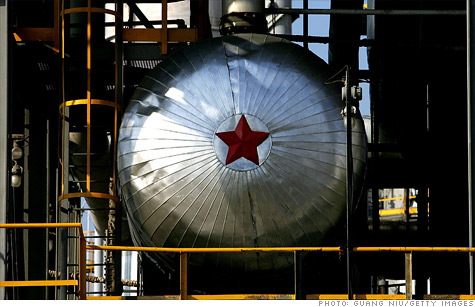

China National Petroleum Corp will develop the first oil field in northern Afghanistan. Other deals to follow.

NEW YORK (CNNMoney) -- China National Petroleum Corp. won the first oil deal in Afghanistan earlier this week, signing a contract with the Afghan government to develop a small oil field in the northern part of the country.

The deal, with an initial investment from CNPC of around $400 million, is expected to eventually generate $7 billion in revenues for the war torn nation.

"Today is a historic day in Afghan history," Wahidullah Shahrani, the Afghan minister of mines told reporters in announcing the deal. "This is the first time that Afghanistan signs a great contract for the country's oil exploration."

The field, located in the relatively stable northern area of the country, is estimated to contain 80 million barrels of oil, according to a statement on the Afghan Ministry of Mines' Web site.

The ministry signed with CNPC over firms from the United States, Britain and Australia because, according to the ministry, the Chinese offered the most favorable terms.

CNPC will get 15% of the proceeds from the fields, with the remaining 85% going to the Afghan government.

For oil comapnies the Afghan royalty arrangement is favorable compared to places like Iraq or Libya, where royalties can exceed 90%. But it's more stringent than the United States or Canada, which take about a 50% cut.

While the size of the oil field is small, CNPC may be hoping to get in early on future contracts to develop what the ministry says are oil reserves totaling 1.6 billion barrels. The ministry says there will be several more auctions in the near future.

It's fairly common for Chinese firms or smaller oil companies to be the first to bid on contracts in unstable or unproven regions.

The big Western firms like Exxon Mobil (XOM, Fortune 500), BP (BP), Royal Dutch Shell (RDSA) and Chevron (CVX, Fortune 500) tend to be a bit more conservative in their strategic decisions.

Afghanistan's overall reserves of 1.6 billion barrels are not large by international standards -- the United States has nearly 20 billion barrels of proven reserves while Saudi Arabia holds 266 billion, according to the U.S. Energy Information Agency.

But Afghanistan's overall mineral wealth is sizable and includes metals like copper and iron as well as rare earth elements prized for use in high tech gadgets.

The U.S. Defense Department estimates the country to hold over $1 trillion worth of these minerals, and could eventually use this wealth to wean itself from foreign aid. Other estimates put the number at $3 trillion. But development of these resources had been hindered by the security situation on the ground.

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates: